Ethereum Exodus: 1M+ ETH Flees Exchanges—Is $3K the Next Stop?

Whales are voting with their wallets—again. Over one million ETH vanished from exchanges this week, the equivalent of Wall Street’s ’smart money’ quietly exiting before a rally. Cue the ’supply shock’ narrative.

Price action’s already reacting: ETH’s up 12% since the withdrawals began, flirting with $2,800. Traders whisper about $3,000 being the next psychological barrier—unless, of course, this is just another ’buy the rumor, sell the news’ setup by the usual suspects.

Fun fact: The last time withdrawals hit this scale, ETH doubled in three months. But hey, past performance is no guarantee of future results—just ask anyone who bought the last ’institutional adoption’ hype cycle.

Over 1 Million ETH Withdrawn from Exchanges in the Past Month

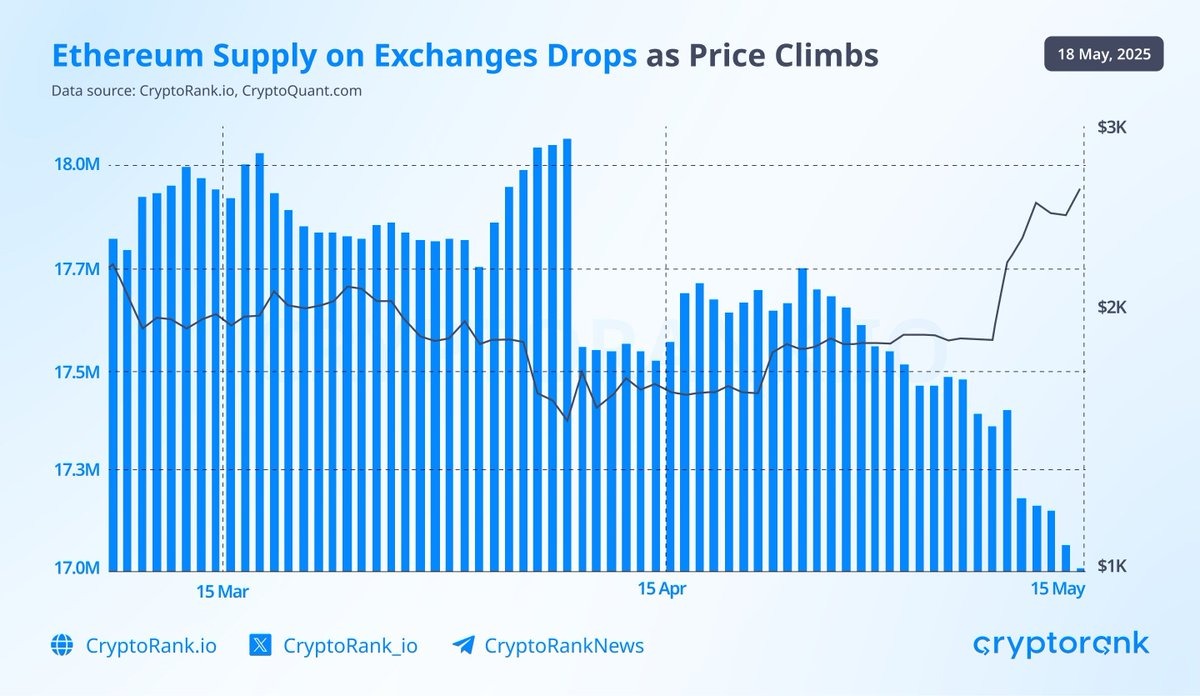

According to Cryptorank, the amount of ETH available on centralized exchanges has dropped from over 18 million to nearly 17 million within one month.

“Over the past month, more than 1 million ETH have been withdrawn from centralized exchanges, which accounts for approximately 5.5% of the total ETH held on these platforms. This trend suggests that users are increasingly choosing to accumulate ethereum rather than trade it. The recent Pectra upgrade, which went live on May 7, may further support this behavior and, in turn, add upward pressure to Ethereum’s price,” Cryptorank said.

CryptoQuant data shows that over 300,000 ETH were withdrawn from Binance alone in the past month. Since the beginning of the year, more than 800,000 ETH have been withdrawn from the platform.

This withdrawal activity occurred not just when ETH prices dropped sharply below $1,400 in early April, but also accelerated during ETH’s rebound above $2,400 in May.

Furthermore, the chart from CryptoRank illustrates that ETH prices surged while exchange reserves fell, reinforcing the correlation between supply and price.

