Bitcoin Crashes Below $115K as Binance Buying Power Implodes—Here’s Why It Matters

Crypto markets just got a brutal wake-up call.

Bitcoin's nosedive below $115,000 isn't just another dip—it's flashing the same warning signs as previous corrections. And Binance's collapsing buying power ratio? That's the canary in the coal mine.

The leverage reckoning is here

When the world's largest exchange sees demand dry up, even diamond hands start sweating. Retail FOMO can't outrun derivatives liquidations forever—just ask the 2021 and 2023 bull run bagholders.

Institutions are playing chicken

Whales aren't selling… yet. But with OI shrinking faster than a shitcoin's liquidity pool, the smart money's waiting for someone else to blink first. Classic Wall Street psychology—just with more memes and less regulation.

This isn't doomposting. It's math. Every parabolic move needs consolidation, and frankly, the market was overdue for a sanity check. (Though if you believe in 'number go up' theology, this is just discount season.)

One hedge fund manager's 'correction' is a degen's buying opportunity—assuming you still trust exchanges after the last three 'black swan' events. Happy trading!

Binance Buying Power Ratio Raises Alarms

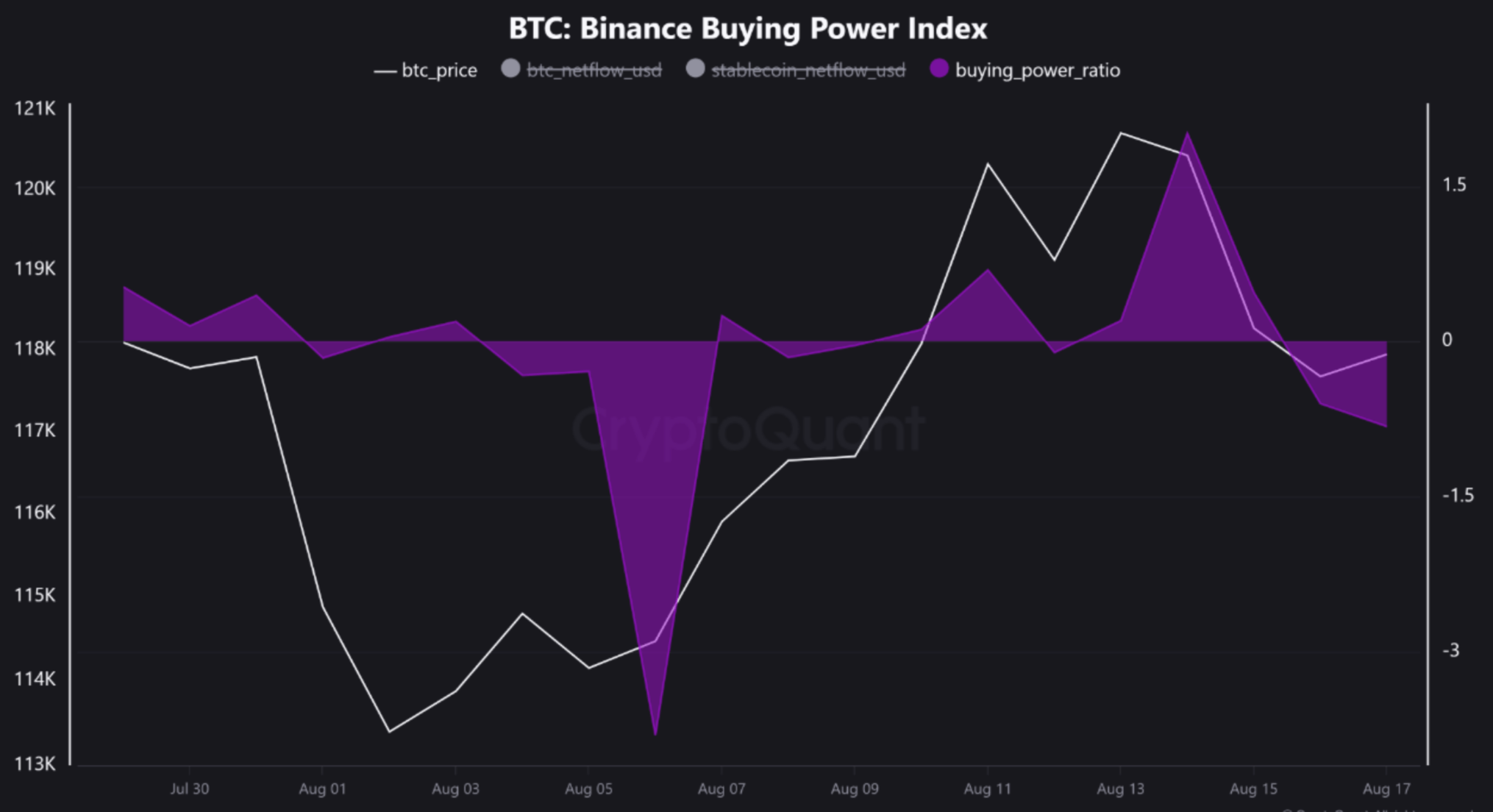

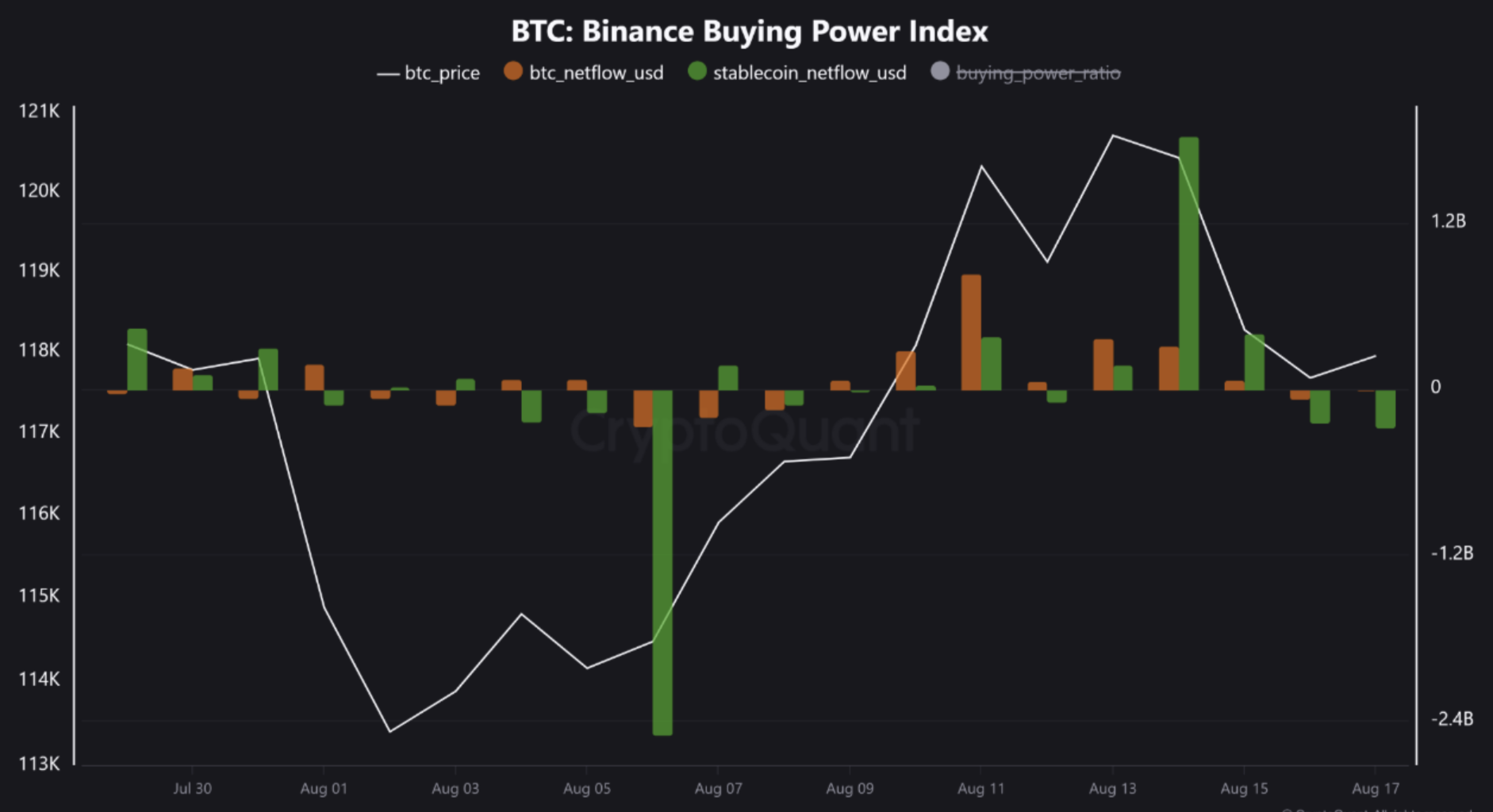

According to a CryptoQuant Quicktake post by contributor Crazzyblockk, the Binance Buying Power Ratio serves as a reliable indicator of overall market health. The analyst explained that the current reading points to a possible downturn for Bitcoin.

To explain, the ratio measures stablecoin inflows against bitcoin outflows on Binance, essentially showing how much new capital is available to buy BTC compared to how much is leaving the exchange. A rising ratio reflects strong buying power and liquidity, while a sharp drop signals weaker demand and a greater risk of correction.

