Pi Network Price Alert: Brace for Impact as 10M Token Unlock Threatens PI’s Value

Pi Network faces a make-or-break moment as 10 million tokens flood the market—just when holders least need it.

### The Unlock Effect: More Supply, More Problems

Markets hate uncertainty almost as much as VC investors love dumping tokens on retail. With Pi Network's looming 10M token release, the math isn't in bulls' favor.

### Technicals Scream Caution

Every trader's chart looks like a horror movie when circulating supply jumps overnight. PI's recent support levels could vanish faster than a crypto influencer's ethics.

### The Silver Lining Playbook

If history's any guide, the smart money's already positioned for this—either shorting the news or waiting to scoop panic sells. Because nothing makes crypto folks happier than buying others' desperation at a discount.

Bottom line: This isn't Pi's first rodeo, but with the network still fighting for mainstream relevance, the unlock couldn't come at a worse time. Watch those stop-losses—or enjoy the fireworks.

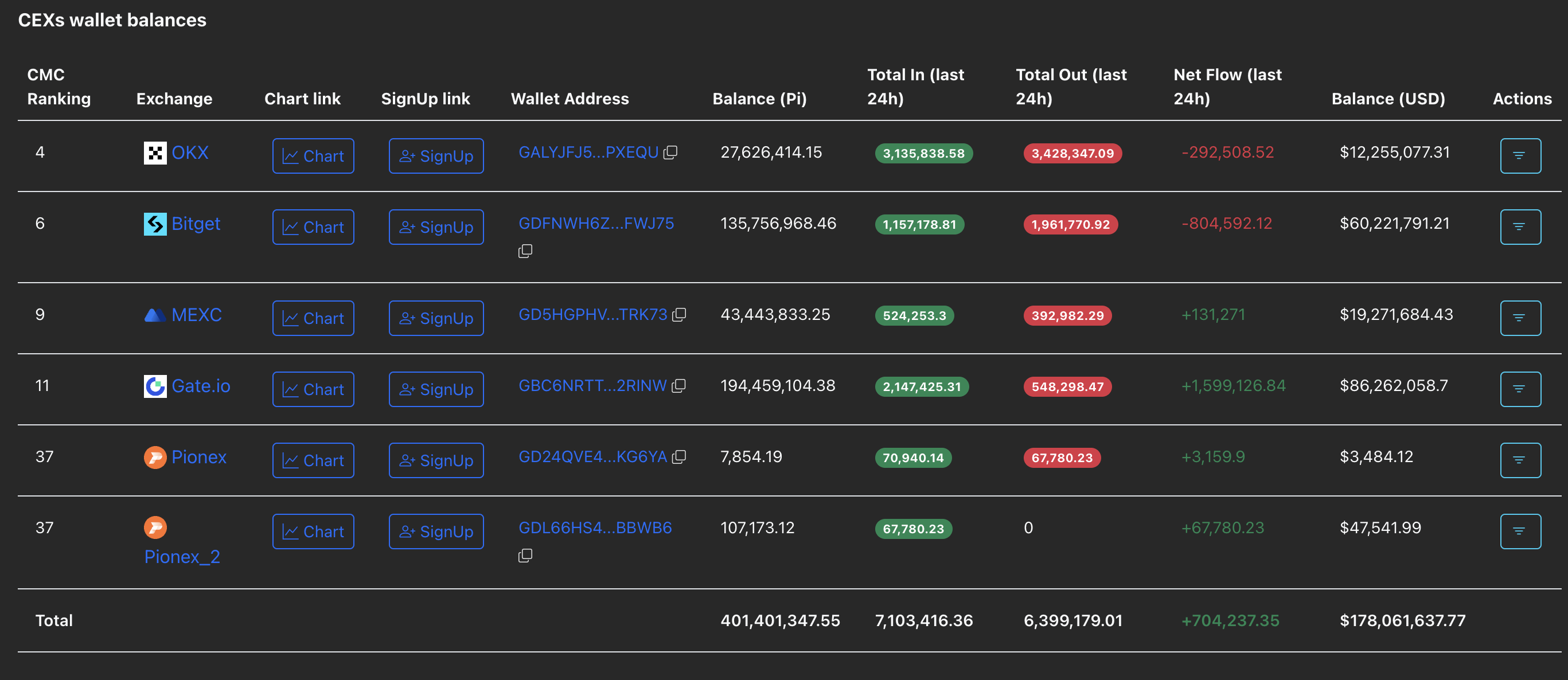

CEXs' wallet balances surge ahead of 10.8 million PI token unlock

PiScan data shows a net inflow of 704,237 PI tokens on CEXs' wallet balances so far on Thursday, with Gate.io holding over 194 million PI tokens out of the total 401 million CEXs' wallet balances. Typically, a surge in selling pressure boosts CEXs' balances as traders or the team book profits.

