BTCC Crypto Daily (7.18)| Three Crypto Bills Passed by the U.S. House of Representatives, Small Bitcoin Transactions Tax Exemption Approved

1.Overview

- The U.S. House of Representatives passed three cryptocurrency bills;

- President Trump supports tax exemption for small Bitcoin transactions;

- Fidelity: Bitcoin’s growth trajectory is very similar to the adoption curve of the internet in recent decades;

2.Macro & Policy Outlook

Key Events Today

- The U.S. Michigan Consumer Confidence Index for July will be released today, with a previous value of 60.7.

- South Africa will host the G20 Finance Ministers and Central Bank Governors meeting today.

Global Macro Developments

1.U.S. House of Representatives Passes Three Cryptocurrency Bills

The U.S. House of Representatives has passed three major cryptocurrency-related bills: the CLARITY Act, GENIUS Act, and Anti-CBDC Surveillance Act. The GENIUS Act is expected to be signed into law by President Trump on Friday. The other two bills will be sent to the Senate for review. These bills aim to strengthen cryptocurrency regulation and provide clearer legal guidelines to the industry, further promoting market stability and development.

2. SEC Chairman Gary Gensler: Considering Introducing Cryptocurrency ‘Innovation Exemption’ Policy

Gary Gensler, Chairman of the U.S. Securities and Exchange Commission (SEC), recently stated that the SEC is considering launching a “crypto innovation exemption” policy. This initiative is designed to accelerate the tokenization process in the cryptocurrency market. The policy would offer regulatory leniency to crypto projects that meet specific conditions, providing flexibility for innovative enterprises while ensuring compliance with fundamental legal frameworks. Gensler emphasized that the SEC aims to provide more regulatory clarity without stifling innovation. This measure could facilitate the legal listing of new crypto projects and tokens, encouraging greater market participation.

3. Trump Supports Tax Exemption for Small Bitcoin Transactions, White House Says It Will Explore Related Legislation

White House Press Secretary Karine Jean-Pierre confirmed during a press conference that President Trump supports a tax exemption for small Bitcoin transactions, and the government “will continue to support this initiative.” Jean-Pierre explained that the goal is to make cryptocurrency payments as easy and efficient as paying for a cup of coffee with crypto. Relevant departments are exploring the possibility of implementing this through legislation. This statement comes as the U.S. Congress passed the GENIUS Act and CLARITY Act on July 16, which are now prepared to be signed by Trump. Once signed, the U.S. could become the global hub for cryptocurrency.

4. Trump: Allowing Pensions to Invest in Cryptocurrencies and Gold

President Donald Trump plans to sign an executive order allowing alternative investments beyond traditional stocks and bonds for 401(k) retirement plans. These investments will cover a wide range of assets, including digital assets, metals, and funds focused on mergers, private loans, and infrastructure deals. Sources say that the executive order will direct regulators to investigate barriers preventing alternative investments from being included in 401(k) professional management funds. The Trump administration had already eased restrictions on cryptocurrency investments in retirement accounts and is actively pushing related legislation.

5. SharpLink Gaming Announces $5 Billion Stock Offering, Advances Ethereum Reserve Strategy

SharpLink Gaming (Nasdaq: SBET) announced a new stock offering through an agreement with A.G.P./Alliance Global Partners, raising up to $5 billion. The funds from the offering will mainly be used to acquire Ethereum (ETH) as the company’s primary reserve asset, as well as for daily operations, market expansion, and core alliance marketing. Additionally, SharpLink Gaming purchased 32,892 ETH (approximately $118.8 million) on Thursday, bringing its total holdings to over 353,000 ETH, making it the largest corporate ETH holder globally.

6.Sberbank Plans to Launch Cryptocurrency Custody Services

Russia’s largest state-owned bank, Sberbank, recently announced plans to offer custody services for Bitcoin and other digital assets. The services will be available to “high-quality investors,” who must meet thresholds such as securities investments or deposits exceeding 100 million rubles (approximately $1.25 million) and annual income exceeding 50 million rubles ($625,000). The service will operate similar to traditional bank account management, ensuring asset safety and supporting enforcement agency requests for freezing, while expanding into crypto-related products like Bitcoin futures and structured bonds through the Moscow Exchange.

