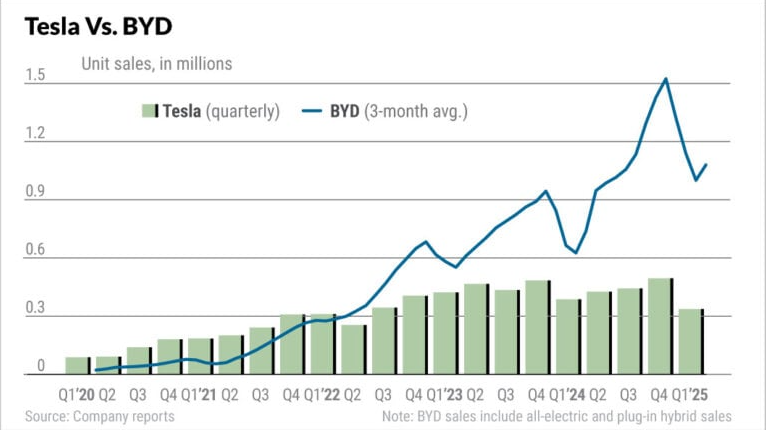

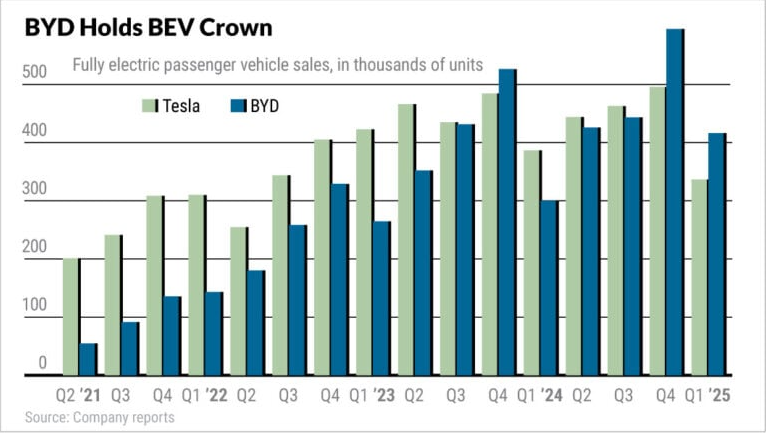

BYD’s 416K Sales Crush Tesla’s $200B Robotaxi Gamble—Who’s Really Winning the EV War?

Elon’s moonshot bets look shaky as BYD quietly moves metal—416,000 units sold last quarter alone, while Tesla’s robotaxi hype burns cash like a meme stock.

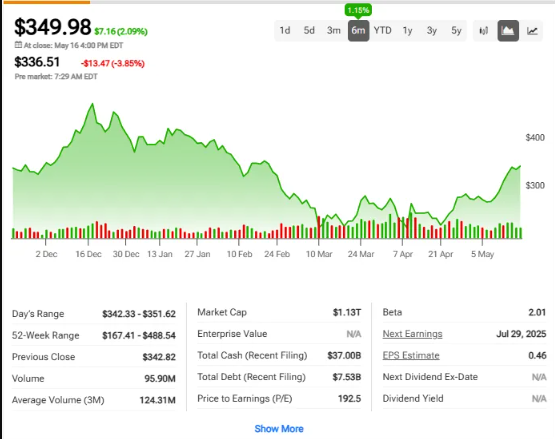

Here’s the brutal math: BYD’s $157B valuation is built on actual demand, not vaporware promises. Tesla’s ’autonomous future’ still needs humans to babysit its FSD beta.

Wall Street’s darling might need more than cult loyalty to outrun the Chinese juggernaut. But hey—at least TSLA shareholders are used to volatility.

Source: Investors.com

Source: Investors.com

Can Tesla’s (TSLA) Robotaxi Dream Survive BYD’s Real-world Dominance?

The intensifying Tesla vs BYD competition clearly shows that BYD’s manufacturing advantages are, frankly, widening over time. Looking at recent data, their Q4 2024 deliveries reached approximately 526,000 BEVs as compared to Tesla’s 427,000 units. At the time of writing, TSLA stock trades around $349.98, which seems to reflect some genuine market concerns about Robotaxi timeline execution and such.

1. BYD’s Production Momentum

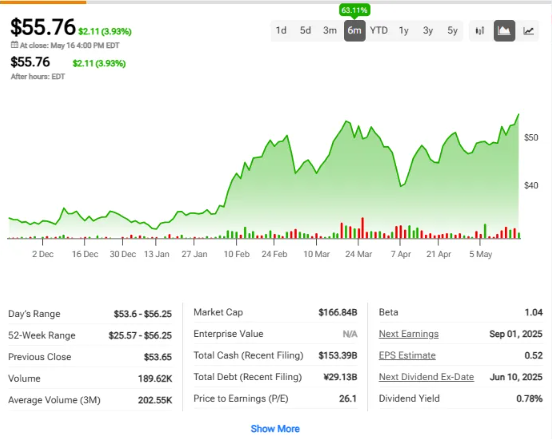

BYD has been able to leverage its vertically integrated supply chain to essentially outpace Tesla across various global markets. The Chinese EV manufacturer’s stock currently receives, interestingly enough, unanimousratings from analysts who closely track the Chinese yuan-backed company and its performance.

Automotive analyst Zhang Wei stated:

2. Tesla’s $200B Strategic Gamble

The ongoing Tesla vs BYD competition centers primarily on their rather divergent strategies – Musk’s forward-looking autonomous driving vision against BYD’s present-day market execution. Tesla (TSLA) currently faces, to be honest, somewhat mixed analyst sentiment with about 37 ratings split between Buy, Hold, and Sell recommendations.

Automotive industry consultant Richard Chen explained:

Market Dynamics

Global cryptocurrency fluctuations and related trends have been influencing both Tesla vs BYD market positions in various ways. BYD’s yuan-denominated operations seem to provide certain advantages as TSLA navigates through both production challenges and also Robotaxi development hurdles.

EV sector analyst Maria Rodriguez noted:

Tesla’s near-term performance will likely hinge on their upcoming Robotaxi revelations, while, in contrast, BYD continues actively expanding its production capacity in multiple markets around the world, which essentially sets the stage for what might be the next important phase of the Tesla vs BYD competition.