Billionaire Paul Tudor Jones Predicts Stock Market Boom - Time to Load Up on AI Stocks?

Wall Street legend Paul Tudor Jones sees massive gains ahead for equities - and artificial intelligence plays could lead the charge.

The AI Gold Rush Heats Up

When a billionaire who called the 1987 crash gets bullish, markets listen. Tudor Jones' latest projection has traders scrambling to position themselves for what he calls an 'imminent surge' in stock valuations.

Tech Sector Primed for Takeoff

AI stocks specifically stand to benefit from this projected upswing. The technology that's already reshaping entire industries now gets a vote of confidence from one of finance's most respected voices.

Of course, when billionaires talk about market surges, it's usually after they've already positioned their own portfolios - but what do they know about timing anyway?

Image source: Getty Images.

Where Jones sees the market going

In an interview with CNBC earlier this month, Jones made a clear prediction for the stock market, saying, "My guess is that I think all the ingredients are in place for some blow off. History rhymes a lot, so I WOULD think some version of it is going to happen again. If anything, now is so much more potentially explosive than 1999." When Jones references a blow-off, he's referring to a spike in stocks that caps off a bull market before giving way to a sell-off.

Jones is far from the first investor to draw comparisons between today's environment and that of the dot-com era. After all, there are plenty of parallels between today's market and that of the late 1990s, and the disruption from artificial intelligence (AI) and the internet, as AI appears to be the most disruptive technology since the internet.

Like the dot-com boom, billions of dollars are pouring into AI development, and investors are bidding up valuations on everything ranging from AI picks-and-shovels plays like(NVDA -0.31%), to startups like OpenAI and Anthropic, to infrastructure companies like(ORCL -4.95%), and AI-connected software companies like(PLTR 1.90%).

Is it 1999 yet?

While the sentiment in the market may feel similar to that of the late 1990s, the numbers don't really align at this point.

Since the end of 2022, essentially when the bear market then was at a bottom, the(^IXIC 1.37%) has jumped 116% since then.

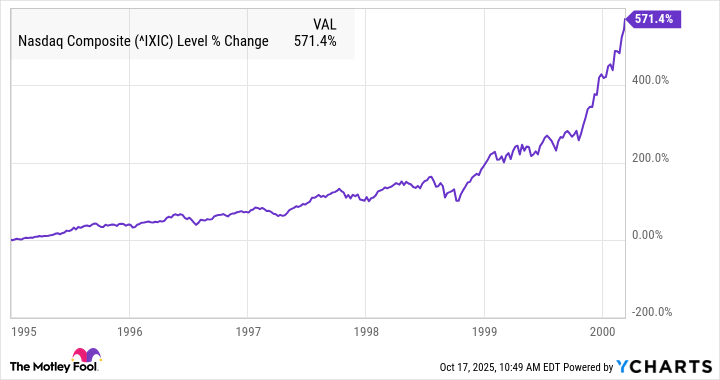

By comparison, from the start of 1995, when the dot-com boom first started gaining steam, to its peak in March 2000, the stock gained an incredible 571%. However, much of that jump came in the late stage of the boom as frenzy drove tech stocks higher before what would be a blow-off top, as the chart below shows.

Data by YCharts.

Over the four years from the start of 1995 to the end of 1998, the Nasdaq jumped 192%, which is closer to the current AI rally. In fact, through Oct. 17, 1997, or the same amount of time as the current AI boom, the Nasdaq was up 122%, a nearly identical gain to the current rally.

Over the last five months of the dot-com boom, the Nasdaq nearly doubled.

What should investors do?

Following the setback in April after the Liberation Day tariffs announcement, stocks have resumed their surge, and as deals in the tens or even hundreds of billions of dollars continue to be made, AI stocks seem likely to keep gaining. However, risks in the market are also mounting as the labor market is weakening and signs of credit risk are growing.

While big winners like Nvidia and, especially, Palantir are more fully valued now, there are still AI stocks that look well-priced like(MU 2.34%), the memory-chip maker that could be next in line for a deal with OpenAI as high-bandwidth memory components are crucial for running AI applications.

Above all, owning high-quality companies that can endure any potential bubble burst is key. Timing the market is difficult, but owning quality stocks will pay off over the long term, no matter what happens with the AI boom.