Whales? Think Again—Newbies Are Flooding Into BTC, Driving the 2025 Rally

Forget the whales—this bull run belongs to the rookies. Bitcoin's latest surge isn't being fueled by institutional deep pockets, but by a stampede of first-time buyers. On-chain data reveals a tidal wave of fresh wallets stacking sats, not OGs rebalancing portfolios.

Why the newbie frenzy? Three words: FOMO, accessibility, and that sweet 2025 regulatory clarity. Exchanges have slashed onboarding friction to three clicks and a selfie, while ETFs finally let boomers ape in via their retirement accounts. The 'number go up' machine has a new feedstock: normies.

But here's the kicker: these entrants aren't chasing $100K BTC. They're buying the dip at $60K, convinced it's discount season. Whether that's genius or greater fool theory depends on which hedge fund manager you ask (between sips of their $28 oat milk latte).

One thing's certain—when the taxi drivers start explaining UTXOs at cocktail parties, even the suits pay attention. The market's voting with its wallet, and right now it's betting on green. Just don't tell the SEC.

Fresh Capital Flooding In

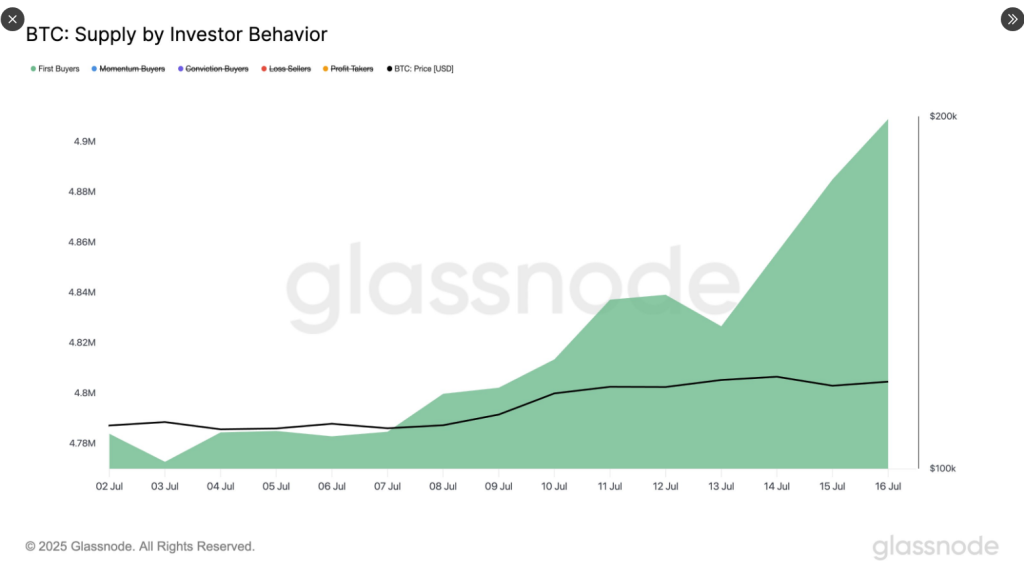

According to on‑chain data from Glassnode, first‑time buyers picked up an extra 140,000 BTC over the past two weeks. Their holdings climbed from 4.77 million to nearly 5 million BTC—a 2.86% rise.

That influx of fresh coins helped push Bitcoin past its latest high. It also shows that new investors are gaining confidence in the world’s biggest cryptocurrency.

Over the past two weeks, the supply held by first-time $BTC buyers ROSE by +2.86%, climbing from 4.77M to 4.91M #BTC. Fresh capital continues to enter the market, supporting the latest price breakout. pic.twitter.com/W95HSAMaHI

— glassnode (@glassnode) July 17, 2025

Short‑Term Holders Hit A New Cost Base

Newer players aren’t the only ones getting active. Based on reports, entities that bought bitcoin within the last six months now sit on a cost basis above $100,000 for the first time.

They’ve held on through price swings and have not yet sold at a loss. That suggests many expect the rally to continue. At the same time, holding on tight could create pressure if prices dip below their average buy‑in point.

Dip Buyers Act FastGlassnode’s cost‑basis heatmap revealed that buyers moved quickly when Bitcoin dipped below $116,000 earlier this week. About 196,600 BTC changed hands between $116,000 and $118,000.

That buying spree added over $23 million in value NEAR what looks like a local top. It’s a sign of strong resolve from those backing the market at lower levels.

While whales and newer buyers are busy, the crowd on Google seems less thrilled. Search activity for “Bitcoin” ticked up modestly in the last fortnight, but it’s well below the highs seen when BTC first broke $100,000 this year.

At the same time, data from Santiment indicate chatter has shifted toward altcoins. With ethereum grabbing the spotlight, many retail investors appear more excited by tokens promising bigger short‑term moves.

Retail Interest Remains MutedDespite soaring prices, everyday investors haven’t jumped back in en masse. Based on reports, the broad public’s FOMO hasn’t shown up in a big way yet. That lack of widespread buzz could limit how far and how fast Bitcoin goes from here.

In past rallies, it was the flood of curiosity from casual buyers that turned spikes into parabolic runs.

Featured image from Meta, chart from TradingView