BTCC Crypto Daily (7.17)|Market Seeks Breakout Amid Uncertainty; U.S. House Resumes Crypto Legislation

1.Overview

- U.S. House passes procedural vote on crypto legislation

- Trump: No current plans to dismiss Fed Chair Powell

- CME explores 24/7 crypto trading

2.Macro & Policy Outlook

Key Events Today

- Eurozone June HICP YoY final (prior: 2%)

- Fed Governor Kugler speaks on housing and economic outlook

- U.S. June Import Price Index to be released (prior: 0.2%)

Global Macro Developments

1. U.S. House Advances Key Crypto Bills, Final Vote Expected This Week

The U.S. House of Representatives has narrowly passed a procedural vote to advance the GENIUS Stablecoin Act, the Clarity Market Structure Act, and the Anti-CBDC Surveillance Act. A final vote is expected later this week. The vote follows direct engagement from Donald Trump, who met with several GOP lawmakers and publicly voiced support, helping revive the stalled agenda.

2. Trump: Trade Talks with India and EU Progressing, Canada Deal Premature

President Donald Trump said in an interview that trade talks with India are “very close” to completion, and negotiations with the EU also show promise. Both Indian and EU delegations are currently in Washington for discussions. However, he stated that a deal with Canada is “too early to call.” Trump also reiterated his plan to impose a 10–15% universal tariff on over 150 countries as leverage in trade talks.

3. Bank of America Developing Stablecoin, Awaiting Market Conditions

Bank of America CEO Brian Moynihan confirmed that the bank is actively preparing to launch its own stablecoin, pending suitable market conditions and regulatory clarity. Although current demand remains limited, the bank is assessing customer needs and may collaborate with other institutions. Citi, JPMorgan, and Morgan Stanley have also disclosed plans to enter the stablecoin space, amid growing regulatory momentum aligned with the GENIUS Act.

4. Fed Beige Book: Economic Outlook Slightly Pessimistic

The latest Federal Reserve Beige Book indicates slight growth in the U.S. economy from late May to early July. Among the 12 Fed districts, five reported expansion, five saw flat activity, and two experienced minor contractions. Most regions observed modest price increases, with seven describing inflation as “moderate” and five as “modest.” Input costs rose due to tariffs, with some firms passing on the burden to consumers, while others absorbed the costs, squeezing margins.

5. Trump Denies Drafting Letter to Dismiss Fed Chair Powell

President Trump denied media reports suggesting he had drafted a letter to dismiss Fed Chair Jerome Powell. He stated that no such plan exists and removal is “highly unlikely” unless fraud is proven. Trump did acknowledge private discussions on the topic with Republican lawmakers, fueling speculation about his intent to pressure the Fed on rate cuts.

6. Thailand Launches Crypto Sandbox to Enable Tourist Payments in Baht

Thailand’s SEC and central bank have launched a crypto sandbox initiative to allow foreign tourists to convert digital assets into Thai Baht for local use. Exchange will be facilitated via licensed digital asset operators and e-money firms under KYC and AML compliance. Daily purchases can be made via QR codes, with spending capped at THB 50,000/month for informal vendors and THB 500,000/month for KYM-certified merchants.

Traditional Asset Correlation

- Nasdaq +0.3%, S&P 500 +0.3%, Dow +0.5%

- Spot gold +0.7% at $3,336/oz

- WTI crude (USOIL) -0.2% at $66.6/bbl

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(as of July 17, 14:00 HKT)

