BigBear.ai Stock (BBAI) Soars 51% - Here’s Who Really Owns It

Artificial intelligence play BigBear.ai just ripped 51% higher - but who's actually holding the bags?

The Institutional Chessboard

Hedge funds and asset managers piled into BBAI during the AI frenzy, betting big on military and commercial contracts. BlackRock, Vanguard, and a handful of quant firms dominate the shareholder registry.

Insider Moves That Raise Eyebrows

Executives have been quietly trimming positions while retail investors FOMO into the rally. The classic pattern: institutions accumulate during quiet periods, then distribute during parabolic moves.

Why This Ownership Structure Matters

High institutional concentration means volatility swings get amplified. When the big players decide to exit, they don't bother with limit orders - they just smash the bid.

Another AI stock pumped on defense contractor promises. Because what could go wrong betting on military tech that'll probably get outdated before the next earnings call?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, on September 23, BBAI stock surged following the announcement that it will deploy advanced AI and orchestration technologies for the U.S. Naval Forces Southern Command/U.S. 4th Fleet at the UNITAS 2025 event.

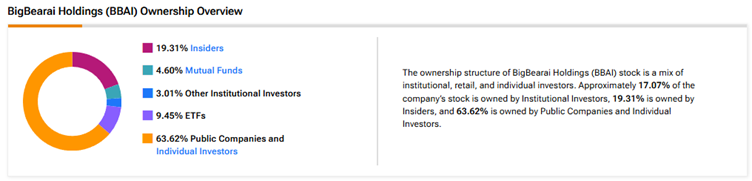

Now, according to TipRanks’ Ownership page, public companies and individual investors own 63.62% of BigBear.ai Holdings. They are followed by insiders, who own 19.31% of the AI stock. Meanwhile, ETFs, mutual funds, and other institutional investors own 9.45%, 4.6%, and 3.01%, respectively.

Digging Deeper into BBAI’s Ownership Structure

Looking closely at top shareholders, insider BBAI Ultimate Holdings, LLC holds the largest stake at 17.32%.

Meanwhile, Vanguard and Vanguard Index Funds own 5.1% and 3%, respectively, of the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 2.35% stake in BBAI stock, followed by the iShares Russell 2000 ETF (IWM), which holds a 1.95% stake.

Moving to mutual funds, Vanguard Index Funds holds about 3% of BigBear.ai. Meanwhile, Fidelity Salem Street Trust owns 0.37% of the company.

Is BBAI a Good Stock to Buy?

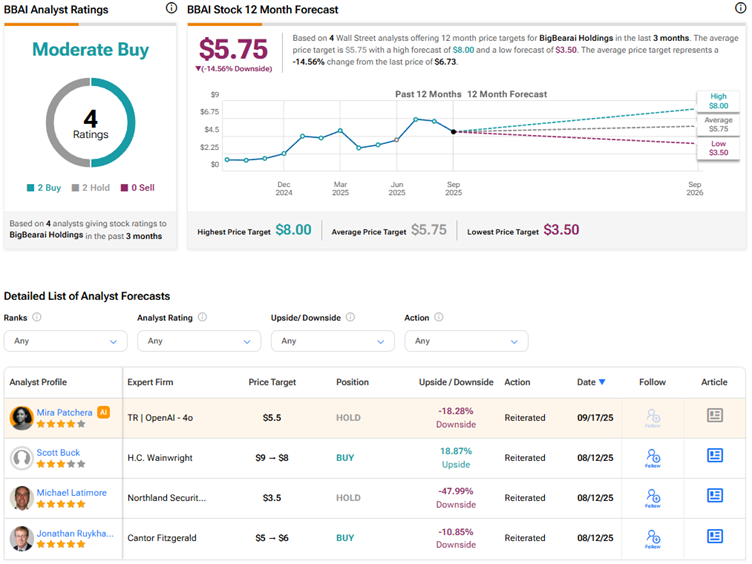

Currently, Wall Street has a Moderate Buy consensus rating on BigBear.ai Holdings stock based on two Buys and two Holds. The average BBAI stock price target of $5.75 indicates 14.6% downside risk from current levels.