🚀 Uniswap (UNI) Rockets 20% as DeFi TVL, Open Interest & Trading Volume Explode

DeFi's blue-chip darling Uniswap just pulled a classic crypto moon shot—UNI surged 20% in a single bullish wave. Here's why traders are piling in.

TVL, Open Interest & Volume: The Trifecta Pumping UNI

Total Value Locked isn’t just climbing—it’s scaling Everest. Open interest? Ballooning like a Wall Street bonus pool. Trading volume? Let’s just say Uniswap’s liquidity pools are drinking from the firehose.

The DeFi Domino Effect

When Uniswap sneezes, the whole DEX ecosystem catches a cold. This rally’s got more legs than a centipede—thanks to that sweet combo of protocol upgrades and yield farmers chasing APYs like dogs after cars.

Warning Lights Behind the Green Candles

Sure, UNI’s pumping—but let’s not pretend this isn’t crypto. For every trader riding this wave, three are waiting to paper-hand at the first sign of a 5% pullback. Remember kids: in DeFi, ‘sustainable growth’ is just what we call the gap between two liquidations.

Uniswap rallies on strong DeFi sentiment

Uniswap’s recovery comes amid steady interest in altcoins, evidenced by ethereum (ETH) surging above $3,600 and Ripple (XRP) reaching a new all-time high of $3.66. UNI's technical bullish structure, which upholds the short-term support at $10.00, is supported by the growth highlighted by Uniswap’s DeFi ecosystem.

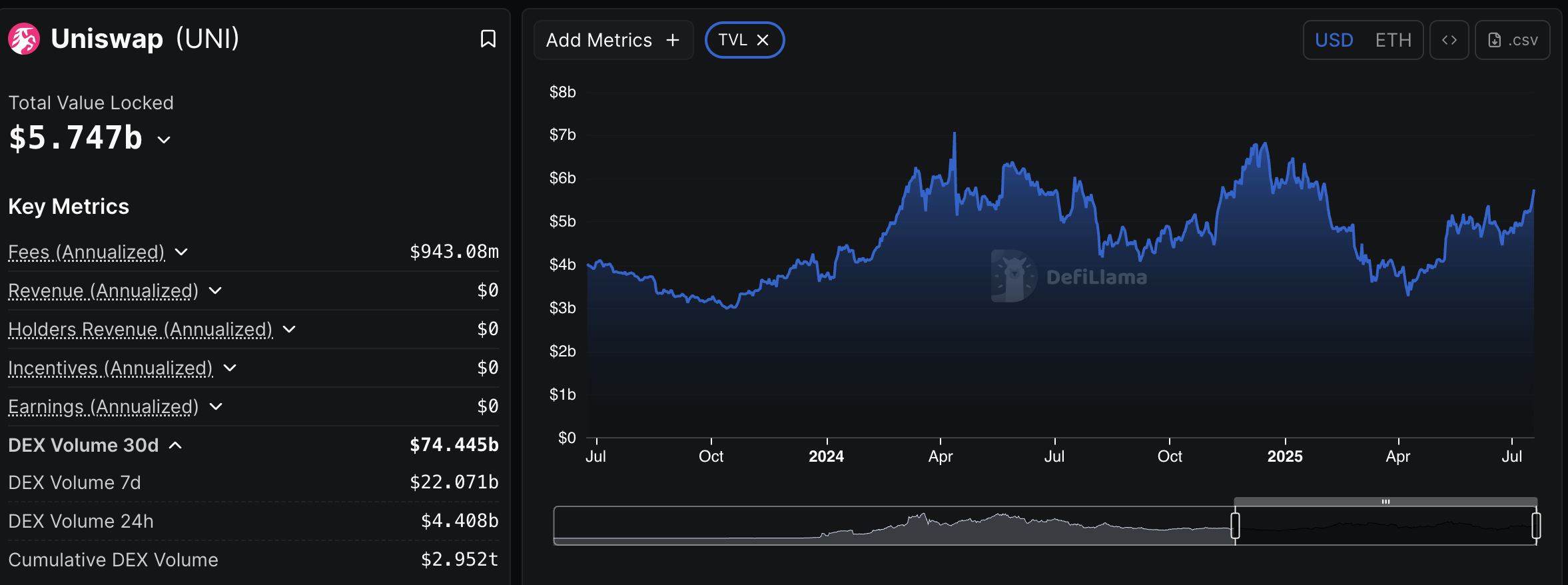

According to DefiLlama, the UNI’s Total Value Locked (TVL), which represents the value of all coins locked in smart contracts across all protocols on the chain, stands at $5.75 billion.

UNI’s DeFi TVL declined persistently in the first quarter, and stabilized at $3.28 billion in April before rising steadily to the current level. The increase in TVL is a bullish sign for UNI, as it indicates growing investor confidence in the ecosystem. A higher TVL also reduces the circulating supply and the potential selling pressure.

Uniswap DeFi TVL | Source: DefiLlama

Interest in UNI is also reflected in the macro environment, particularly with the surge in the derivatives market Open Interest (OI) and volume. CoinGlass data shows that Open Interest, which refers to the value of all futures and options contracts that have not been settled or closed, increased nearly 23% to $738 million over the past 24 hours. With the volume rising 75% to $2.9 billion over the same period, it indicates that traders are willing to bet on future price increases.

Uniswap derivatives market data | Source: CoinGlass

A wave of liquidations also hit short position holders the most, with NEAR $4.4 million wiped out in the last 24 hours compared to $1.34 million in long positions. The long-to-short ratio on Binance also increased, averaging 1.2660, signaling a higher risk appetite for Uniswap.

Technical outlook: Can Uniswap extend the rally?

Uniswap is currently in a bullish technical setup, supported by a Golden Cross pattern and a buy signal sustained by the Moving Average Convergence Divergence (MACD) indicator since July 8 on the daily chart below.

The call to traders to consider buying UNI occurred when the blue MACD line crossed above the red signal line. Notably, the green histogram bars above the zero line reinforce the bullish grip, hinting at steady momentum amid the increase in spot trading volume, currently at $23 million.

An earlier confirmed Golden Cross pattern, where the 50-day Exponential Moving Average (EMA) crossed above the 100-day EMA, confirms the bullish outlook. A second similar pattern is expected if the 50-day EMA closes the day above the 200-day EMA.

UNI/USDT daily chart

The overbought Relative Strength Index (RSI) at 74 suggests that traders should temper their bullish expectations. If the RSI continues to rise, it will indicate bullish momentum but also predispose UNI to sudden pullbacks, as the market overheats.

Hence, there’s a need for the DEX token to find support above the $10.00 level; otherwise, potential profit-taking could see traders extend their scope to lower support levels, such as the 50-day EMA and 200-EMA confluence at around $7.68 as well as he 100-day EMA at $7.31.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.