Quantum Leap or AI Powerhouse: D-Wave vs. Nvidia - Which AI Stock Dominates in 2025?

Two tech titans collide in the race for artificial intelligence supremacy—one harnessing quantum mechanics, the other dominating classical computing.

The Quantum Contender

D-Wave's quantum annealing processors tackle optimization problems that would make traditional supercomputers sweat. Their qubit-based approach promises exponential speedups for machine learning workloads—if they can overcome decoherence challenges.

The Graphics Giant

Nvidia's GPUs already power the AI revolution, with data centers scrambling for their latest tensor core architecture. Their CUDA ecosystem locks in developers tighter than a Bitcoin wallet's private keys.

Market Realities

While quantum computing promises paradigm-shifting potential, Nvidia's revenue streams flow deeper than a crypto bull market's optimism. Institutional investors keep betting on proven silicon over quantum uncertainty—because nothing warms a fund manager's heart like predictable quarterly earnings.

The Verdict

Choose quantum's high-risk moonshot or silicon's steady climb? Both stocks could rocket—but only one has Wall Street's algorithm already programmed to buy. Sometimes the most advanced AI still can't beat old-fashioned profit margins.

Image source: Getty Images.

D-Wave's marriage of AI and quantum computing

D-Wave is developing annealing quantum computers, a method to identify the best solution among many possible choices. The company demonstrated the strength of this approach by using it to complete complex calculations in minutes that WOULD have taken 1 million years on classical supercomputers.

D-Wave released an AI toolkit this year, allowing software developers to tap into its quantum computers. The company described the achievement as "a milestone in quantum AI development." These tools integrate D-Wave's quantum systems with PyTorch, a leading framework for building AI models.

Leveraging quantum devices for AI can significantly lower the rapidly increasing cost of building AI models. This approach also harnesses the superior computational power of quantum computers. Research centers in Germany, Canada, and Japan have achieved AI improvements using D-Wave's quantum machines.

The company's technological advances contributed to second-quarter revenue growing 42% year over year to $3.1 million. That said, Q2 operating expenses soared 41% year over year to $28.5 million, resulting in an operating loss of $26.5 million.

Nvidia's AI advances

Nvidia's state-of-the art semiconductor chips helped to kick off the current wave of generative AI applications, such as OpenAI's ChatGPT. Its latest chip technology, called Blackwell, is pushing the boundaries of what classical computers can do.

Blackwell was designed to support the largest, most complex AI models. To do so, Nvidia fused multiple semiconductor chips together into a superchip, which lives in a rack holding other components that collectively weigh over a ton. Each rack is a single, massive computer processor.

Blackwell is so powerful, Nvidia is using it to bridge classical and quantum computers. Users can create quantum software applications through Blackwell without needing access to a quantum machine.

Nvidia envisions a period where quantum and classical computers depend on each other. Currently, quantum devices face significant hurdles, such as calculation errors, which hinder widespread adoption. Nvidia sees the Blackwell platform working in concert with quantum computers to overcome these challenges.

Blackwell production began in late 2024, and it's selling well. In the company's fiscal Q2, ended July 27, Blackwell sales ROSE 17% over Q1, contributing to Q2 revenue growing 56% year over year to $46.7 billion. This success resulted in operating income climbing 53% year over year to $28.4 billion.

Making a choice between D-Wave Quantum and Nvidia stocks

At this point, Nvidia's Blackwell platform is keeping pace with D-Wave in the race to power increasingly potent AI. However, shares of D-Wave have seen the greater gains in 2025, surging over 200% through the week ending Sept. 19, helped by the Federal Reserve cutting interest rates. Nvidia's stock was up more than 30% in that time, a robust gain in its own right.

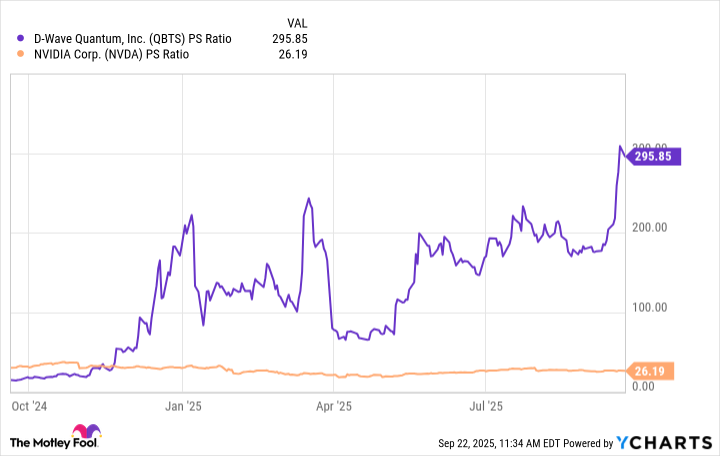

But aside from the technological advances each company is making, another factor to consider is share valuation. Since D-Wave isn't a profitable business, valuation can be assessed using the price-to-sales (P/S) ratio.

Data by YCharts.

Since D-Wave's share price took off recently, its P/S ratio has skyrocketed, and the chart reveals it's now more than 10 times higher than Nvidia's. This indicates D-Wave stock is expensive by comparison.

Although quantum computing's potential is exciting, it's a nascent technology with significant challenges to overcome. It's too early to tell whether D-Wave's tech or a competitor's will win over the long run.

In addition, D-Wave's rising operating loss compared to its minimal revenue will eventually put the company in financial trouble if it doesn't reverse. Meanwhile, Blackwell's help to address quantum computing's shortcomings means Nvidia can partner with D-Wave, as well as other quantum computing companies.

Nvidia's AI tech, measured approach to a quantum computing transition, profitable and growing business, and better share price valuation make it the superior AI investment over D-Wave.

On top of these advantages, Nvidia recently announced multibillion-dollar investments inand OpenAI to build out infrastructure for artificial intelligence, further strengthening its offerings. Nvidia is firing on all cylinders, making it a great long-term investment in AI.