US Tariffs Slash Eurozone Inflation to 1.7%—EU Admits What Markets Already Knew

Brussels finally catches up to reality as its own forecasts confirm the obvious: American trade barriers are gutting Euro-area price growth. Here’s how the dominoes fell—and why central bankers are sweating.

The Tariff Tsunami Hits Main Street

EU economists now project inflation will crater to 1.7%—a number so benign it’d make Draghi blush. Turns out, when you tax imports into oblivion, demand crumbles faster than a Deutsche Bank risk model.

ECB’s Nightmare Scenario

Lagarde’s team just lost their ‘higher for longer’ alibi. With inflation diving toward the 2% target, rate cuts are now a when—not if—proposition. Traders are already front-running the pivot like it’s a pre-ICO shitcoin.

The Cynic’s Footnote

Nothing unites Europe faster than watching technocrats rediscover basic economics—with all the urgency of a blockchain governance vote.

How US Tariffs and Trade Tensions Shape Euro-Area Inflation Forecast

Downward Pressures on Euro-Area Inflation Forecast

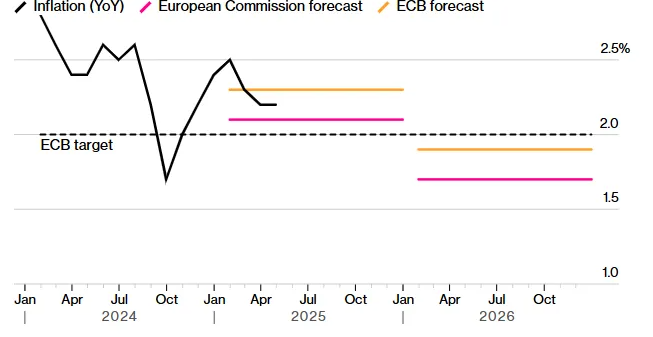

The European Commission has identified some key factors that are right now pushing Eurozone inflation trends down faster than was previously expected. The Euro-Area inflation forecast now projects that consumer prices will eventually reach the 2% target by mid-2025 before falling further to around 1.7% in 2026.

European Economy Commissioner Valdis Dombrovskis stated:

The European Commission cited lower energy costs, as well as diverted Chinese goods, and also a stronger euro as creating what they called a ‘clearly negative’ impact on inflation. The US tariffs impact on inflation currently contributes significantly to these Eurozone inflation trends across the continent.

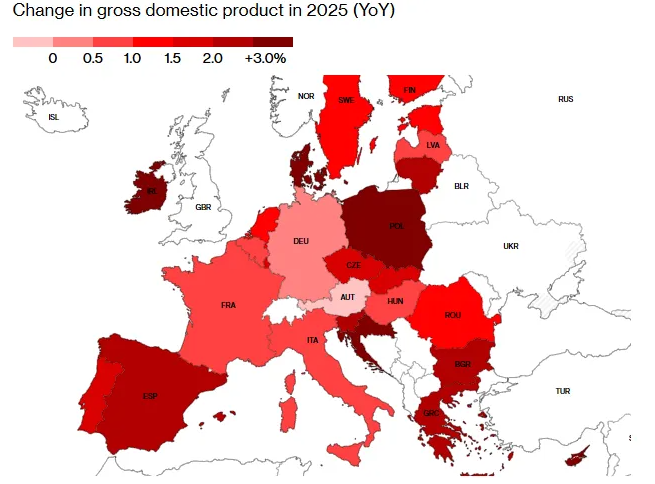

Economic Growth Amid Changing Inflation

Despite ongoing concerns about undershooting the ECB inflation target 2026, economists actually expect economic growth in the Euro-Area to improve. The Euro-Area inflation forecast comes alongside projections of about 1.4% growth next year, up from approximately 0.9% in 2025, which is certainly a modest improvement.

Germany, at the present time, faces some significant challenges with essentially no growth expected this year before a rather modest 1.1% rebound in 2026. European Commission’s economic outlook also notes that uncertainty continues to weigh on domestic demand while analysts generally expect labor markets to remain robust.

Trade Tensions and Monetary Policy

US tariffs impact on inflation creates several policy challenges right now, with most Euro-Zone exports to America facing 10% tariffs during the ongoing negotiation period. European Commission’s economic outlook assumes these tariffs will remain in place, affecting the Euro-Area inflation forecast quite significantly over the coming quarters.

The commission’s report indicates:

Goods inflation may actually fall to nearly 0% due to such trade dynamics and Euro strength in the NEAR term. Meanwhile, services inflation remains somewhat elevated due to wage growth, which economists expect will slow “only gradually” to around 2.5% by late 2026.

ECB’s Challenging Response

The ECB faces a rather complex situation at the moment, trying to balance short-term effects from tariffs against longer-term impacts and considerations. The Eurozone inflation trends create certain dilemmas for policymakers as they consider future rate decisions and monetary policy adjustments.

The ECB will present its own forecasts alongside its June 5 rate decision, and will likely include various scenarios for how US tariff policies might affect the ECB inflation target 2026. European Commission’s economic outlook provides important context for these upcoming decisions.

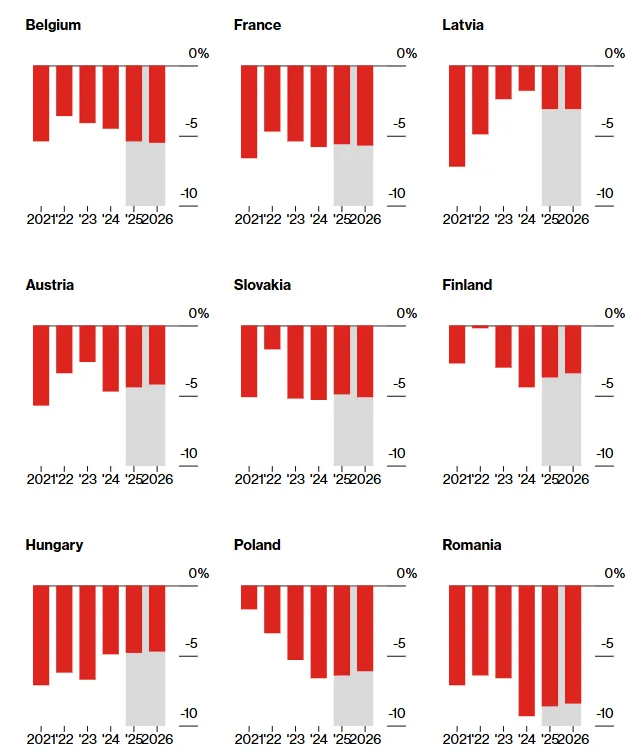

Rising Debt Amid Low Inflation

The Euro-Area inflation forecast comes at a time when collective debt is expected to rise to approximately 91% of GDP next year from around 89% in 2024. Nine EU countries will likely breach the 3% deficit level, creating additional challenges alongside below-target inflation and trade uncertainties.

These combined factors—US tariffs impact on inflation, below-target Eurozone inflation trends, and also rising debt levels—create significant challenges for European policymakers as they attempt to navigate economic uncertainties in the years ahead.