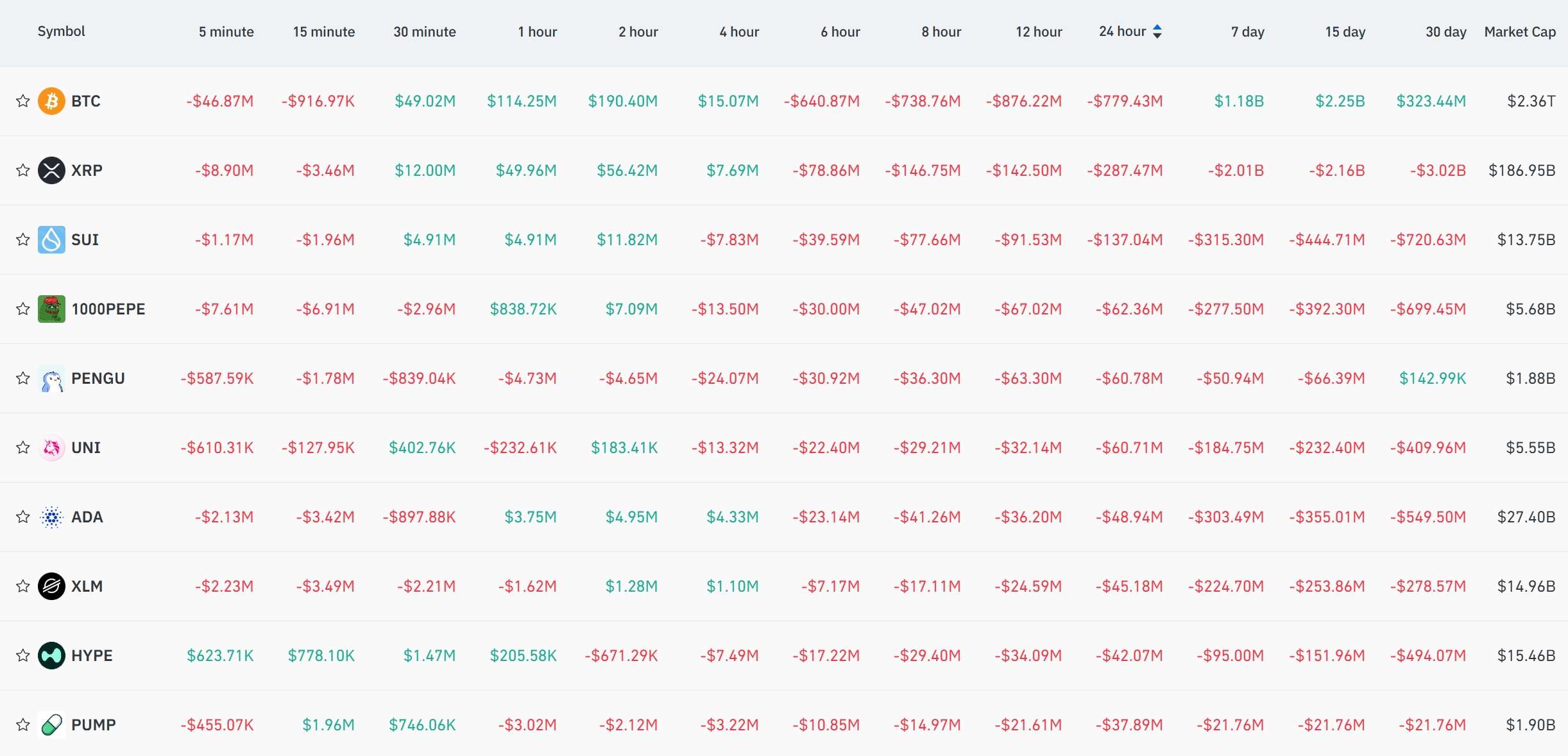

2.Futures Capital Flow Analysis

According to Coinglass data on July 17, net outflows in contract positions were led by BTC, XRP, SUI, 100PEPE, PENGU, and UNI over the past 24 hours, suggesting potential trading opportunities.

