Chainlink’s Bullish Surge: Can It Defy Gravity and Hit $25?

Chainlink's price action has traders buzzing—can the oracle network's momentum outlast the skeptics?

Fueled by smart contract demand and DeFi's relentless expansion, LINK's rally shows few signs of fatigue. But crypto's history of 'up-only' hopium warrants caution.

Key drivers: Institutional adoption of hybrid smart contracts and LINK's entrenched position as the go-to oracle solution. Yet with staking yields compressing and competitors lurking, the $25 target hinges on more than just hype.

Remember: In crypto, even the surest bets have expiration dates—usually timed with maximalist Twitter meltdowns.

A rally backed by real demand

For starters, LINK’s upward trend isn’t just clean - it’s convincing. Since early July, it’s been grinding higher with impressive consistency, forming a textbook bullish structure. Even when it pulls back, buyers step in. That kind of resilience is hard to ignore.

Source: Deriv X

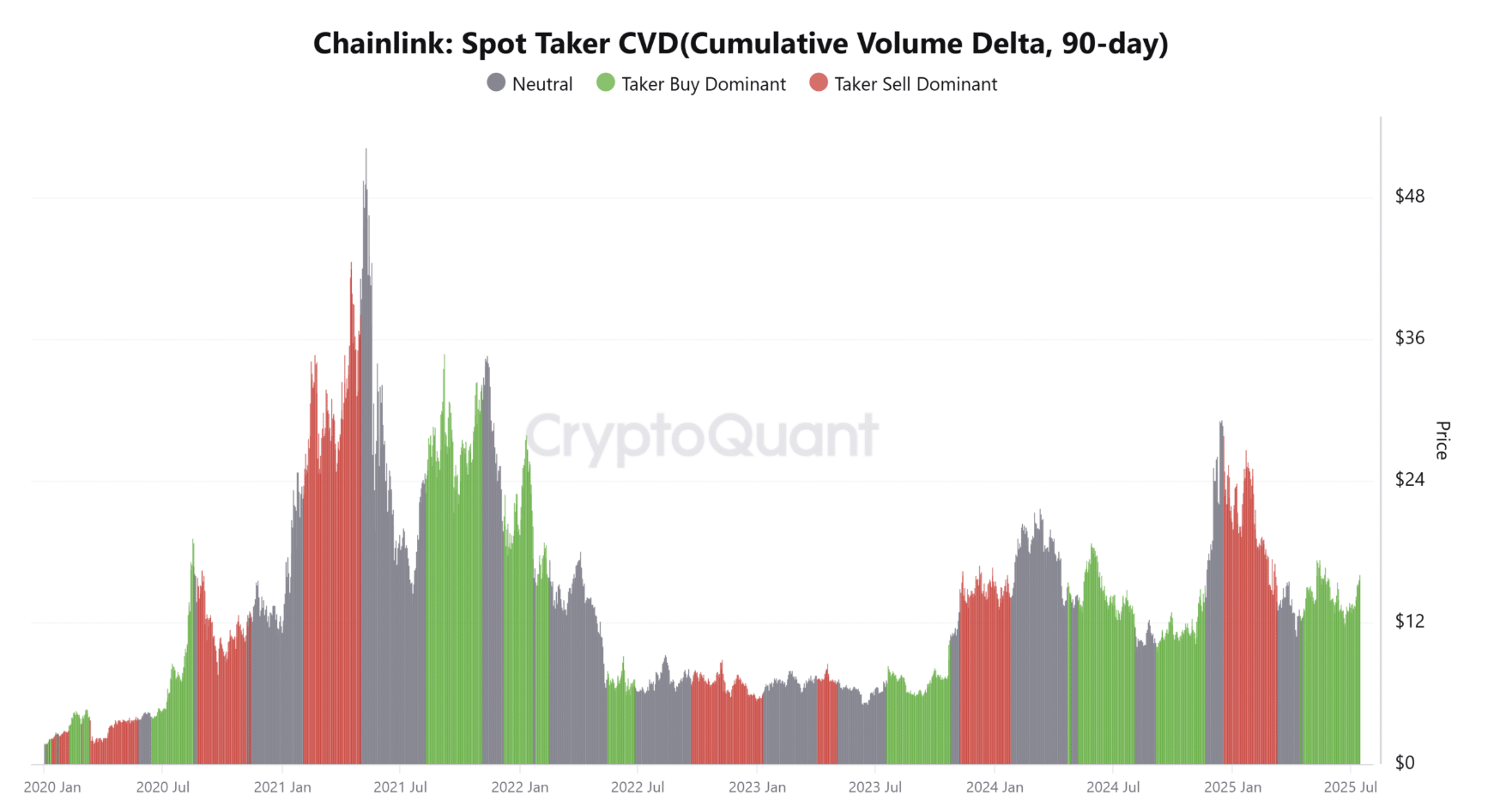

Spot market data backs this up. Over the past 90 days, Taker Buy Volume Dominance has leaned firmly toward the bulls, a sign of aggressive accumulation.

Source: CryptoQuant

Add to that a daily trading volume of over $659 million, and we’re looking at solid participation, not the kind of thin, twitchy liquidity that fades after a single move.

It’s clear that the market likes these prices. While that doesn’t guarantee a breakout, it certainly puts the bulls in the driver’s seat.

