Trump Backpedals? Wall Street Rallies Behind the Fed Amid Dismissal Drama

Recently, U.S. President Donald Trump sparked fresh controversy in financial markets by reportedly considering the dismissal of Federal Reserve Chair Jerome Powell. According to multiple media outlets, Trump floated the idea during a closed-door meeting with Republican lawmakers. However, the drama saw a sudden reversal within 24 hours—Trump swiftly told the press that firing Powell was “highly unlikely.”

1. A Scare That Lasted Only Hours: Trump Backs Off Amid Market Jitters

On Wednesday, reports emerged that Trump had privately raised the idea of removing Powell and consulted Republican lawmakers for feedback. Some GOP members even expressed support. The news shook financial markets:

- U.S. Treasury yields fell sharply,

- Gold and Bitcoin rallied,

- Equities and the U.S. dollar came under short-term pressure.

Yet only hours later, Trump publicly denied the plan, stating, “I have no plans to fire him. I never rule anything out, but I think it’s highly unlikely unless there’s some kind of fraud.”

This swift reversal surprised observers. Did Trump back down under media and market pressure? The more plausible explanation is strategic: a calculated move to pressure the Fed into cutting interest rates more aggressively.

2. Why Is It So Difficult for Trump to Fire Powell?

Despite repeated criticism—calling Powell a “terrible Fed Chair” and accusing him of serving “Democratic interests”—Trump faces significant legal hurdles in attempting to dismiss the Fed Chair.

From a legal standpoint:

- Analysts at Wolfe Research point out that removing Powell would require “just cause.” Without it, Trump risks a prolonged legal battle, potentially reaching the Supreme Court.

- Roger Altman, founder of Evercore, called the idea “one of the worst” and said Powell is unlikely to resign voluntarily. Any attempt at removal would inevitably lead to a constitutional challenge.

The Supreme Court has previously affirmed the Fed’s unique legal status and independence from other federal institutions. Legal experts believe any such action would trigger immediate judicial intervention, likely resulting in an injunction.

In short, dismissing Powell would mean long, costly legal and political uncertainty—an extremely risky move for any administration.

3. Rare Unity on Wall Street: Central Bank Independence Must Be Preserved

Trump’s remarks triggered rare and vocal support for the Fed from top Wall Street executives:

- JPMorgan CEO Jamie Dimon said Fed independence is “absolutely essential” for economic and market stability.

- Goldman Sachs CEO David Solomon, Bank of America CEO Brian Moynihan, and Citigroup CEO Jane Fraser all echoed similar sentiments, stressing the importance of an independent central bank.

These industry leaders oversee more than $12 trillion in assets. Their coordinated response underscores a deep-seated concern across the financial sector that political interference in monetary policy could undermine confidence in the U.S. dollar and Treasury markets, and trigger global volatility.

4. What Did the Market Believe?

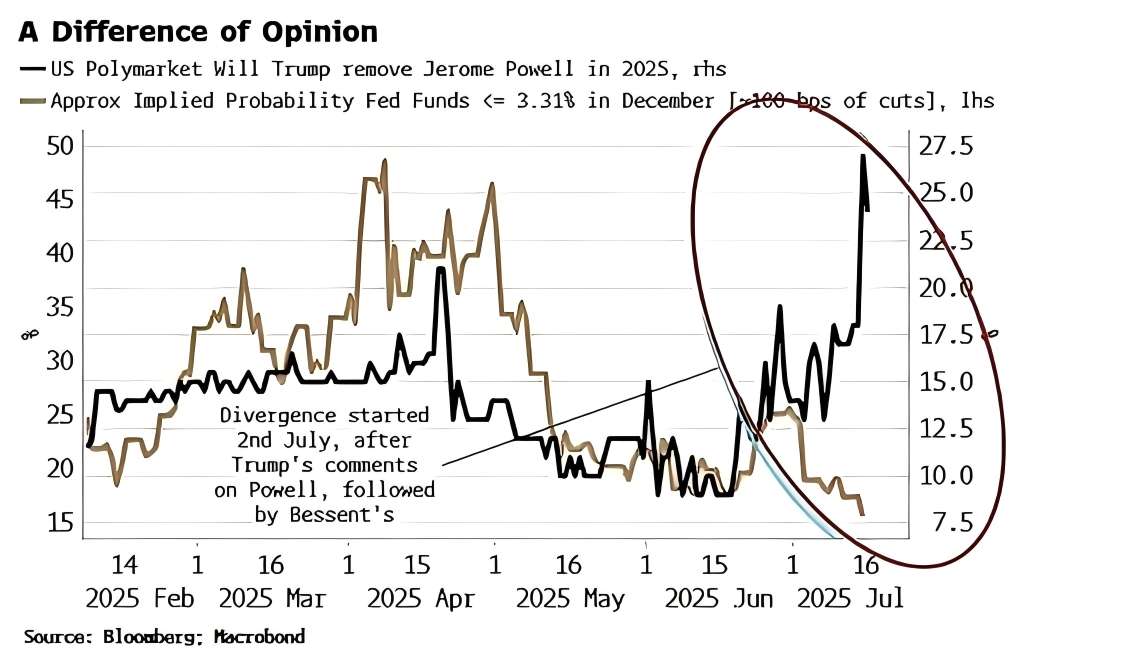

Interestingly, while Trump’s remarks stirred political headlines, the financial markets sent mixed signals:

- Prediction markets like Polymarket saw betting odds for Powell’s removal surge;

- Yet the interest rate markets (e.g., Fed funds futures) remained largely calm.

Given strong recent U.S. economic data and labor market resilience, the Fed funds futures market reacted more to fundamentals—and perhaps showed greater trust in Treasury Secretary Scott Bessent’s measured responses.

This divergence indicates that while Trump’s comments rattled some sentiment, markets are still guided primarily by policy credibility and macroeconomic data—not political theater.

5. In the End, Markets Trust Stability Over Political Noise

Taken together, it is highly unlikely that Powell will be removed before his term ends in May 2026. Trump’s swift reversal illustrates the strength of institutional guardrails protecting the Fed’s independence—safeguards that even a sitting president cannot easily dismantle.

Rather than fixate on whether Trump can oust Powell, markets would be better served by analyzing Trump’s underlying policy intentions—and what they reveal about the broader U.S. economic outlook. After all, long-term market direction will be shaped not by soundbites, but by the consistency of monetary policy and the strength of economic fundamentals.

Disclaimer: This article is based on publicly available media reports and institutional market analysis. It does not constitute investment advice. Investing involves risk. Please proceed with caution.

For more detailed market analysis, strategies, and educational resources, visit BTCC Academy and stay ahead of the curve in the rapidly evolving crypto space.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

- Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

- Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]