Ethereum Fuels Historic $4.39B Crypto Influx – Biggest Weekly Haul Ever Recorded

Ethereum just supercharged the crypto markets like a nitro boost in a drag race. The result? A jaw-dropping $4.39 billion flood of institutional money in just seven days—smashing all previous records.

The ETH effect: More than just gas fees

While Bitcoin ETFs still grab headlines, Ethereum's smart contract ecosystem is quietly becoming the institutional gateway drug. DeFi yields, NFT infrastructure upgrades, and that looming spot ETF decision are creating perfect storm conditions.

Wall Street's 180

Remember when Jamie Dimon called crypto 'a fraud'? Now every hedge fund's scrambling to get exposure—though they'll still charge you 2-and-20 for the privilege of holding your own keys.

The real question: Is this sustainable momentum or just FOMO hitting escape velocity? Either way, the crypto bulls are back in the china shop.

Crypto Inflows Hit $4.39 Billion Last Week

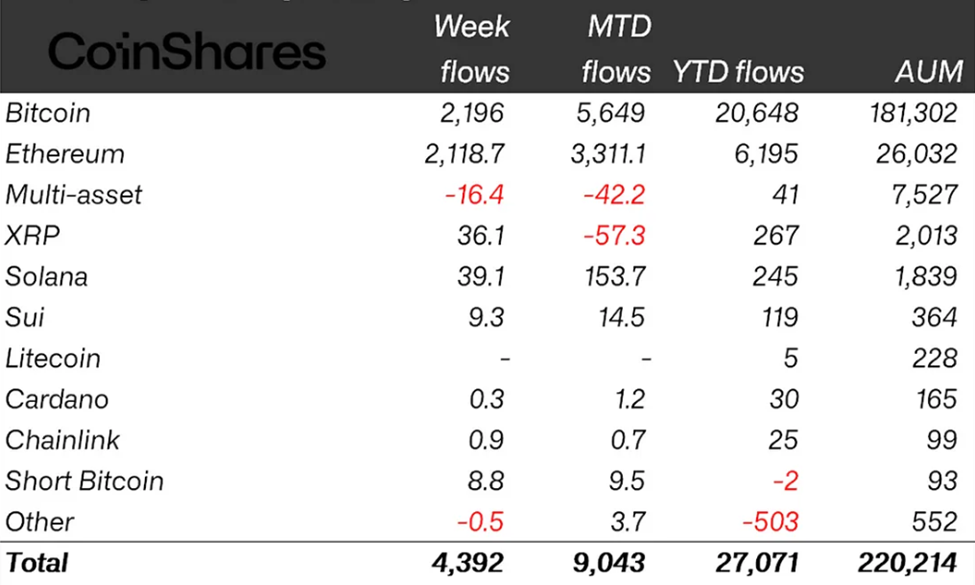

The latest CoinShares report indicates crypto inflows reached $4.39 billion last week. It marks an all-time high (ATH) in weekly inflows, bringing year-to-date (YTD) positive flows to $27 billion. Meanwhile, assets under management (AuM) are at a record $220 billion.

“Digital asset investment products recorded their largest weekly inflows on record, totaling $4.39 billion, surpassing the previous peak of $4.27 billion set post-US election in December 2024,” wrote James Butterfill, head of research at CoinShares.

It marks a significant upscale, after the week ending July 12 saw crypto inflows top out at $3.7 billion. It also extends the streak of positive flows, marking the 14th consecutive week of crypto inflows.

As indicated in the chart, Bitcoin (BTC) led, recording up to $2,196 billion in crypto inflows. However, Ethereum remains the outlier, more than doubling its inflows in a week. As BeInCrypto reported for the week ending July 12, Ethereum inflows reached $990.4 million.

Last week, however, inflows into Ethereum products reached 2,188.7 billion, a 2.1x growth in a week. Meanwhile, positive flows to Bitcoin dropped from $2,731 to $2,196.

“Ethereum stole the show, attracting a record $2.12 billion in inflows, nearly double its previous record of $1.2 billion. The past 13 weeks of inflows now represent 23% of Ethereum AuM, with 2025 inflows already exceeding the full-year total for 2024 at $6.2 billion,” Butterfill added.

The 2.1x surge in Ethereum inflows is unsurprising, coming on as institutional interest in the pioneer altcoin accelerates. Among them are Sharplink Gaming and BitMine, which now hold over $1 billion in Ethereum.

Ethereum is inevitable

— SBET (SharpLink Gaming) (@SharpLinkGaming) July 20, 2025BeInCrypto also reported the recent surge in Ethereum price, with the giant altcoin’s market capitalization exceeding that of Goldman Sachs and the Bank of China combined.

JUST IN: $ETH surpasses combined market cap of Goldman Sachs and Bank of China. pic.twitter.com/WumMKdOf9W

— Whale Insider (@WhaleInsider) July 20, 2025Whales and ETFs (exchange-traded funds) have also been pouring billions into the Ethereum market, with analysts highlighting a possible ATH soon.

Nevertheless, even as Ethereum continues to ride the wave of soaring interest, both at retail and institutional levels, some analysts call for caution.

“It’s time to start thinking about exit strategies… bitcoin and altcoins are approaching the traditional 4-year cycle tops in terms of timing,” Ran Neuner, host of Crypto Banter, told his followers.

Similarly, Benjamin Cowen, founder of Into the Cryptoverse, notes that many altcoins are underperforming Ethereum.

According to the analyst, Ethereum’s growing dominance at the expense of smaller-cap assets often signals a late-cycle, with capital consolidating into majors before a broader downturn.

Against these backdrops, trader Daan Crypto Trades advises investors to consider rotating gains and managing risk, a strategy for maximizing returns in the face of inevitable volatility.

80% of altcoins in the top 100 have outperformed $BTC this month.

This drops down to 41% when looking at the last 3 months.

Both of these are on the rise as we speak. This cycle has rarely seen these moves occur with a few exceptions.

The big question will be how long will it… pic.twitter.com/FceSxQtMjK

As of this writing, Ethereum was trading for $3,786, up by over 2% in the last 24 hours.