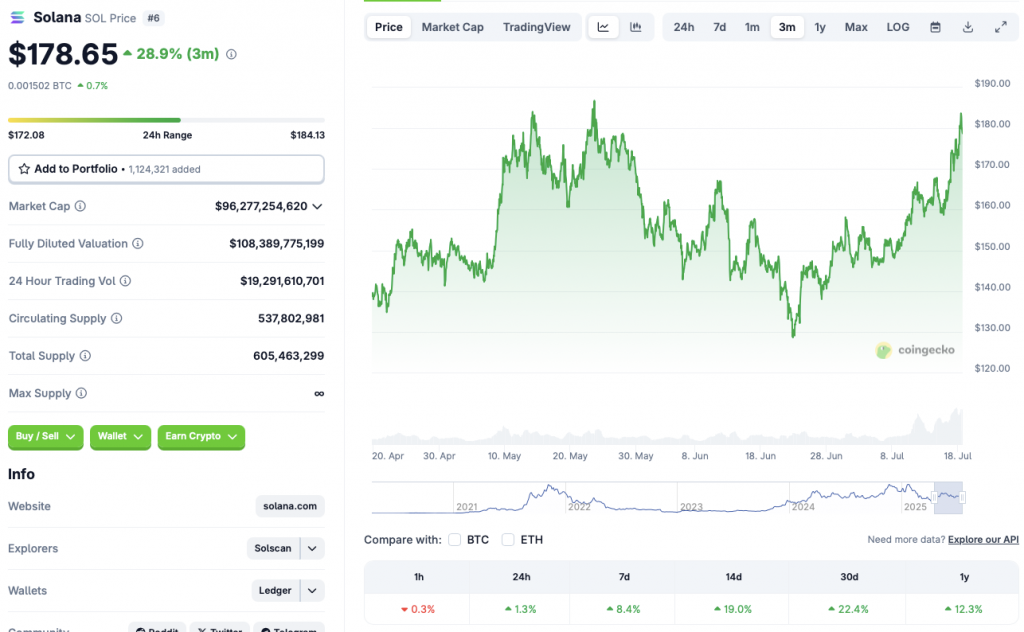

Solana Soars 22%—Can It Smash Through $183 Resistance and Hit $200 Next?

Solana's bulls are back in charge—blasting past resistance levels with a 22% rally. But the real question looms: can SOL convert momentum into a $200 breakout?

The $183 Wall

Traders eye the current resistance like a crypto version of Sisyphus' boulder—every push toward $183 gets met with profit-taking. Technicals hint at consolidation, but sentiment’s frothier than a Wall Street IPO pitch.

The $200 Horizon

If Solana clears $183, the path to $200 opens up. Liquidity pools show heavy ask orders just above—typical 'buy the rumor, sell the news' behavior from traders who still think 'HODL' is an investment strategy.

Bottom Line

SOL’s got the volatility (and the VC bagholders) to make this interesting. Whether it’s a breakout or a bull trap depends on whether the network can handle more hype without another outage. Place your bets—just don’t mortgage your dog for leverage.

Source: CoinGecko

Source: CoinGecko

When Will Solana Hit the $200 Mark?

SOL faces immediate resistance at the $183 mark. The asset unsuccessfully tested this price point in May of this year. Breaching the $183 mark could set the stage for SOL to hit the $190 price level. It may be smooth sailing for the asset to hit $200 from the $190 level.

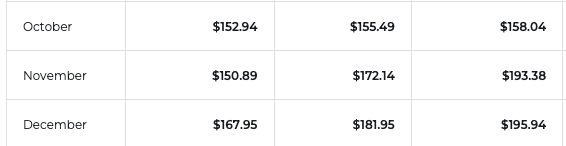

According to Changelly, solana (SOL) will not hit the $200 mark in 2025, but he platform anticipates the asset to trade at a maximum price of $195.94 this year. Changelly expects the assets to hit the $195 target sometime in December. Hitting $195.94 from current price levels will entail a rally of about 9.38%.

There is also a chance that SOL will continue its rally over the coming weeks. The asset could breach the $190 mark over the coming weekend, under bullish market conditions. Such a scenario could lead to SOL hitting the $200 mark over the next week.

SOL’s rally is likely fueled by Bitcoin (BTC) climbing to a new all-time high of $122,834 earlier this week. BTC’s rise was followed by another bullish development of the US House of Representatives passing the GENIUS, Clarity, and anti-CBDC Act and bill. BTC facing a correction could trigger a market-wide dip. Such a scenario could pull SOL’s price to the $150 area.

SOL also has a few spot ETF applications awaiting approval at the SEC. ETF inflows have led BTC to hit multiple all-time highs over the last year. A similar pattern could emerge for SOL as well.