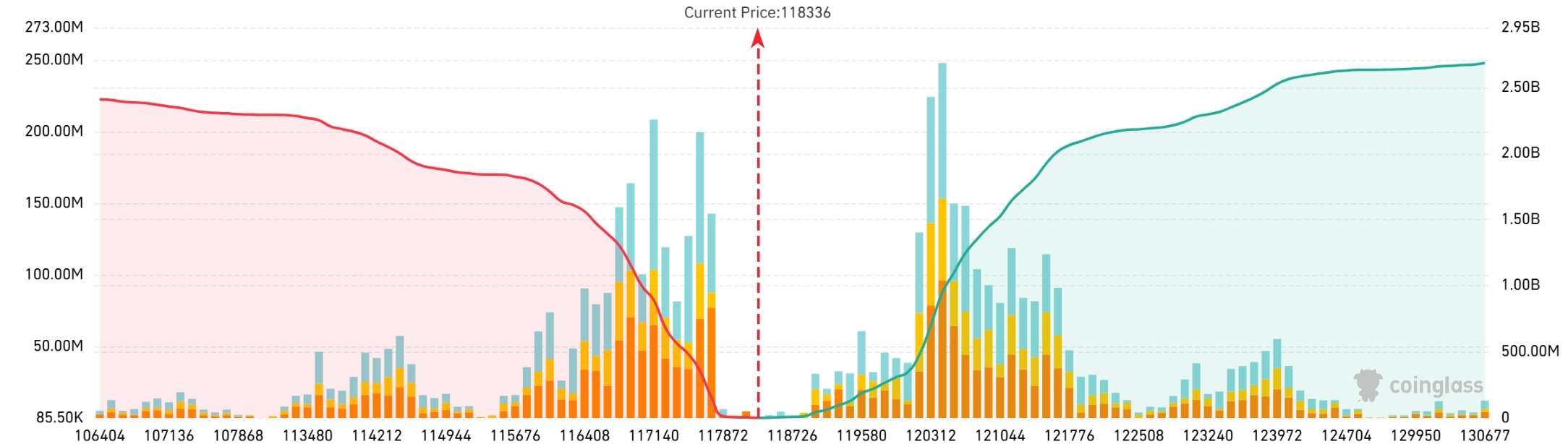

3. Bitcoin Liquidation Map

As of July 17, Coinglass data shows that if BTC drops below $116,000 (with current price at $118,336), cumulative long liquidation pressure on major CEXs could reach $1.78 billion. Conversely, if BTC breaks above $122,000, cumulative short liquidation pressure could surge to $1.958 billion. Traders are advised to manage leverage prudently to avoid forced liquidations in volatile conditions.

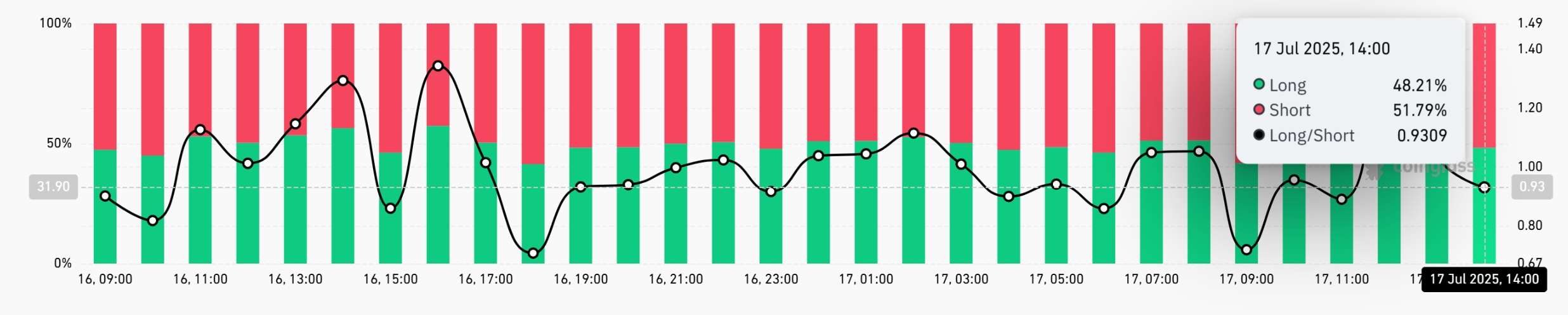

4. Bitcoin Long/Short Ratio

As of 14:00 HKT on July 17, the global BTC long/short ratio stands at 0.9309, with 48.21% long and 51.79% short positions, per Coinglass.