Traditional Asset Correlation

- U.S. Stock Market: Nasdaq +0.75%, S&P 500 +0.27%, Dow +0.52%

- Spot Gold +0.1%, $3,337.60/oz

- WTI Crude (USOIL) +0.99%, $68.21/bbl

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(as of July 18, 14:00 HKT)

2.Futures Capital Flow Analysis

As of July 18, based on Coinglass data, the largest net outflows in contracts over the past 24 hours were observed in XRP, ETH, SOL, DOGE, SUI, and ADA, potentially indicating trading opportunities.

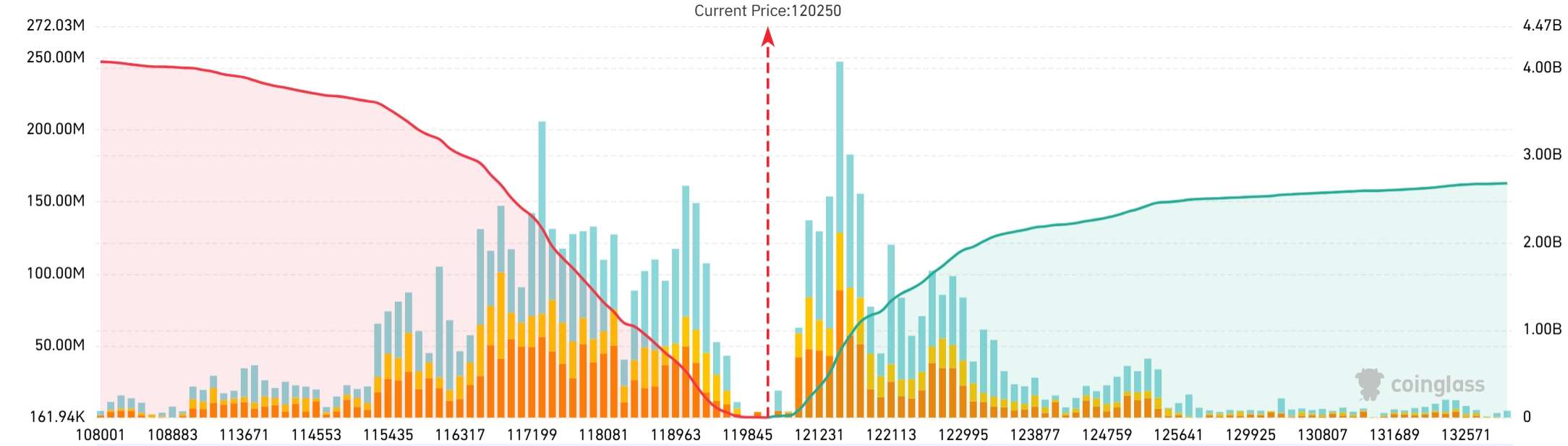

3. Bitcoin Liquidation Map

According to Coinglass, as of July 18, based on the current price of $120,250, if Bitcoin drops below $117,000, the total liquidation of long positions on mainstream CEXs could reach $2.155 billion. Conversely, if Bitcoin breaks through $123,000, the total liquidation of short positions could reach $1.65 billion. It is recommended to reasonably control leverage to avoid triggering large-scale liquidations due to market fluctuations.

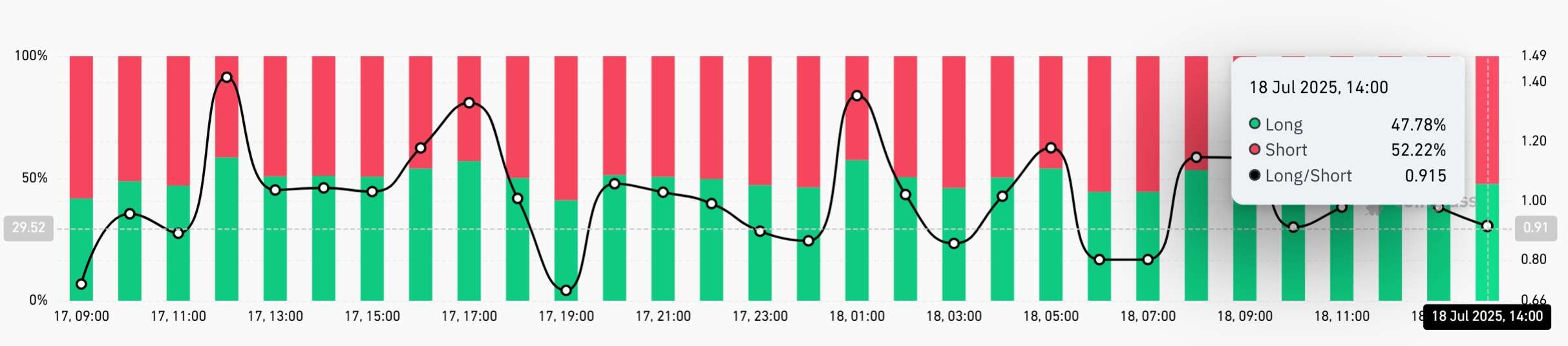

4. Bitcoin Long/Short Ratio

As of July 18, 14:00 HKT, the long/short ratio for Bitcoin across the entire network is 0.915, with 47.78% long positions and 52.22% short positions.

