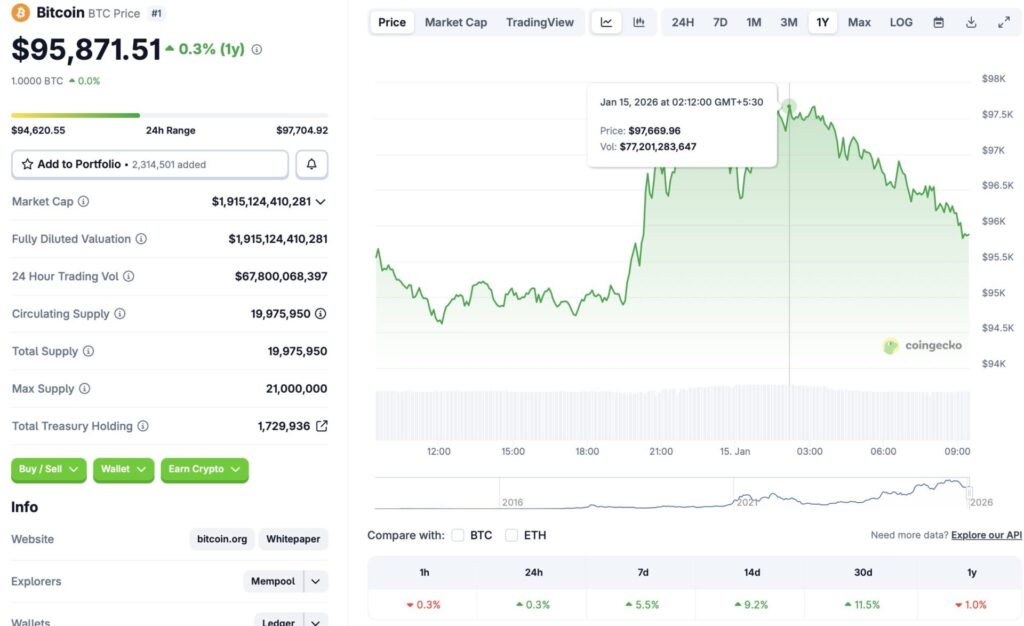

Bitcoin Battles $97,000 Resistance Wall: The Final Push to $100k by January 20?

Bitcoin's price action hits a major inflection point. The world's leading cryptocurrency is testing a formidable resistance level at $97,000, setting the stage for a potential historic breakout. All eyes are on whether this digital asset can shatter the barrier and claim the elusive six-figure valuation within the week.

The Psychological Ceiling

That $97,000 mark isn't just another number on a chart—it's a massive psychological and technical hurdle. Breaking through requires a significant surge in buying pressure, one strong enough to absorb sell orders from traders looking to cash in before the big round number. The market's holding its breath, watching for the tell-tale signs of accumulation or distribution.

The Countdown to Six Figures

The timeline is tight. A move from current resistance to $100,000 represents a roughly 3% climb—a move Bitcoin has executed countless times in a single day during bull runs. But in these compressed conditions, every percentage point becomes a war of attrition between bulls and bears. Momentum indicators, exchange flow data, and derivatives market positioning are now the key metrics for predicting the next explosive leg up.

What a Breakout Really Means

Clearing $100,000 isn't just a headline victory. It fundamentally resets the valuation framework for the entire crypto asset class, acting as a rising tide that lifts everything from large-cap alts to nascent DeFi protocols. It would signal a definitive shift in global capital allocation, moving further away from traditional finance's legacy systems—which, let's be honest, could use a little disruptive competition after the latest round of rate-hike whiplash and inflationary 'transitory' narratives.

The next few trading sessions will separate speculative hype from genuine institutional conviction. Either Bitcoin carves a new peak above the noise, or it gets rejected back into consolidation—proving once again that in crypto, the most anticipated moves are often the hardest to execute.

Source: CoinGecko

Source: CoinGecko

Is Bitcoin On Track To Reclaim $100000 by Jan. 20?

Bitcoin (BTC) hit an all-time high of $126,080 in October 2025, but has since faced a steep price correction. The crypto market, in general, turned bearish due to macroeconomic uncertainties, and is still far from recovered. BTC is currently facing substantial resistance at the $97,000 price level. Breaking past $97,000 could push the original crypto back to the $100,000 level.

CoinCodex analysts anticipate Bitcoin (BTC) to rally over the coming days, but does expect it to hit $100,000 by Jan. 20. The platform predicts BTC will reclaim the $100,000 mark on Feb. 1, 2026. Reclaiming the $100,000 mark will greatly increase BTC’s chances of hitting a new all-time high.

Bernstein and Grayscale also anticipate Bitcoin (BTC) to have a bullish year in 2026. Both institutions claim that BTC is following a 5-year path, and not a 4-year trajectory. This means that BTC will hit a new all-time high in 2026, five years after its 2021 peak. Bernstein predicts BTC will hit a new all-time high of $150,000 sometime this year. Moreover, the financial institution expects Bitcoin (BTC) to breach the $200,000 mark in 2027.

Despite the bullish outlook, the crypto market is still quite weak. The October 2025 market crash had quite a bad impact on investors. Market participants are still keeping away from risky assets. Bitcoin (BTC) could see some challenges arising from fresh market volatility due to macroeconomic uncertainties.