HYPE Whales Pivot To Game-Changing Crypto Presale Offering 1000% ROI Potential With Daily Rewards

Major crypto investors are shifting their attention to what could be the most explosive presale opportunity of 2025.

The 1000% Return Proposition

While traditional finance struggles with single-digit yields, this emerging project promises returns that would make Wall Street bankers blush—if they weren't too busy counting their annual bonuses.

Daily Rewards Revolution

Forget quarterly dividends—this protocol delivers consistent daily payouts, creating a passive income stream that actually lives up to the hype.

In a market where most financial products are designed to enrich institutions first, this presale represents the kind of disruptive potential that keeps traditional finance executives awake at night—probably while checking their own crypto portfolios.

Wells Fargo is now playing offense

The presidential election of Donald TRUMP brings a much more favorable regulatory environment for banks. Coming into the year, Wells Fargo still operated under an asset cap after a series of regulatory violations, preventing the bank from expanding for more than seven years.

Image source: JPMorgan Chase.

Expanding the balance sheet and reaping more interest income from loans and other assets is one of the main ways banks make money. The Federal Reserve had placed an asset cap on Wells Fargo in 2018 as punishment for the bank's phony-accounts scandal, in which employees opened unauthorized customer accounts to meet performance quotas. Although I do think Wells Fargo WOULD have eventually gotten the asset cap removed, Trump's regulatory regime expedited the process.

Now the bank, which has already been improving returns under the leadership of Chief Executive Officer Charles Scharf, can play offense, and in Q3, Scharf seemed to remove the training wheels.

Scharf said the bank is now targeting a 17% to 18% return on tangible common equity (ROTCE) in the medium term, although he did not define how long the medium term is. Still, this is a significant increase in management's internal targets. Wells Fargo only earned an 8% ROTCE in 2020 but has made significant progress during the past five years, achieving a 15% ROTCE year to date.

Scharf took over in 2019. While spending significant time on transforming the bank's regulatory infrastructure, he also significantly cut expenses and focused on the bank's Core U.S. banking business, and on higher-returning operations like credit cards, as well as more capital-efficient businesses like investment banking. On the company's Q3 earnings call, Chief Financial Officer Michael Santomassimo also said he sees a good opportunity to expand margins in wealth management and lending, where the bank is undersized compared to peers.

Scharf also noted these new return targets depend on interest rates, the macro environment, and the future regulatory climate. These returns are also based on the bank bringing one of its key regulatory ratios -- its common equity tier 1 (CET1) capital ratio, a measure of CORE capital to risk-weighted assets like loans -- down from 11% to a range of 10% to 10.5%. Generally, the less capital a bank holds the higher returns it can generate.

Can Wells Fargo catch JPMorgan?

For many years now, JPMorgan Chase has targeted a 17% ROTCE through the interest rate and economic cycle. But it has overdelivered for a number of years. In fact, during the past four quarters the bank hasn't reported less than a 20% ROTCE. This is also happening as the bank continues to hold a TON of excess capital and well over a 15% CET1 until last quarter when it dropped to 14.8%. The bank's regulatory requirement is 11.5%.

However, as recently as the bank's Q2 earnings call, CEO Jamie Dimon maintains that the bank's ROTCE target is still 17%. Now, I think Wall Street analysts believe it will ultimately be higher, especially if the bank is able to lower its CET1 ratio, which should be attainable at some point, especially if the current administration makes good on its promise to deregulate the sector and lower capital and liquidity requirements.

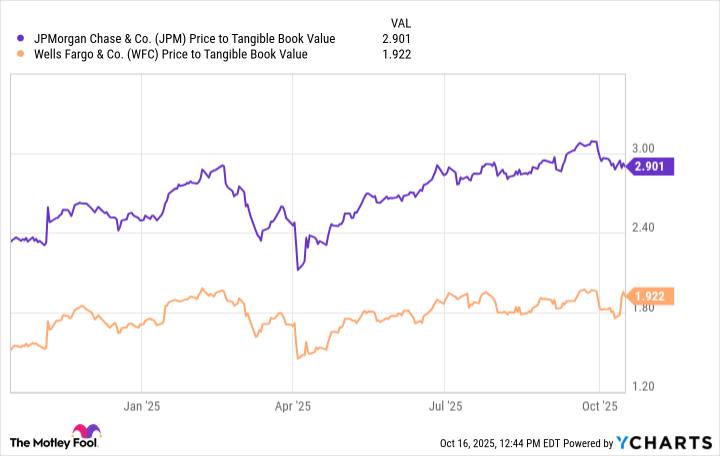

But Dimon may be waiting until new regs are etched in stone because of all of the proposed changes to bank regulatory capital and liquidity requirements over the years. In theory though, if Wells Fargo executes on its 17%-18% ROTCE goal and JPMorgan does not maintain its elevated ROTCE, which management has not committed to yet, perhaps the valuation gap between the two stocks will close.

JPM Price to Tangible Book Value data by YCharts.

But it's too early to assume this yet. JPMorgan's premium comes from several factors including Dimon himself, who is revered in the banking industry, as well as the bank's many strong revenue streams from credit card lending, investment banking, and its lesser-known but very strong payments business. Also, since Q3 2023, JPMorgan has only generated less than a 17% ROTCE once. In every other quarter, it reported at least a 19% ROTCE.

Still, the fact that Scharf, a former Dimon protégé, and Wells Fargo are now targeting roughly the same ROTCE as JPMorgan is noteworthy, and I'm sure it's caught JPMorgan's attention.