CEXs' wallet balances. Source: PiScan.

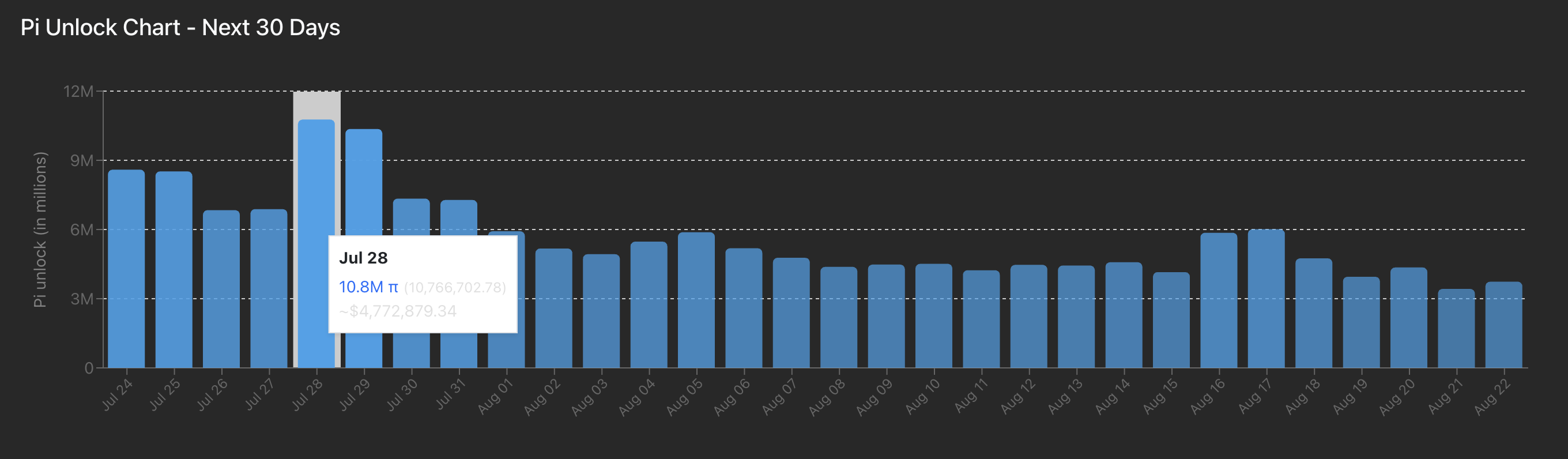

PiScan data indicates that 10.8 million PI tokens will be unlocked next Monday, the highest in the next 30 days, which accounts for a total of 171.25 million PI tokens worth $75.91 million. Typically, a surge in token unlock can fuel the selling pressure as traders may book profits.

PI unlock chart. Source: PiScan.

Pi Network risks losing $0.43 support floor as bearish momentum surges

Pi Network holds above the $0.4371 support floor that previously acted as the base of a consolidation range, marked by green on the 4-hour price chart. PI struggles to float above this crucial support level with a long shadow candle, while the path of least resistance signals a downside.

A decisive close below the $0.4371 level could test the $0.4204 low marked on July 15 or the $0.4000 support, last tested on June 13.

The Moving Average Convergence Divergence (MACD) drops below the zero line as the red histogram bars intensify, signaling increased bearish momentum.

Still, the Relative Strength Index (RSI) reads 40 on the 4-hour chart, indicating a significant decline in buying pressure. A drop below 30 WOULD indicate overbought conditions in the PI network, potentially increasing the chances of a turnaround.

PI/USDT daily price chart.

To renew a bullish run, PI bulls must reclaim the 200-period Exponential Moving Average (EMA) at $0.4950, which could stretch the uptrend to $0.5430.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.