Crypto Carnage: BTC, XRP, SOL, ETH Get Crushed in Long Squeeze as Futures Open Interest Collapses

Blood in the streets—again. Bitcoin and major altcoins just got steamrolled by a brutal long squeeze, with futures open interest nosediving alongside prices. Here's how the dominos fell.

The great leverage flush

Margin traders learned the hard way that crypto doesn't do slow bleed-outs. When BTC broke key support, the cascade liquidations turned into a full-blown deleveraging event—taking ETH, SOL, and even the perennially lawsuit-plagued XRP down with it.

Futures market capitulation

Open interest across derivatives platforms evaporated faster than a meme coin's utility. Turns out those 100x leveraged longs work great... until they don't. Who could've predicted that? (Answer: everyone except the degens still 'buying the dip' with rent money.)

The silver lining? At least the exchanges made bank on liquidations—some things in crypto never change.

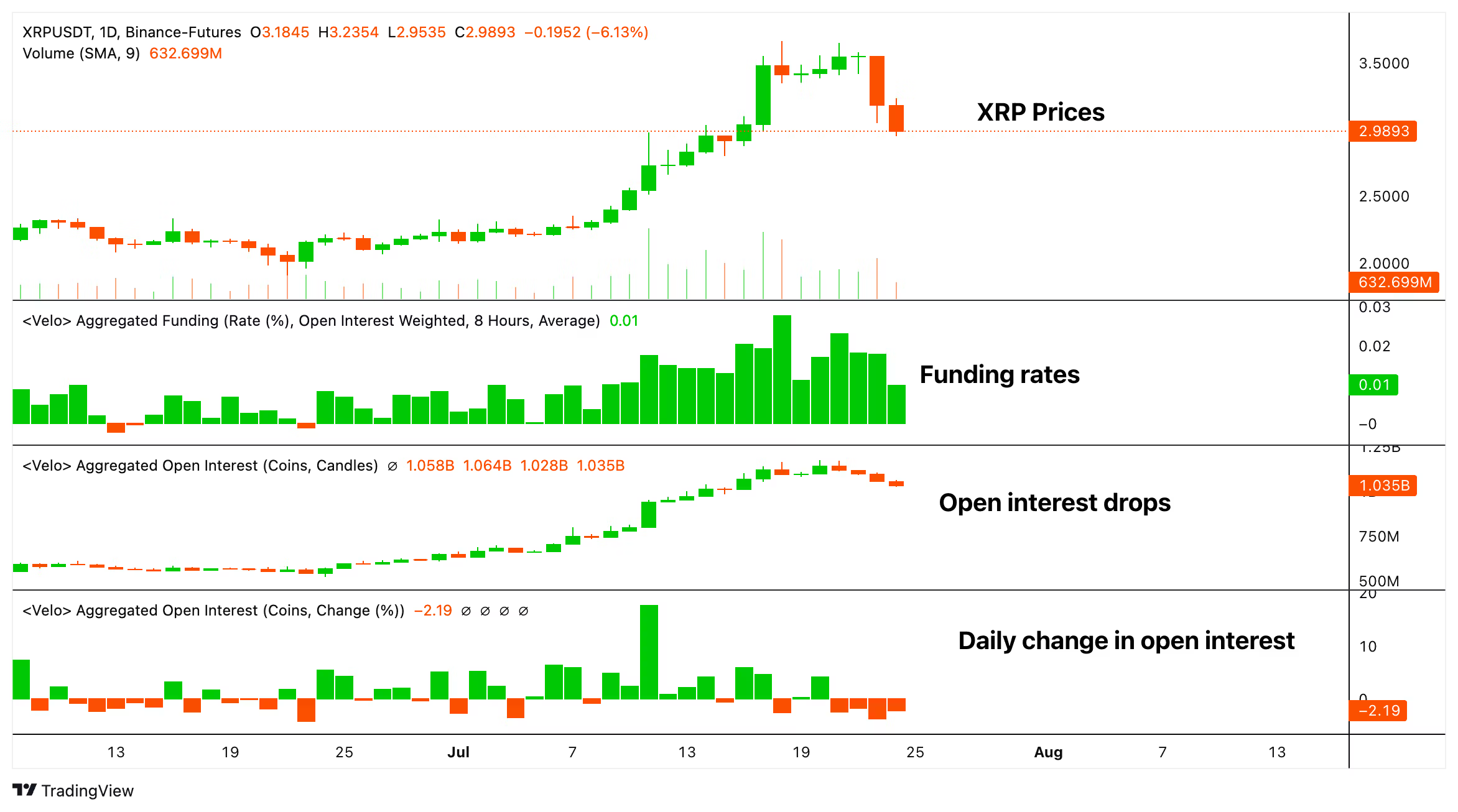

The combination of falling prices, lower open interest and positive funding rates suggests that bullish bets are being actively removed from the market.

It rules out the likelihood that the price decline is backed by investors taking new short, or bearish, positions because in that case the funding rate WOULD have dropped into negative territory as the short holders would need to pay the longs.

Furthermore, the new shorts would have increased open interest as prices dropped, which is not the case either.

The decline in open interest suggests that traders are closing their positions, a characteristic of leveraged longs being liquidated or voluntarily exiting the market, rather than new shorts entering the market. Put together it signals that while the price is dropping, sentiment remains fairly robust.