CoreWeave’s $6.3 Billion Lifeline Fuels Explosive Growth: Long-Term Investor Insights

Cloud infrastructure provider CoreWeave just secured a massive $6.3 billion funding round—the kind of number that makes traditional VCs blush. This isn't just another Silicon Valley vanity metric; it's rocket fuel for GPU-centric computing infrastructure.

The AI Infrastructure Gold Rush

CoreWeave's timing couldn't be better. As artificial intelligence workloads explode, demand for specialized computing power outstrips supply. The company positions itself as the picks-and-shovels play for the AI revolution—a bet that's clearly resonating with deep-pocketed investors.

Long-Term Play or Short-Term Hype?

While the headline number dazzles, savvy investors should look beyond the press release. The real question isn't about current valuation but sustainable competitive advantage. Can CoreWeave maintain its edge against cloud giants and specialized competitors? The $6.3 billion vote of confidence suggests institutional believers.

Investment Implications

This funding round signals broader recognition that specialized compute infrastructure represents a fundamental shift—not just a niche market. For long-term portfolios, it underscores the growing value of infrastructure plays in the AI ecosystem. Because sometimes the smartest money isn't in building the AI models themselves, but in renting out the digital shovels.

Remember: Wall Street analysts will likely spend weeks debating whether this valuation represents genius foresight or just another case of 'too much money chasing too few viable deals'—a familiar tune in tech financing circles.

Image source: Getty Images

Nvidia's guarantee is great news for CoreWeave investors

CoreWeave has built its business by offering dedicated artificial intelligence (AI) data centers powered by graphics processing units (GPUs) from Nvidia. It rents out its cloud computing capacity to the likes ofand, which account for the majority of its top line. It has also added a third big customer in the FORM of OpenAI.

The ChatGPT maker offered an initial contract worth $11.9 billion to CoreWeave in March this year, before enhancing the size of the deal by another $4 billion. And now, Nvidia has signed a $6.3 billion contract with CoreWeave that will guarantee the latter's revenue growth in the long run. Under this agreement, Nvidia will be purchasing any unsold data center capacity from CoreWeave through April 2032.

In a filing with the Securities and Exchange Commission (SEC), CoreWeave pointed out that "Nvidia is obligated to purchase the residual unsold capacity" of its data centers in case its "data center capacity is not fully utilized by its own customers." CoreWeave's existing data center capacity is falling short of demand.

CFO Nitin Agrawal remarked on the August earnings conference call that CoreWeave's "growth continues to be capacity-constrained, with demand outstripping supply." This is evident from the fact that its contractual backlog increased by close to $14 billion year over year in Q2, driven by the multibillion-dollar contracts the company signed in the quarter.

For comparison, CoreWeave's Q2 revenue increased to $1.2 billion from $395 million in the year-ago period. Not surprisingly, the company is laser-focused on bringing online more data center capacity so that it can fulfill its massive revenue backlog worth $30 billion. It currently operates 33 dedicated AI data centers in the U.S. and Europe, with active power capacity of 470 megawatts (MW).

However, it has been increasing its contracted data center power capacity at a nice clip so that it can bring more active capacity online. Specifically, CoreWeave's contracted data center power capacity increased by 600 MW in the previous quarter to 2.2 gigawatts (GW). But even that might not be enough in the long run, as according to McKinsey, data center capacity demand could grow by 4x between 2023 and 2030.

The firm estimates that global data center capacity demand could hit 220 GW in 2030 from 55 GW in 2023 in a midrange scenario. So there is a good chance that CoreWeave could remain capacity-constrained in the long run thanks to the AI-powered data center boom. For instance, McKinsey is expecting a deficit of more than 15 GW in data center power capacity in the U.S. itself by 2030.

As such, CoreWeave may not be left with any residual capacity to sell to Nvidia going forward, as there is a good chance that data center demand will continue to be stronger than supply on account of AI. And now, Nvidia's guarantee gives CoreWeave investors an extra cushion that should ensure healthy long-term growth for the company, even if there's a drop in AI computing capacity requirements.

What should investors do?

Nvidia's guarantee suggests that the demand for AI computing is likely to remain robust in the long run. This should ideally translate into a bigger backlog and stronger growth for CoreWeave, which is just what analysts are expecting from the company through 2028.

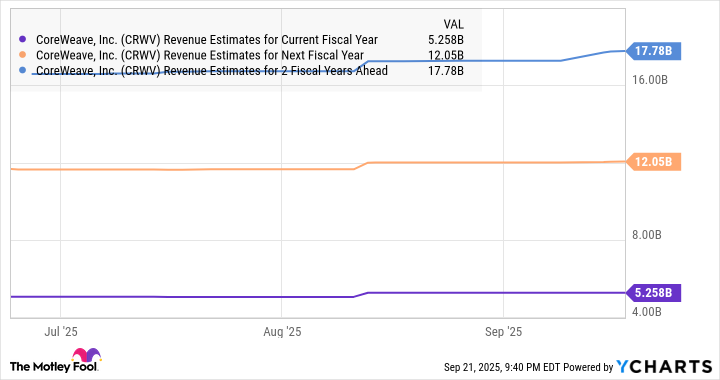

CRWV Revenue Estimates for Current Fiscal Year data by YCharts

The massive opportunity in the cloud AI infrastructure market should help CoreWeave sustain impressive growth rates beyond 2028. For instance, even if it clocks 20% annual top-line growth in 2029 and 2030, its revenue could hit $25.6 billion. If the stock is trading at even 5 times sales at that time, in line with the's average sales multiple, its market cap could get close to $130 billion. That WOULD be more than double CoreWeave's current market cap.

Importantly, CoreWeave can now be bought at 16 times sales, which isn't all that expensive when we consider its remarkable growth.

So investors looking to capitalize on the AI cloud infrastructure market's long-term growth potential can consider buying this AI stock right away, especially considering that the Nvidia deal is a vote of confidence in CoreWeave's -- and the AI data center market's -- prospects.