Ondo Finance’s USDY Makes Waves with Sei Network Launch – The Next Big Leap in Tokenized Yield?

Ondo Finance just dropped a bombshell—its yield-bearing stablecoin USDY is going live on Sei Network. Move over, sleepy legacy finance; the race for institutional-grade DeFi just got hotter.

Why Sei? Speed meets compliance.

Sei’s parallelized EVM isn’t just another blockchain—it’s a turbocharged highway for institutional capital. By hosting USDY, the network positions itself as the go-to rail for tokenized real-world assets (RWAs). No more settling for 0.01% APY from your neighborhood bank.

The cynical take? Wall Street’s still figuring out wallets while builders ship. But with Ondo’s treasury-backed USDY expanding its reach, even the suits might finally catch on. Maybe.

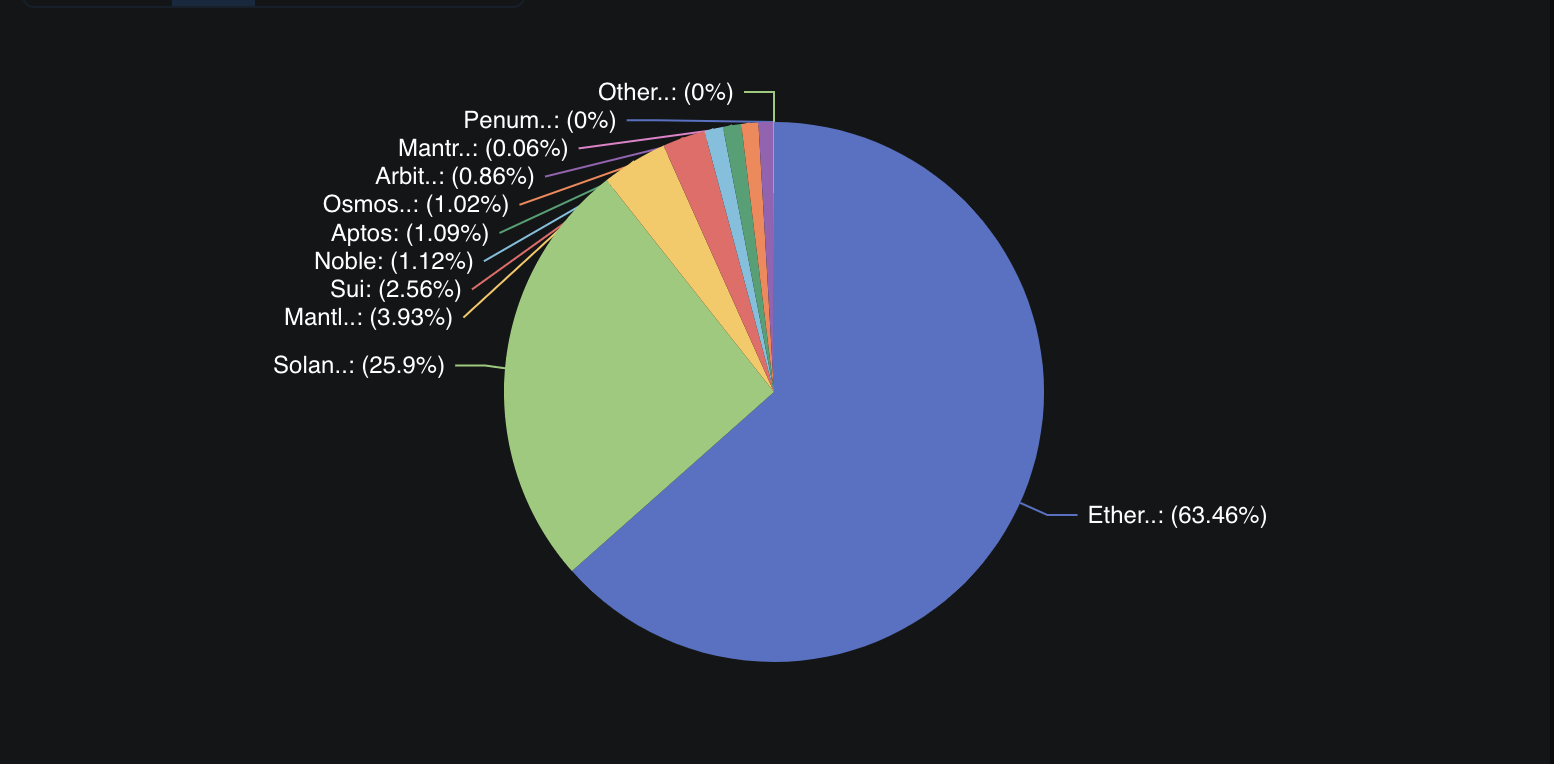

Source: Breakdown of USDY circulating supply by chain | DeFiLlama

Source: Breakdown of USDY circulating supply by chain | DeFiLlama

It’s also worth noting that USDY is now fully fungible across Ethereum, Mantle, and Arbitrum — eliminating the need for wrapping or swapping between chains — following the integration of LayerZero’s omnichain standard in November last year. Support for additional networks is planned.