Conflux (CFX) Soars 119% Weekly: Pharma Deal & 3.0 Upgrade Ignite Rocket Fuel

China's blockchain dark horse just got a double espresso shot.

Pharma deal + protocol upgrade = 119% weekly pump

The 'Ethereum of China' narrative gets a Viagra boost

Meanwhile, traditional finance bros still think blockchain is a type of ski binding

TLDR

-

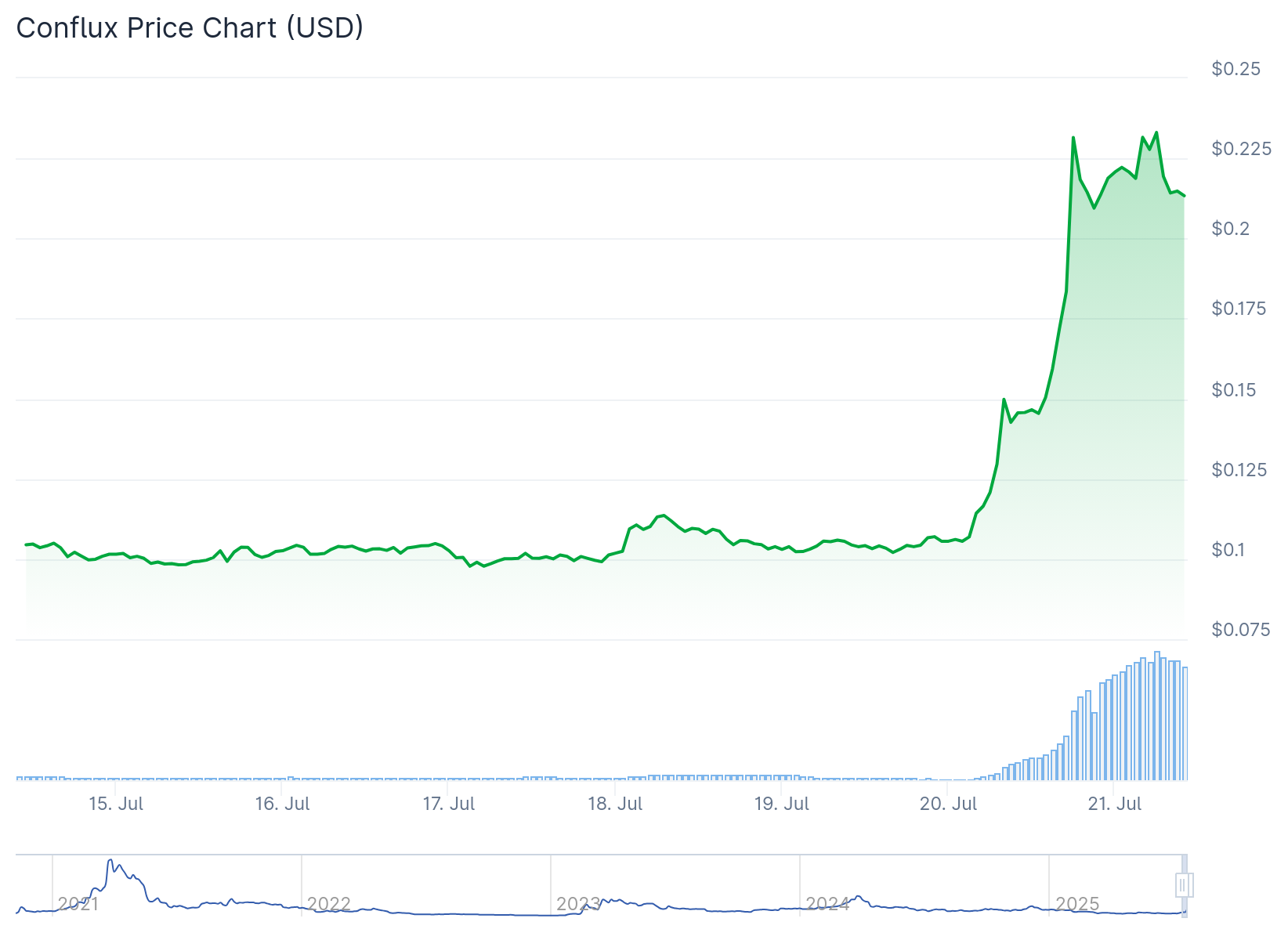

Conflux (CFX) price surged 119% in a week, hitting a high of $0.2441.

-

A Hong Kong pharma deal, stablecoin news, and Conflux 3.0 upgrade fueled the rally.

-

Over $11 million in short liquidations triggered a sharp short squeeze.

-

RSI sits near 95, signaling extreme overbought conditions and potential consolidation.

-

Analysts now watch key levels at $0.1869 support and $0.2814 to $0.33 resistance.

Conflux (CFX) has rallied 119.45% in the past seven days. The price jumped from $0.11 to $0.2441, drawing attention across crypto markets.

The MOVE was driven by three key events. These include a rumored acquisition by a Hong Kong-listed pharmaceutical company, the upcoming Conflux 3.0 upgrade, and a China-linked stablecoin pilot.

CFX has also seen a spike in short liquidations. Over $11 million in shorts were wiped out, suggesting a strong short squeeze played a part.

The current price sits at $0.2326 after a slight pullback. In 24 hours alone, it gained over 66%, with trading volume rising to $1.76 billion.

RSI Nears Overbought Levels as Rally Cools

Technical indicators now show stretched conditions. The Relative Strength Index (RSI) on the 4-hour chart is at 94.51, well above the typical overbought threshold.

The 20-period EMA has curved upward with Bollinger Bands widening sharply. This reflects increased volatility and strong price momentum.

Despite this, the RSI level and sharp run suggest a pause or pullback may be near. Traders are watching for support at $0.1869 to hold during any correction.

Development activity surged in late June ahead of the 3.0 upgrade. However, it has since slowed, possibly entering a code freeze before the July 30 upgrade milestone.

Volume and Open Interest Confirm Breakout Strength

Open interest in CFX futures has doubled, now at $325 million. Funding rates have flipped positive across exchanges, and the long/short ratio favors bulls.

Spot supply on exchanges has dropped, signaling lower selling pressure and rising investor confidence. On-chain activity shows more active addresses and transactions, backing the rally’s strength.

Volume jumped over 374%, and price has broken above the 200-day EMA. The bullish structure shows a higher high and positive MACD crossover.

Analysts say holding above $0.18 is key to sustaining this trend. Fibonacci extension targets place resistance at $0.21, $0.235, and $0.2814.

If $0.28 is cleared, the next upside zone lies around $0.33. This level acted as resistance in early 2023.

A possible Golden Cross between the 50- and 200-day MAs may confirm longer-term upside. Traders are watching that signal closely.

Support below sits at $0.145 and $0.12 in case of a deeper pullback. Holding those levels may keep the broader uptrend intact.

For now, CFX is showing strong momentum. But extreme RSI values and past resistance could lead to short-term volatility around current levels.