Derivatives traders are all in

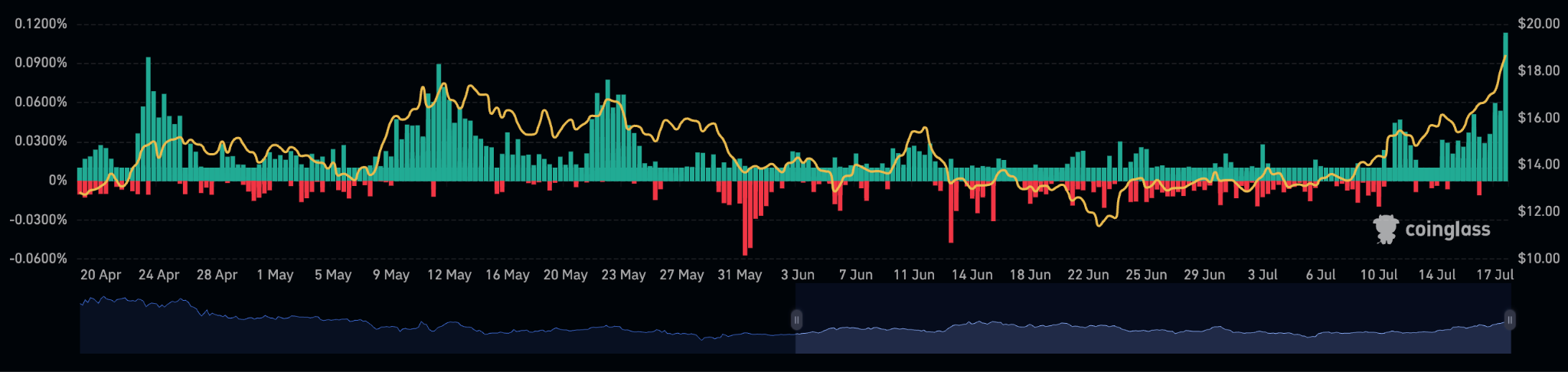

The derivatives side of the market has also flipped bullish. Funding rates have turned positive, a strong signal that traders are now willing to pay a premium to hold long positions.

Source: Coinglass

That’s a shift in sentiment - and a sharp one, considering rates had been negative just weeks ago.

Open interest is up 8.47% in a single day, hitting $843 million.

Source: Coinglass

That’s a lot of capital betting on further upside. But here’s the catch: as positions stack up, so does risk. And according to Binance’s heatmap, there’s a build-up of liquidation levels just below the $17 mark, right where LINK is currently trading.

That could go either way. A clean break through resistance could trigger a short squeeze and send prices rocketing. But a sharp rejection? That might pop a few Leveraged longs and drag prices back down in a flash.

Under the surface, some red flags

On-chain metrics are adding a little tension to the otherwise bullish mood. The MVRV ratio is sitting at 37.87%, which means many holders are in profit. Historically, that’s when we start seeing more people cash out, and that can weigh on price.

Meanwhile, the NVT ratio has been spiking - a classic signal that price is rising faster than the network’s actual activity. In other words, LINK might be running a bit ahead of its fundamentals.

None of this spells disaster, but it does suggest traders should stay alert. Momentum is powerful, but frothy conditions don’t last forever.

The tokenyze factor

What’s refreshing about this rally, though, is that it isn’t only driven by speculation. Chainlink’s utility story is quietly gathering strength, and the recent partnership with Tokenyze is a case in point.

Tokenyze is working to bring real-world assets like copper and aluminium onto the blockchain, and Chainlink is at the core of that effort. Through the BUILD programme, Tokenyze gets access to Chainlink’s top-shelf tools - from Proof of Reserve to price feeds and the Cross-Chain Interoperability Protocol (CCIP).

These aren’t gimmicks. They’re mechanisms for verifying asset reserves, transferring value securely across blockchains, and ensuring price integrity - all the things traditional institutions care about when stepping into DeFi.

Even better, Tokenyze is allocating a portion of its native tokens to Chainlink stakers and service providers, creating deeper alignment and value-sharing within the ecosystem.

This kind of collaboration helps shift the narrative around Chainlink. It’s no longer just “the oracle coin” - it’s fast becoming a pillar of tokenised finance.

So, what about $25?

Here’s the honest read: Chainlink has momentum, real use cases, and strong market participation. Those are the ingredients you want if you’re betting on a breakout.

But with on-chain signals flashing caution and derivatives activity running hot, a clean run to $25 won’t come easily. It might take a few failed tests and short-term setbacks before that level gives way.

Still, with partnerships like Tokenyze expanding Chainlink’s reach into the real economy and traders showing a clear appetite, the foundation looks strong. Whether it rips through $25 now or later, this is really worth watching.

Chainlink price prediction: Can LINK push through $25?

The rally has real legs, according to analysts. There’s spot demand, derivatives enthusiasm, and institutional-grade adoption all converging at once. But that doesn’t mean it’s a straight line to $25.

Yes, the momentum is strong, and if LINK can smash through resistance NEAR $18.81, the path to $25 opens up quickly. But elevated open interest, profit-heavy wallets, and shaky on-chain ratios suggest we could see a test of nerves before the next leg up.

At the time of writing, Chainlink is still on a tear, but there are signs of waning momentum, with a large wick forming at the top. It remains to be seen whether the wick will signify price exhaustion or if the uptick will reaccelerate. If we see an uptick, bulls will be in price discovery mode on their way towards $25. Conversely, if we see a price reversal, sellers could find floors at the $15.00 and $13.41 support levels.

Alt Text: A daily candlestick chart showing Chainlink (LINK) vs US Dollar with price currently at $18.677.

Source: Deriv X