Recently, the ratio suffered a steep decline, issuing what the analyst called a “textbook warning” just before BTC’s latest price drop. The correction saw Bitcoin fall from as high as $124,474 on August 13 to a low of $114,786 earlier today.

The analyst noted that the ratio peaked at 2.01 on August 14, showing peak buying pressure where for every $1 of BTC moving to cold storage, more than $2 in stablecoins entered the market.

In the following days – from August 16 to 17 – the ratio witnessed a sharp reversal, crashing to -0.81 within 48 hours. As a result, more buying power left Binance than entered it, confirming that the BTC market’s primary fuel source was exhausted.

Subsequently, BTC underwent a sustained price correction, falling 4.7% over the past seven days. Currently, the cryptocurrency is hovering slightly below $115,000, while its next major support lies around the $110,000 level. Crazzyblockk concluded:

This analysis proves that Binance is the market’s center of gravity. Its capital flows are an early warning system. A falling Buying Power Ratio signals exhausted liquidity and high correction risk. For any serious analyst, monitoring Binance isn’t optional – it’s essential.

How Will Bitcoin Perform In September?

If Bitcoin avoids slipping below $110,000, the short-term holder cost basis model suggests its next major resistance lies around $127,000. A strong breakout above this level could send BTC climbing toward $140,000.

In a separate X post, crypto analyst KillaXBT said BTC must hold above $115,787 to target the $125,000 – $127,000 range in September. However, the analyst warned that even if Bitcoin opens the month with a fresh all-time high, it may not guarantee sustained bullish momentum. At press time, BTC trades at $114,988, down 2.4% in the past 24 hours.