Michael Saylor Slapped With Class Action Over Bitcoin Strategy—’Hodl’ Backfires?

MicroStrategy’s Bitcoin gambit faces legal heat as investors file class action lawsuit. Allegations? Reckless treasury management disguised as ’corporate strategy.’

Plaintiffs claim Saylor’s all-in BTC bets violated fiduciary duty—turning shareholder funds into a leveraged crypto casino play. Meanwhile, Bitcoin’s 2025 volatility leaves the company’s balance sheet looking like a over-leveraged DeFi protocol.

Legal experts warn this could set precedent for how public companies handle crypto allocations. Bonus jab: At least they didn’t put it all in a yield-farming scheme... yet.

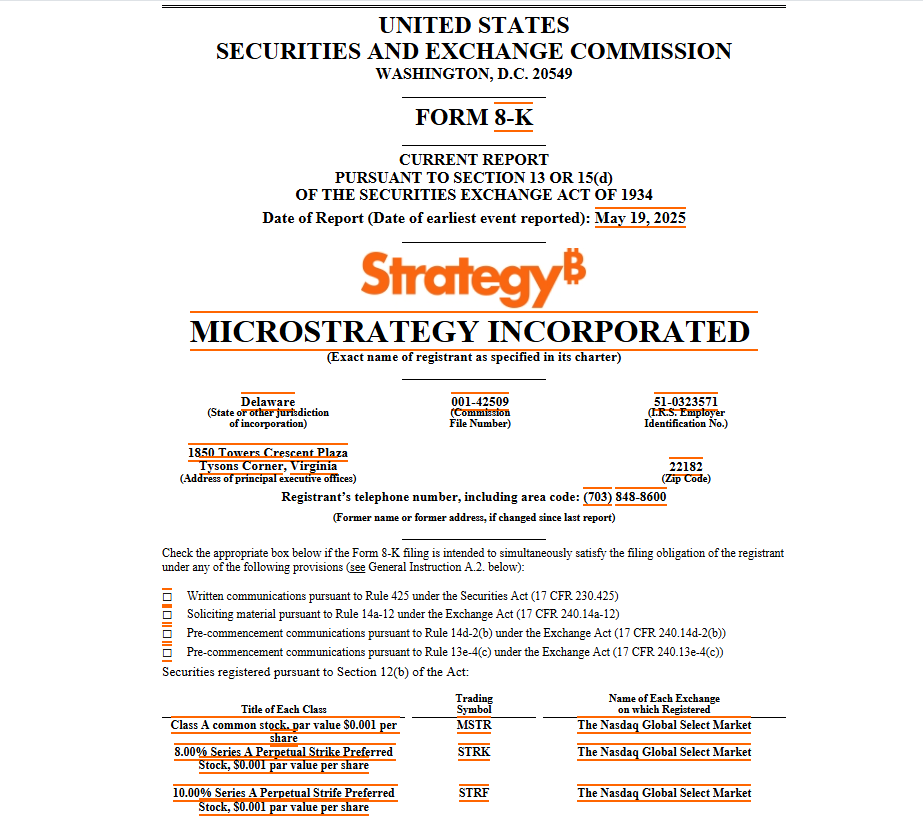

Michael Saylor’s Strategy Faces Lawsuit Over Bitcoin and Cryptocurrency Claims

The class action lawsuit essentially centers on claims that Strategy provided somewhat misleading information about bitcoin investments. According to recently filed court documents, multiple investors have now joined the legal action, alleging significant losses from following the company’s cryptocurrency investment advice.

Key Allegations in the Class Action Lawsuit

Plaintiffs in the class action lawsuit allege that Strategy and also Saylor himself exaggerated Bitcoin returns while downplaying cryptocurrency market volatility. The legal filing specifically mentions various public statements regarding Bitcoin as an alternative to the United States dollar and other traditional currency options.

The class action lawsuit also contends that Strategy failed to disclose certain relevant conflicts of interest related to cryptocurrency holdings and investment positions.

Saylor’s Bitcoin Strategy

Saylor has been, for quite some time now, a rather prominent Bitcoin advocate in the corporate world. His company gained considerable attention when it began converting substantial treasury reserves into cryptocurrency. This particular strategy was actively promoted as protection against currency devaluation, which has led to rather substantial Bitcoin holdings that have attracted both praise and criticism from financial analysts.

Market Implications

It could impact the way companies market their crypto investments to anyone considering an investment in this field in the future. Experts in finance and the government monitor what is going on. At this point, a lot of interest in cryptocurrency networks and blockchain technology has appeared because people are showing an interest in local currency alternatives and options outside the BRICS.

Right now, strategy is dealing with several lawsuits that cryptocurrency proponents have encountered. Throughout the next several months as the case develops in court, it could determine rules for revealing information in Bitcoin and cryptocurrency markets.