Nansen Report Reveals: Bitcoin-Heavy Firms Face Uneven Stock Market Reception

Not all crypto plays are created equal—at least not on Wall Street.

The Bitcoin divide

Nansen's latest data shows a glaring disparity in how public markets value firms betting big on BTC. Some get standing ovations from investors—others get crickets (and maybe a sympathy clap from the crypto bros in the back).

Market cap mystery

Why do two companies with similar Bitcoin treasuries trade at wildly different multiples? Blame the usual suspects: regulatory uncertainty, institutional bias, and that one hedge fund manager who still thinks blockchain is a type of ski binding.

The closer

Until traditional finance stops treating crypto exposure like a risky Tinder date, this volatility won't end. Pro tip: maybe try impressing them with your 'long-term hodl strategy' instead of your Lambo dreams.

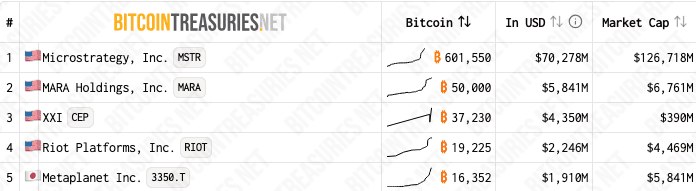

BTC holdings and market cap of the five largest corporate Bitcoin holders | Source: Bitcointreasuries

BTC holdings and market cap of the five largest corporate Bitcoin holders | Source: Bitcointreasuries

Strategy leverages debt to outperform BTC

This suggests that markets care about how a company structures its BTC holdings. Strategy uses debt, allowing it to consistently accumulate Bitcoin and effectively act as a Leveraged bet on its price.

This gives Strategy’s stock both more upside and greater volatility than Bitcoin. For instance, in December 2024, Strategy’s stock fell by 21%, while Bitcoin declined just 2%. However, Strategy’s stock has outperformed Bitcoin over the long term.

“Investors treat MicroStrategy akin to a leveraged Bitcoin ETF, amplifying exposure to Bitcoin price movements. Consequently, its stock typically exhibits 2–3× Bitcoin’s volatility,” Nansen report.

Japanese firm Metaplanet also trades above the value of its BTC holdings, at a 3.5x multiple. Nansen notes that traders favor its first-mover advantage in Asia. Like Strategy, Metaplanet is also issuing debt to buy Bitcoin.