If You’d Put $10,000 in Rigetti Computing Last Year - Here’s What It Would Be Worth Now

Quantum computing meets quantum losses - Rigetti's rollercoaster year leaves early investors reeling.

The Cold Hard Numbers

That $10,000 investment from twelve months ago? Let's just say you wouldn't be buying a quantum computer with the returns. The actual figures tell a brutal story of volatility in the quantum computing space.

Market Forces at Play

Rigetti got hammered by the same forces crushing most speculative tech stocks - rising interest rates, slowing venture funding, and investors fleeing risky bets for safer harbors. Quantum computing remains years from commercial viability, and Wall Street's patience is wearing thinner than a qubit's coherence time.

When Hype Meets Reality

Another case of revolutionary technology taking longer to mature than investor expectations. The quantum computing space continues to burn cash faster than classical computers can calculate pi - because in tech investing, sometimes the future arrives later than your margin call.

Image source: Getty Images.

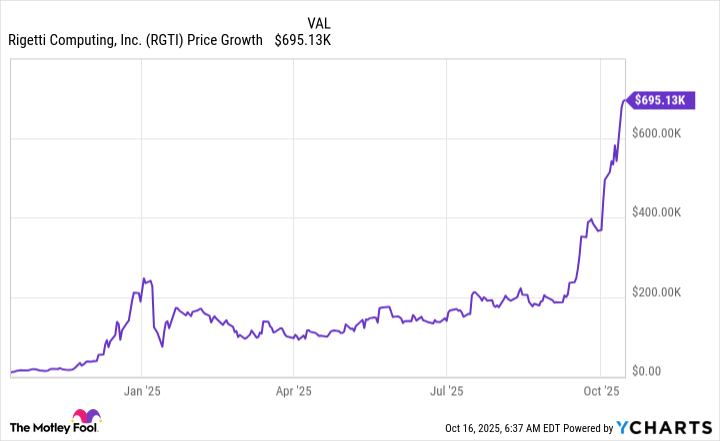

$10,000 invested a year ago is worth nearly $1 million now

Every investor always talks about the fabled 100-bagger stock. These are extremely difficult to find, and even harder to hold as the stock goes stratospheric. However, Rigetti Computing has nearly delivered that in just one year.

RGTI data by YCharts

$10,000 invested is worth nearly $700,000 now, and it won't take much more for Rigetti to cross above the 100x threshold, especially with all of the momentum in the quantum computing space.

However, to achieve those returns, you had to be an early investor in quantum computing. The quantum computing investment trend really began in December of last year when Google announced the success of its Willow quantum computing chip. While this was impressive, it caused investors to consider other pure play quantum computing stocks, like Rigetti Computing, and realize that these start-ups were delivering similar results. This kicked off the initial stage of quantum computing investing, although these stocks sold off at the start of 2025.

However, quantum computing has gained a TON of momentum recently, causing every stock in the industry to soar. Rigetti has no exception, but it also has some business wins that helped its stock rise.

Rigetti is actually selling quantum computing units now

Although most quantum computing companies (Rigetti included) point toward 2030 as being the year when quantum computing becomes commercially viable and accepted, it's already seeing some sales now. Rigetti Computing announced sales of two of its Novera systems, with one going to an Asian tech manufacturing company and another going to a California-based physics and AI start-up. These sales only totaled $5.7 million, but it's a start to what could become a much larger business.

Before 2030, there is only going to be limited quantum computing demand, mostly coming from research institutions. Rigetti estimates the annual value for this market to be between $1 billion $2 billion. However, it's expected to boom after that, with the annual market value reaching $15 billion to $30 billion between 2030 and 2040.

Quantum computing will likely not be a winner-takes-all space, but if Rigetti Computing can capture a 25% market share by 2035 and have the industry reach $30 billion, that's $7.5 billion in potentially annual revenue for Rigetti Computing. It's impossible to predict what kind of margins Rigetti Computing will get on these devices, but if it can achieve a 25% profit margin, that WOULD amount to $1.88 billion in profits.

Once again, those are just projections that could be wildly off. However, I think it gives an overall goal to shoot for in a decade from now. Unfortunately, if those figures turn out to be true, Rigetti doesn't have a ton of room left to go. If we assign a 40 times earnings multiple to that $1.88 billion in profits, that would give the stock a market cap of $75 billion. That's still a strong rise from the $18 billion it's valued at today, but it's nothing like the returns that early investments have enjoyed.

Time will tell if those predictions pan out, and even if they do come true, Rigetti Computing will still outperform the broader market. This would make it not too late to buy the stock, but there's still the risk of Rigetti Computing getting beaten out by a competitor. If it does, the stock will likely fall to zero. Rigetti is a high-risk, high-reward stock, but with a large chunk of the reward being baked into the stock price already, I think there are better alternatives to invest in.