Bitcoin’s Bull Run Still Has Legs: Short-Term Holder MVRV Signals More Gains Ahead

Bitcoin isn't done surprising us yet. The Short-Term Holder Market Value to Realized Value (MVRV) ratio—a key on-chain metric—just flashed its most bullish signal since the 2021 cycle. And Wall Street's still trying to explain it with their 'efficient market' fairy tales.

Why this metric matters

When short-term holders (those who bought within 155 days) see their coins' market value significantly outpace the price they paid, history shows we're in the acceleration phase. Not the exit ramp.

The institutional FOMO factor

With spot ETFs now holding 5% of all circulating BTC—and paying 2% management fees for the privilege—the smart money's playing catch-up. Again.

Watch these key levels

The $60K support held like a champ during last week's 15% pullback. Now we're eyeing the $75K liquidity zone where futures traders keep stacking shorts like it's 2024.

One final thought: When your Uber driver starts quoting MVRV ratios, maybe then it's time to worry. Until then? Buckle up.

Bitcoin Rally Far From Over

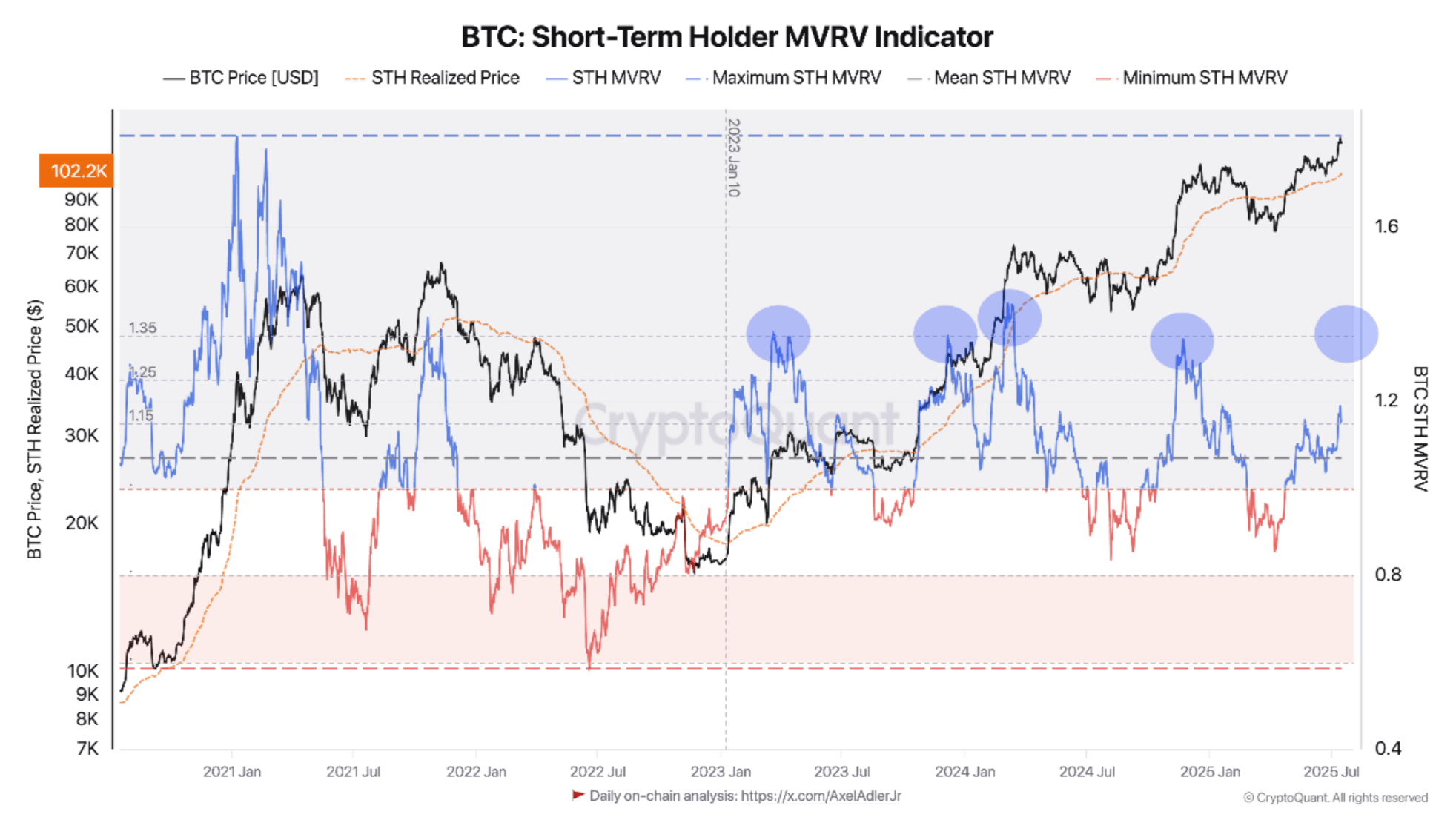

According to a recent CryptoQuant Quicktake post by contributor Darkfost, Bitcoin’s rally is not yet over. The analyst points to the Short-Term Holder (STH) Market Value to Realized Value (MVRV) indicator as evidence.

For context, STH MVRV measures the profitability of bitcoin held by short-term investors – typically those who acquired BTC within the last 155 days – by comparing the current market price to their average purchase price.

When the STH MVRV is high, it suggests short-term holders are in profit and may sell. On the contrary, a low or negative MVRV indicates undervaluation and potential for further upside.

Darkfost noted that during the current market cycle, unrealized profits among STH have yet to surpass the 42% threshold. Historically, every time the STH MVRV reaches around 1.35 – implying a 35% unrealized profit – it has triggered a wave of profit-taking, followed by short-term price pullbacks.

As of now, the STH MVRV stands at approximately 1.15, well below the profit-taking zone. The analyst attributes this to the STH realized price exceeding $100,000 for the first time in Bitcoin’s history on July 11. At the time of writing, this realized price has risen above $102,000, providing BTC with a robust support base.

To clarify, STH realized price refers to the average price at which all Bitcoin held by short-term holders was acquired. When Bitcoin’s current market price remains above this level, it reflects growing market confidence among newer investors.

Darkfost added that BTC could rise another 20–25% before the STH MVRV reaches its critical level again. If this projection holds, Bitcoin could potentially hit $150,000 before the next wave of widespread profit-taking.

Fresh Liquidity May Help, But Exercise Caution

Bitcoin may also benefit from fresh liquidity entering the market. Fellow CryptoQuant analyst Amr Taha recently highlighted a $2 billion USDT deposit into major derivatives trading platforms, signaling potential leverage buildup.

Similarly, favorable macroeconomic conditions are expected to support risk-on assets like Bitcoin. The recent weakness in the USD has fuelled Optimism around capital rotating into cryptocurrencies and other high risk-reward assets.

However, BTC inflows to centralized exchanges have been steadily rising as well, suggesting a short-term correction could be on the horizon. At press time, BTC trades at $118,862, down 0.2% in the past 24 hours.