Ethereum Price Prediction 2025: Can ETH Hit $5,500 as Wall Street Goes All-In?

- Why Institutions Are Betting Big on Ethereum

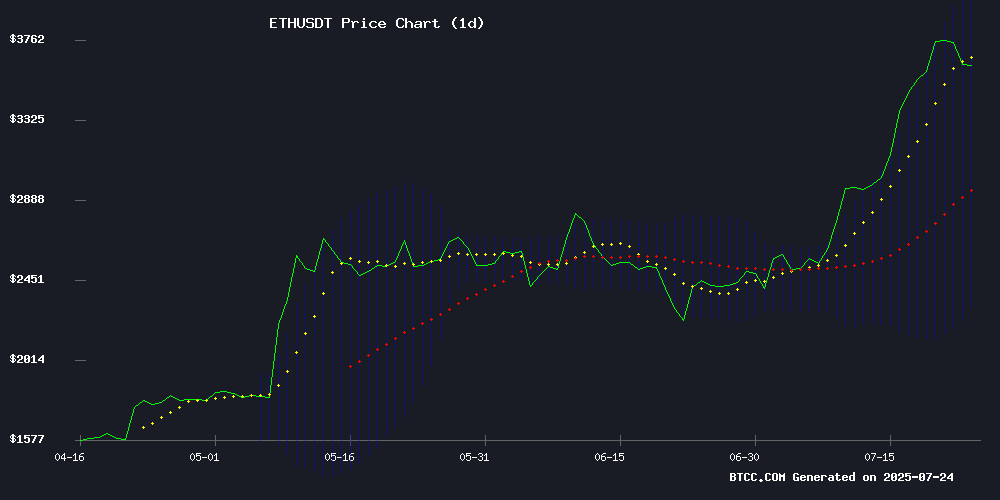

- Technical Breakdown: The Bull Case

- The Whale Watching Chronicles

- Staking Drama: Validator Queue Hits 18-Month High

- Price Forecasts: From Conservative to Moon Shot

- FAQ: Your Burning Ethereum Questions Answered

– ethereum isn't just surviving institutional adoption—it's thriving. With $10 billion flooding into ETH products since May and whale wallets growing fatter by the minute, analysts at BTCC and beyond are whispering about a potential $5,500 price target. But is this rally built on solid fundamentals or speculative froth? Let's unpack the charts, on-chain data, and Wall Street's growing crypto appetite.

Why Institutions Are Betting Big on Ethereum

The numbers don't lie: Corporate treasuries and ETFs have vacuumed up 2.83 million ETH this quarter—that's seven times Ethereum's annual supply growth. "We're seeing demand at 32x the issuance rate," confirms Bitwise CIO Matt Hougan. SharpLink Gaming's $1.32 billion ETH treasury and BitMine's audacious 5% supply grab reveal how serious players now view Ethereum as both yield generator and balance sheet asset.

Technical Breakdown: The Bull Case

As of today's $3,642.06 price (per TradingView data), ETH holds comfortably above its 20-day MA ($3,175.61). The MACD's bullish divergence hints at weakening downward momentum, while Bollinger Bands suggest volatility may soon break either way. Key levels to watch:

| Support | Resistance |

|---|---|

| $3,470 (Recent swing low) | $3,768.9 (Short concentration zone) |

| $3,220 (200-day MA) | $4,044.22 (Upper Bollinger Band) |

The Whale Watching Chronicles

On-chain sleuths spotted two jaw-dropping moves this week: One new wallet accumulated 105,977 ETH ($397M) via FalconX in just four days, while another entity gobbled up 43,787 ETH OTC. Even Justin Sun got in on the action—Arkham Intelligence tracked his linked wallets withdrawing $646 million from Aave. "He moves billions like I go grocery shopping," quipped Aave contributor Marc Zeller.

Staking Drama: Validator Queue Hits 18-Month High

Here's where things get spicy. Ethereum's validator exit queue ballooned to 633,000 ETH this week—the highest since January 2024—as some investors took profits after the 160% three-month rally. But before you panic: ETF inflows hit $533 million Tuesday, marking 13 straight days of net positives. This looks more like musical chairs than an exodus.

Price Forecasts: From Conservative to Moon Shot

BTCC's research team projects these scenarios based on current adoption trends:

| Year | Conservative | Bullish | Catalysts |

|---|---|---|---|

| 2025 | $4,200 | $5,500 | ETF approvals, EIP upgrades |

| 2030 | $12,000 | $18,000 | Mass DeFi adoption |

FAQ: Your Burning Ethereum Questions Answered

What's driving Ethereum's price surge?

The perfect storm of institutional demand ($10B+ inflows), supply shock (exchange reserves at yearly lows), and growing DeFi/NFT utility. It's not just speculation—real money is moving in.

Are staking withdrawals a red flag?

Not necessarily. The simultaneous rise in entry/exit queues suggests stake reshuffling rather than abandonment. Remember: 11-day withdrawal delays create artificial sell pressure.

How reliable are $5,500 predictions?

Analyst Xanrox's target hinges on continued institutional adoption. With ETH ETPs still in their infancy (absorbing just 12% of bitcoin ETPs' early flows), the runway looks long.