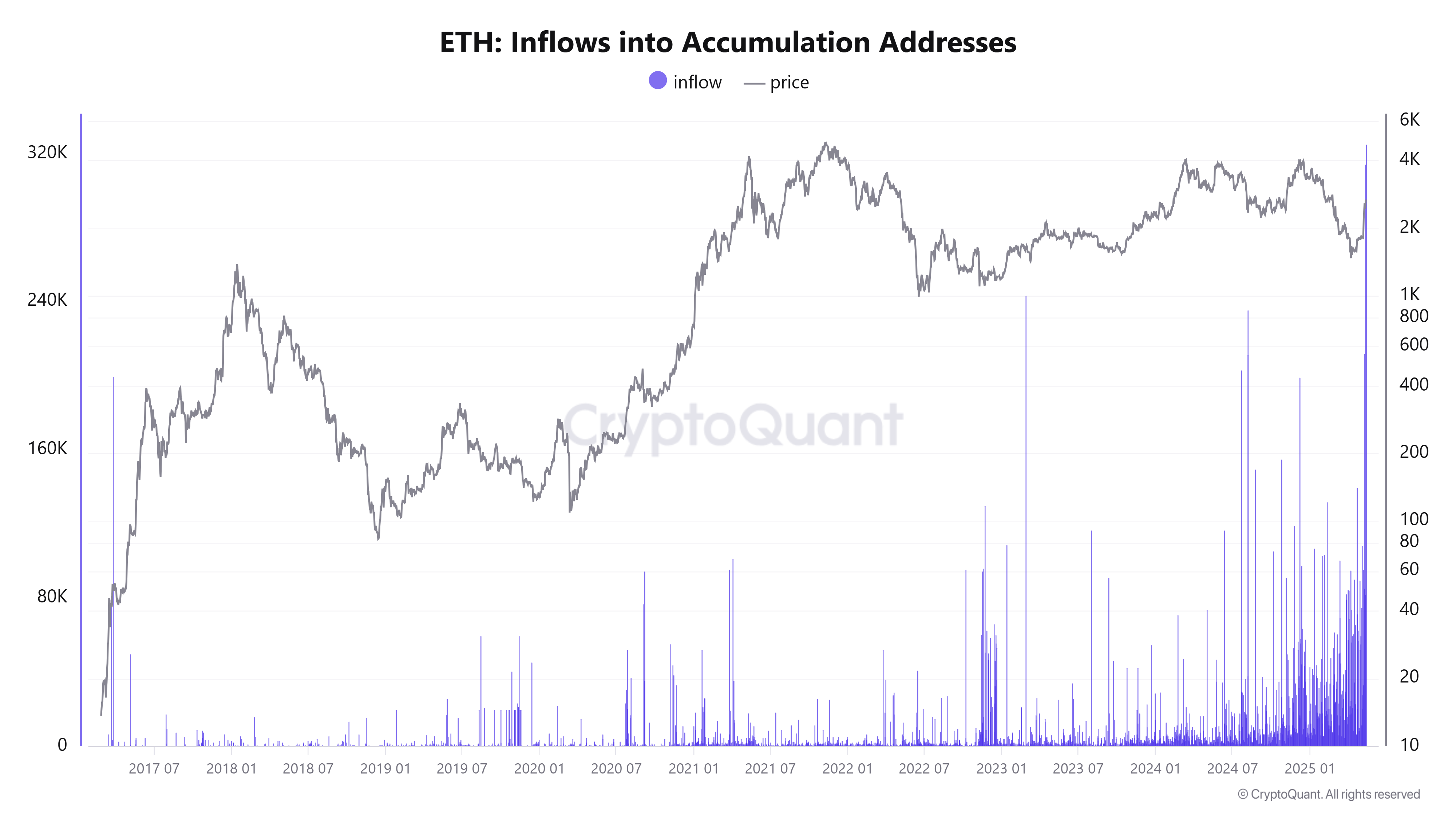

In addition, large accumulation addresses recorded their highest inflow in history. Specifically, CryptoQuant reported that on May 12, whale wallets accumulated over 325,000 ETH — the highest single-day amount ever recorded.

When whales accumulate, they often withdraw ETH from exchanges to store in cold wallets. This reduces the circulating supply and creates upward pressure on the price.

Meanwhile, based on a rare bullish technical pattern that emerged in May, analyst TedPillows predicted ETH could soon return to $3,000, a key psychological level.

“ETH Golden Cross confirmed. $3,000 Ethereum is coming next,” Ted predicted.

Arthur Hayes Predicts Ethereum Will Outperform Solana

Despite these positive on-chain indicators, ETH’s price is still far from its peak. It WOULD need to rise another 70% to surpass its 2024 high, and it would need to more than double to reach a new all-time high.

Bitcoin analyst PlanB recently labeled Ethereum as “centralized” and “pre-mined,” while Zach Rynes argued that ETH lacks a coherent economic narrative.

However, in a May 18 interview, Arthur Hayes offered a different perspective. He admitted that while ETH is often disliked, it remains the most secure blockchain with the highest Total Value Locked (TVL). He believes ETH could soon outperform Solana.

“I think Ethereum has a better performance outlook mostly because it’s very hated. Everyone thinks Ethereum does nothing, that they haven’t done anything correctly. But it still has the most TVL, the most developers, and is still the most secure proof-of-stake blockchain. Yeah, the price hasn’t done that well from 2020 to now. solana obviously did very well, going from $7 to $172. But if I’m going to deploy a fresh unit of fiat capital into the system, I think Ethereum could outperform Solana in this next 18–24 month bull run,” Hayes explained.

Moreover, many industry experts go even further. They predict that ETH could eventually outperform Bitcoin, especially as Ethereum is increasingly central in real-world assets (RWA) and the broader DeFi ecosystem.