Siri Stumbles Again: Apple’s AI Delays Spark Investor Anxiety as Tech Race Intensifies

Apple hits another Siri roadblock just as artificial intelligence becomes the battlefield for tech supremacy.

The Growing AI Gap

While competitors charge ahead with conversational AI, Apple's signature voice assistant keeps missing deadlines. Internal teams scramble to overhaul Siri's aging architecture—but the delays keep stacking up.

Market Implications

Investors watching Apple's AI struggles grow increasingly nervous. The company that revolutionized smartphones now plays catch-up in the AI arms race. Another quarter, another delay—meanwhile, the competition isn't waiting around.

When even your virtual assistant needs assistance, maybe it's time to question the premium valuation. Perfect timing for crypto investors watching tech stocks wobble—nothing like traditional tech stagnation to make decentralized alternatives look appealing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new Siri is designed to handle more personal and complex questions, such as pulling details from messages, calendars, or flight apps in a single request. Yet, the current version being tested has shown slower responses and higher error rates than expected. Earlier this year, Apple had to rebuild Siri’s system after its first version produced error rates near 33%. The new setup, called version 2, is more reliable but has not yet met Apple’s quality standards.

In the meantime, AAPL shares ROSE 1.96%, closing at $252.29.

Talent Shifts and Industry Pressure

At the same time, Apple is facing turnover among its top AI leaders. Ke Yang, who led the team in charge of Siri’s knowledge and information systems, left for Meta Platforms (META) this month. Several other engineers and managers have also joined Meta over the past year, including Ruoming Pang, the former head of Apple’s foundational model team. Analysts say these exits could slow Apple’s progress at a time when rivals are moving faster in AI.

Meanwhile, Alphabet (GOOGL)(GOOG) has rolled out its Gemini model across Android and Google Workspace, while Samsung Electronics (SSNLF) has gained attention for Galaxy AI features like live call translation and smart photo editing. Even some Chinese smartphone makers have introduced more advanced assistants using local models. Apple’s slower pace could make it harder to stand out as users begin to compare AI features more directly.

Impact on iPhone Demand

Despite the challenges, demand for Apple’s newest devices remains solid, with iPhone 17 sales tracking close to levels seen during the pandemic years. Still, many analysts believe that artificial intelligence features will begin to shape smartphone demand more directly in 2026. If the Siri upgrade faces another delay, Apple could lose momentum in an increasingly crowded market.

As the company moves toward its spring 2026 release goal, it must balance product quality with timely delivery. The final performance of the new Siri system will likely affect how investors assess Apple’s overall artificial intelligence strategy and its ability to compete as the technology landscape evolves.

Is Apple a Buy, Hold, or Sell?

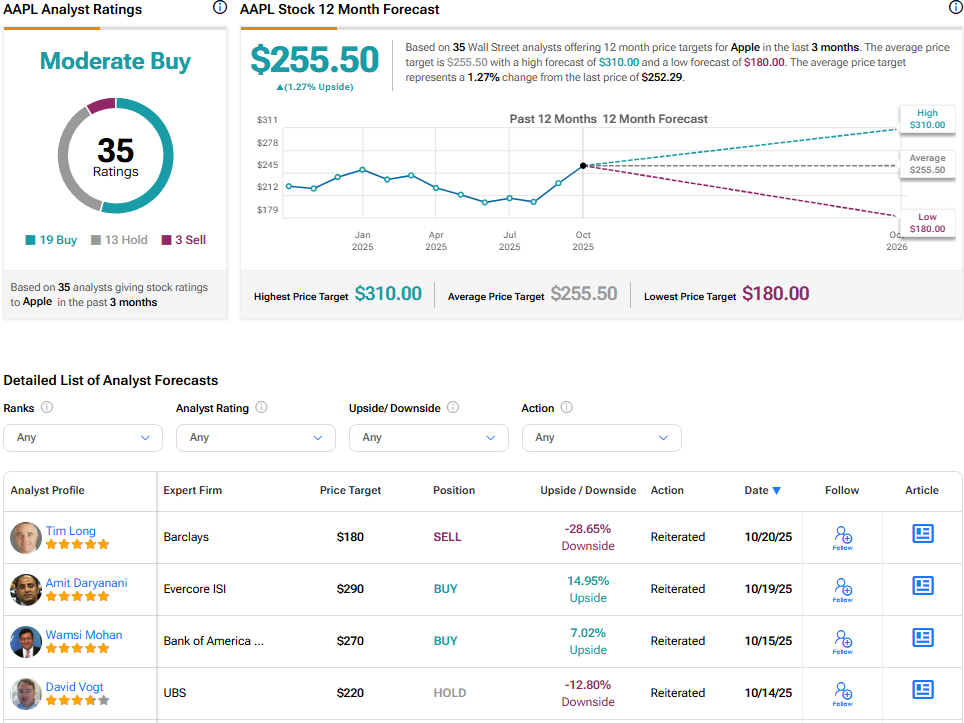

Despite the ongoing challenges to embed AI features across its ecosystem, Apple boasts a fairly positive outlook among the Street’s analysts, with a Moderate Buy consensus rating. The average AAPL stock price target stands at $255.50, implying a 1.27% upside from the current price.