5. On-Chain Monitoring

- According to Onchain Lens, two whales are accumulating large amounts of ETH: Whale 0x52e spent 36.5 million USDT to purchase 10,587.4 ETH at an average price of $3,448; Whale 0xdfc spent 9.98 million USDT to purchase 2,895 ETH at the same price.

- Onchain Lens also monitors a whale making deposits on HyperLiquid to avoid the liquidation of a 20x short ETH position, currently valued at $56.76 million. This whale has deposited 17.04 million USDC over the past 6 days, with a floating loss of $10 million.

4.Blockchain Headlines

- Matrixport: Technical indicators suggest the market may consolidate over the next one or two months.

- LD Capital: UNI is the third largest coin invested by Trend Research, with significant certainty and potential.

- Greeks.live: Nearly $6 billion in options expiring this week, including 41,000 BTC options.

- Total market capitalization of cryptocurrencies has surpassed $4 trillion, with stablecoins reaching a market cap of $266 billion.

- Thumzup Media Corporation (Nasdaq: TZUP) announces $250 million investment in cryptocurrencies.

- Ethereum Spot ETF saw a total net inflow of $602 million yesterday, the second-highest in history.

- SharpLink Gaming further increased its ETH holdings by 18,712 ETH.

- Federal Reserve Board Member Waller: The Fed should cut rates by 25 basis points at the July meeting.

- AI startup Perplexity’s valuation surged to $18 billion within two months.

- BlackRock (BLK.N) has submitted an application to regulators to add staking to its Ethereum ETF.

- AUSTRAC: Cryptocurrency is listed as a top threat in financial crime-fighting actions, with new regulatory priorities.

- The White House plans to hold a signing ceremony for the GENIUS Act at 2 AM on the 19th.

- Trump’s $9 billion foreign aid and public broadcasting cut bill passes both Houses of Congress.

- OpenAI releases ChatGPT agent capable of performing complex tasks autonomously.

- The vote on the “WLFI Token Transfer Proposal” concluded in the early morning today and was approved.

- OpenAI has confirmed that it will begin running ChatGPT on Google Cloud Services.

5.Institutional Insights · Daily Picks

- Fidelity: Bitcoin’s growth trajectory is very similar to the adoption curve of the internet in recent decades, currently at the midpoint of the curve.

- ZachXBT: Long-term performance is the key metric for selecting traders, with the income sources of most CT traders in question.

- Interactive Brokers: Crypto assets had already risen in anticipation of Crypto Week, and some positives have already been priced in. No significant sell-off after the “good news” has been digested.

- 10x Research: Bitcoin’s end-of-year target for 2025 has been adjusted to $140,000–$160,000, with market momentum far surpassing traditional predictions, increasing the likelihood of breaking historical highs.

6.BTCC Exclusive Market Analysis

On July 18, Bitcoin maintained a high-level consolidation, trading around $120,000 in a narrow range, showing strong bullish resilience. On the 4-hour chart, the market continues to consolidate after a breakout, with a bullish alignment of short-term moving averages and solid support. Technically, while the MACD is above zero, the momentum bars have weakened, and short-term bullish momentum is slowing down. The RSI is in the strong zone, suggesting market optimism with no overheat, indicating potential for further upward movement.

For operations, it is recommended to observe market reactions after the legislation’s implementation, and time entry according to technical signals. With macro-positive news and structural support, the probability of upward movement remains high, but short-term volatility and high-level adjustment risks must be monitored. If Bitcoin holds above $118,000 and breaks through the $122,000 high, upward space could open. Otherwise, a break below support might lead to an adjustment, and attention should be given to the $115,000 support level.

The U.S. House of Representatives passed three crypto-related bills, and the GENIUS Act is expected to be signed by Trump on Friday. This move clarifies the stablecoin regulatory framework, providing compliance pathways for institutional participation while limiting the Fed’s retail-type CBDC, easing policy uncertainties, and is seen as a milestone in pragmatic regulatory shifts, supporting market confidence in the mid-term.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]