Futures Traders Bet Against MemeCore Rally Despite 14% Price Surge

Futures markets flash red as traders short MemeCore's 14% surge—classic crypto skepticism meets meme-fueled momentum.

The Contrarian Bet

While retail piles into the rally, institutional money positions for the drop. Leveraged shorts hit record levels despite the green candles painting charts.

Market Mechanics Exposed

Perpetual funding rates spike as bulls pay bears to maintain long positions. The entire ecosystem profits from volatility—except the bagholders left at the top.

Wall Street's favorite game: betting against Main Street's enthusiasm while collecting fees from both sides.

M’s Price Surge Meets Heavy Shorts

Readings from M’s daily chart paint a concerning picture. While its price continues to climb, the Chaikin Money FLOW (CMF), a key indicator that tracks capital inflows and outflows, has dropped below the zero line and is trending downward.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

This creates a clear bearish divergence, where weakening liquidity cannot fuel further price gains. When such a divergence emerges, an asset’s price rally loses strength. It means that even though buyers are still pushing the price higher, capital inflow into the asset is declining steadily.

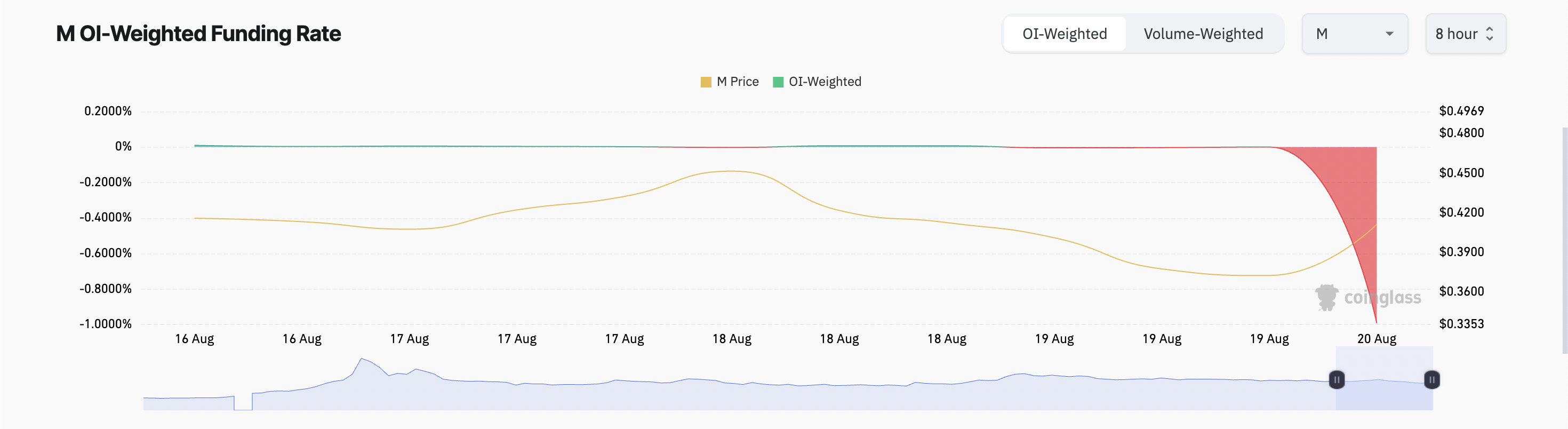

Moreover, the trend is no different among M’s futures traders, as reflected by its negative funding rate. According to Coinglass data, M’s funding rate has dropped to a 38-day low of -0.99%.

The funding rate is used in perpetual futures contracts to keep the contract price aligned with the spot price. When the rate turns negative, short traders (those betting on price declines) dominate and are paid by long traders (those betting on a rally) to maintain their positions.

M’s low funding rate highlights strong bearish sentiment in the derivatives market. Despite the current rally, its futures traders are overwhelmingly positioned for a downside move. This shows a lack of confidence in M’s mid-to-long-term prospects.

Can Demand Save the Rally?

Although M’s price has managed to defy the broader market decline, weakening liquidity flows and heavy short positioning suggest its gains may not be sustainable.

Once buyer exhaustion sets in, M risks losing its recent gains and plummeting toward $0.4105.

On the other hand, a break above $0.4736 remains likely, but only if strong demand enters the market.