5. On-Chain Monitoring

- According to EmberCN, the WLFI portfolio linked to the Trump family has returned to breakeven. Since December, it spent $352 million across 12 assets, with ETH accounting for over 60%. The portfolio once saw unrealized losses of $157 million in April. Most assets have since been moved to Coinbase Prime; current holdings remain unclear.

- On-chain analyst Yu Jin reports that Trend Research has reduced its ETH holdings by 79,000 ETH (approx. $250M). Their outstanding on-chain borrowings have dropped from $275M to $168M since they started selling. They’ve offloaded at least $107M worth of ETH in the past 24 hours, with 108,000 ETH (~$367M) still on-chain.

4.Blockchain Headlines

- Trader Eugene has gradually taken profits on ETH, stating recent price action met expectations

- ETH perpetual futures volume has surpassed BTC, taking the top market position

- BlackRock ETH ETF saw a record $489M inflow yesterday, setting a new high in volume and inflow

- Proposal to make WLFI token tradable has passed voting

- CME FedWatch Tool: 64.9% probability of a 25 bps Fed rate cut in September

- French lawmakers propose using surplus nuclear power for Bitcoin mining, estimating $150M in annual revenue

- UK MPs call for banning crypto political donations over concerns of foreign interference and lack of transparency

- Reporter Eleanor Terrett: U.S. crypto market structure bill discussion delayed to next week

- Bulgaria’s 2018 Bitcoin sell-off cost the nation a missed $25B debt repayment opportunity

- GameStop CEO Ryan Cohen says company is considering accepting crypto in its collectibles division

- House Financial Services Chair Hill: House has votes to pass three major crypto bills

- SharpLink Gaming has acquired 321,000 ETH since June at an average price of $2,745

- Dennis Liu: Altcoins may enter a 1–2 month strong cycle; BTC could target $150,000

- Report: Despite BTC gains, Q2 crypto spot volume declined 22%

- Analysis: If BTC pulls back to around $110,000, it could set a more stable foundation for the next rally

- CME explores 24/7 crypto trading, excluding meme coins

- EU Commission suspends probe into Elon Musk’s X platform over Digital Services Act violations

5.Institutional Insights · Daily Picks

- LD Capital: Plans to take a short-term break before re-entering the market. Long-term bullish outlook on crypto remains intact

- • CryptoRank: Crypto industry fundraising in Q2 2025 surpassed $10B, hitting a three-year high

6.BTCC Exclusive Market Analysis

On July 17, Bitcoin continues to consolidate near $118,000. On the 4H chart, price moves between the Bollinger middle and upper bands, showing weak rebound momentum. Bollinger Bands remain open, but price struggles to break MA5 or upper resistance. MACD lines form a second death cross above the zero axis, red bars expand, and momentum divergence appears—suggesting limited strength in the rebound.

From a short-term structure perspective, BTC remains in a high-level sideways range. If price fails to reclaim MA20 and the Bollinger mid-line, a pullback to the $115,000–$115,500 support zone is likely. This region has seen heavy historical volume and could signal a downside break if lost.

Strategy: With MACD red bars growing and RSI staying below bullish zones, traders should stay cautious. Aggressive traders may test light longs if support at $115,000 holds and MACD bars contract. Stop-losses are critical. Conservative traders may wait for price to regain MA20 before entering, avoiding premature entries.

The House’s passage of the procedural vote on the GENIUS Act signals U.S. crypto legislation is moving forward, lending support to sentiment. However, political uncertainties around the final vote remain.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading..

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]