Ethereum Smashes Into Top 30 Global Assets at $416B – Is $500B the Next Stop?

Move over, legacy giants—Ethereum just bulldozed its way into the elite club of the world's 30 most valuable assets. With a $416 billion market cap, it's now rubbing shoulders with corporate titans and sovereign wealth funds. But here's the real question: What's next for crypto's silver medalist?

The $416B inflection point

This isn't just another milestone—it's a middle finger to traditional finance orthodoxy. Ethereum's valuation now eclipses most Fortune 500 companies while being more liquid than half the currencies in IMF baskets. The network processes more value daily than some small nations' GDPs.

The scaling paradox

Layer 2 solutions are eating base layer fees alive, yet ETH keeps climbing. Institutional money's flooding in not because they love decentralization—but because the yields beat Treasury bonds and the volatility's starting to resemble actual assets rather than casino chips.

What Wall Street won't tell you

The suits are quietly accumulating while publicly dismissing crypto as a 'risk asset.' Meanwhile, ETH's annualized staking yields make traditional savings accounts look like financial malpractice—if you can stomach the occasional 20% haircut before breakfast.

Ethereum's not just disrupting finance—it's exposing how broken the old system really is. Will $500B be the next stop, or will regulators finally wake up and realize they're trying to tax code instead of property? Either way—buckle up.

Global Adoption Increases For Ethereum

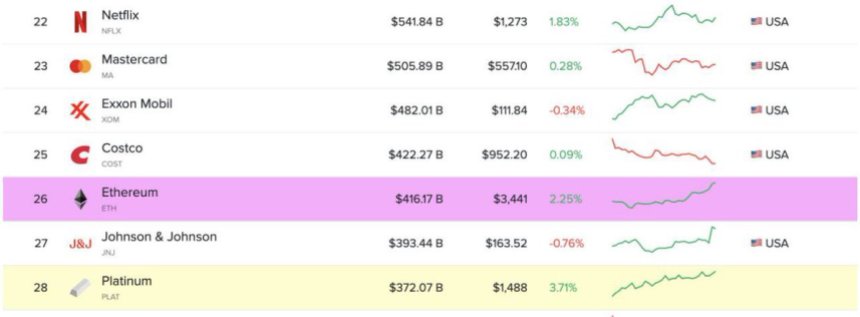

Ethereum has officially become the 26th most valuable asset globally by market capitalization, according to data shared by top analyst Ted Pillows. With a market cap of over $416 billion, Ethereum now sits among the world’s financial giants—an impressive milestone that underscores the asset’s growing legitimacy and investor interest. Pillows added that this positioning could mark the beginning of Ethereum FOMO, as both retail and institutional investors react to rising momentum and market structure.

This surge in valuation comes on the heels of a major legislative breakthrough. The US House of Representatives passed three critical crypto bills yesterday, including the GENIUS Act and the Clarity Act. These laws aim to bring much-needed regulatory transparency to the crypto sector, further reinforcing investor confidence. The passage of these bills is viewed as a turning point in US crypto policy, setting the stage for broader institutional adoption and innovation.

Meanwhile, institutions are ramping up ETH accumulation. On-chain data reveals steady inflows into Ethereum spot ETFs, while a noticeable premium on Coinbase suggests strong demand from US-based whales. Combined with a bullish price structure and improving macro conditions, Ethereum appears to be entering an expansive phase, not only in price but also in network usage and adoption.

ETH Surges To New Highs After Breaking Major Resistance

Ethereum has continued its bullish advance, now trading at $3,619 following a clean breakout above the key resistance level at $2,852. The chart shows a clear shift in momentum, with ETH surging more than 25% over the past week, backed by strong volume and bullish structure. This marks the highest price since early 2024, and it comes as Ethereum decisively clears all major moving averages on the 3-day chart—the 50, 100, and 200 SMAs.

The 200-day SMA at $2,815 had acted as a long-standing ceiling during the past year of consolidation and correction. Now that price has reclaimed it with strength, the previous resistance could flip into strong support in the NEAR term. The recent price action also resembles the breakout pattern seen before ETH’s last major rally toward all-time highs.

Volume has significantly increased, further validating the breakout and suggesting that institutional participation may be rising again, especially as spot Ethereum ETFs continue seeing record inflows. If ETH holds above the $3,400–$3,500 region over the coming days, a continuation toward the $4,000 psychological level could be next.

Featured image from Dall-E, chart from TradingView