Sports Betting Giant SharpLink Doubles Down on Ethereum as Directors Cash Out

SharpLink Gaming just doubled its Ethereum position while insiders dumped shares—because nothing says confidence like executives cashing out during a 'strategic pivot.'

The Bet Behind the Bet

While retail investors chase memecoins, this sports betting powerhouse quietly accumulated another $47M in ETH—timed perfectly with three board members liquidating positions. The company claims it's 'future-proofing their liquidity framework,' but the timing raises eyebrows sharper than a dealer's glance at a blackjack table.

Smart Money or Dumb Luck?

Their treasury now holds over 28,000 ETH purchased at average prices that would make degens weep—all while traditional gaming revenue dipped 12% last quarter. They're hedging against fiat volatility by diving deeper into crypto's wildest waves, betting that Ethereum's infrastructure will outlast their own industry's regulatory headaches.

Finance's eternal paradox: those preaching longest-term vision often have the shortest-term exit strategies.

TLDR

- SharpLink Gaming purchased $667 million worth of Ether at an average price of $4,648, bringing total holdings to 740,760 ETH worth $3.2 billion

- The company generates staking rewards from its Ether holdings, earning 1,388 ETH through participation in Ethereum’s proof-of-stake network

- SharpLink reported a $103 million net loss in Q2 2025, largely due to paper losses from liquid staked Ether accounting

- Three company directors sold identical amounts of stock totaling over $1 million in combined sales on August 18, 2025

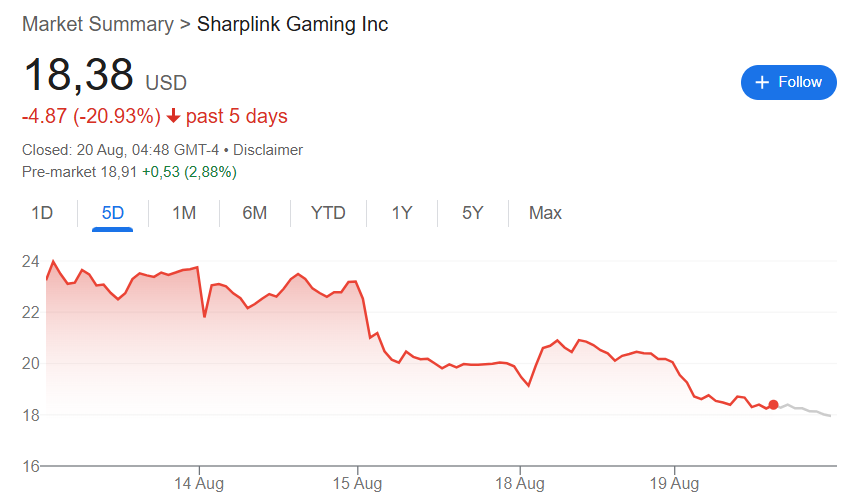

- SharpLink stock dropped 12% following the earnings report, with shares closing at $20.10 down 13.5% over five trading days

Sports betting platform SharpLink Gaming made headlines with a massive Ether purchase worth $667 million. The acquisition came as cryptocurrency prices surged near all-time highs last week.

SharpLink bought 143,593 Ether tokens at an average price of $4,648 per token. The purchase occurred while ETH prices climbed above $4,700, according to SEC filings released Tuesday.

NEW: SharpLink acquired 143,593 ETH at ~$4,648, bringing total holdings to 740,760 ETH

Key highlights for the week ending Aug 17, 2025:

→ Raised $537M through ATM and direct offerings

→ Added 143,593 ETH at ~$4,648 avg. price

→ Staking rewards: 1,388 ETH since June 2 launch… pic.twitter.com/GSe6XzSAwW

— SharpLink (SBET) (@SharpLinkGaming) August 19, 2025

The new acquisition brought SharpLink’s total Ether holdings to 740,760 ETH. At current market prices, the company’s crypto treasury is valued at approximately $3.2 billion.

Staking Rewards Generate Additional Income

SharpLink has been actively deploying its Ether holdings through staking activities. The company reported earning 1,388 ETH in staking rewards by participating as a validator in Ethereum’s proof-of-stake network.

According to the SEC filing, substantially all ETH holdings were deployed in staking as of August 17, 2025. This includes participation in liquid staking protocols that allow the company to earn rewards while maintaining liquidity.

The company acknowledged potential regulatory challenges ahead. SharpLink noted that aspects of its staking activities may face government regulation and guidance changes.

Financial results for the second quarter showed mixed performance. The company reported a net loss of $103 million for Q2 2025.

The loss was largely attributed to paper losses from accounting treatment of liquid staked Ether. Revenue declined to $0.7 million compared to the previous year’s figures.

Directors Execute Stock Sales Following Earnings

Three SharpLink directors sold identical amounts of stock following the earnings announcement. Director Obie McKenzie sold 18,334 shares for $351,279 on August 18, 2025.

Director Leslie Bernhard also sold 18,334 shares for the same amount of $351,279. Director Robert Gutkowski sold an identical number of shares, receiving $351,462 for his transaction.

The stock sales came after SharpLink shares tumbled 12% on Friday. Shares closed at $20.10 on Monday, marking a 13.5% decline over five trading days.

The company’s market capitalization currently stands at $3.35 billion. Year-to-date performance shows gains of 156.79% despite recent volatility.

SharpLink joins other companies in building crypto treasuries. BitMine recently purchased 373,000 Ether tokens, bringing its holdings to 1.52 million ETH worth approximately $6.6 billion.

The institutional buying trend has supported Ether exchange-traded fund inflows. Spot Ether ETFs recorded $3.7 billion in inflows from August 5 through Thursday of last week.