🚀 Bitcoin Holds Strong at $108K: FOMC Minutes Could Spark Next Big BTC Move

Bitcoin traders white-knuckle their positions as the crypto king consolidates at $108,000—all eyes now turn to the Federal Reserve's playbook.

### The Fed Factor: Crypto's Eternal Puppet Master

Market makers hold their breath ahead of FOMC minutes, parsing for hints like medieval soothsayers reading chicken bones. Will Powell blink? The charts don't lie—BTC's price action hangs on every bureaucratic whisper from DC.

### Institutional Jitters Meet Diamond Hands

Wall Street's quant algos twitch nervously while OGs stack sats. Funny how 'risk assets' suddenly look safer than Treasury bonds yielding negative real returns after inflation. The irony's thicker than a Bitcoin maximalist's neckbeard.

### The Cynic's Corner

Watch the suits at BlackRock suddenly 'discover' Bitcoin's store-of-value narrative—right after accumulating positions through their shiny new ETF. How conveniently bullish.

FOMC meeting minutes could trigger volatility for BTC

Bitcoin continues to trade sideways, around $108,000 during the European session on Wednesday. The lack of any relevant market-moving news has caused a consolidation in BTC so far this week. However, this consolidation could come to an end during the American trading session as the Federal Open Market Committee (FOMC) meeting minutes are released late Wednesday, which will provide more cues about the Fed’s interest rate path. This, in turn, will drive and provide a fresh directional impetus to the top cryptocurrency by market capitalization.

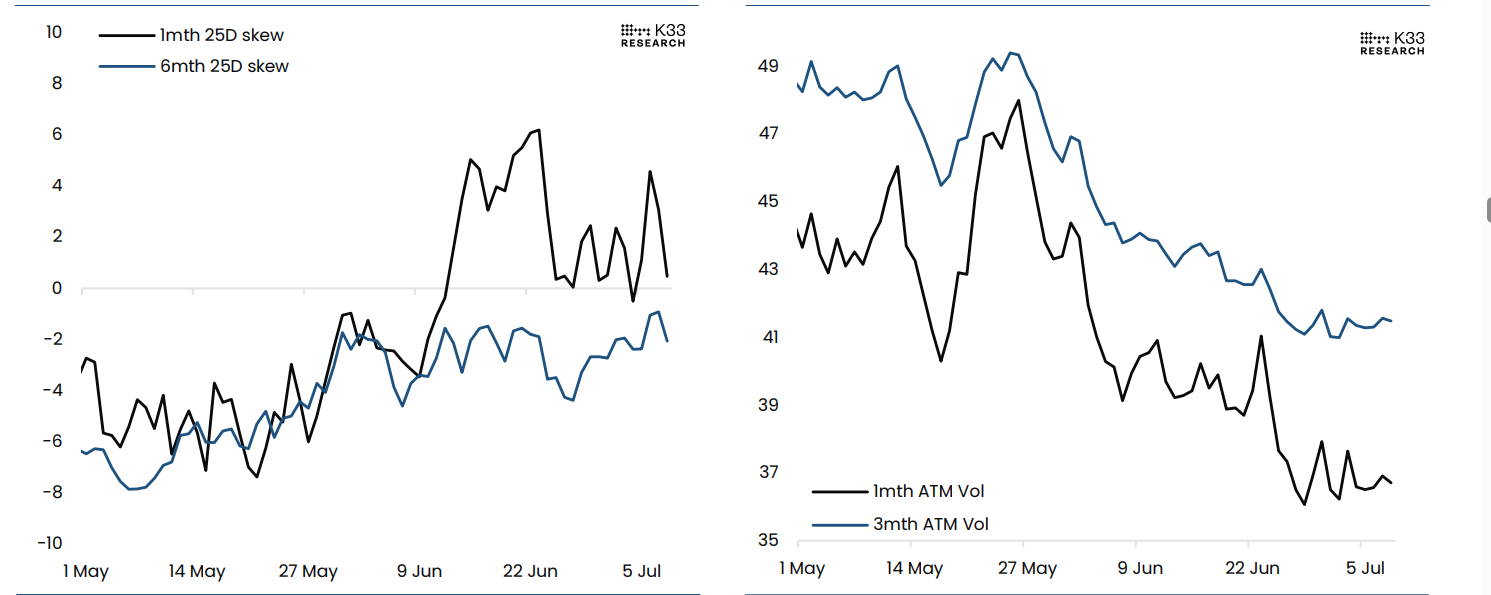

According to a K33 Research report released on Tuesday, BTC has remained rangebound with low day-to-day volatility since May 22, leading to a significant decline in implied volatility across options in the derivatives market.

Despite BTC’s push higher, The Graph below shows that implied volatilities remain at yearly lows after another week of modest activity. BTC’s general lack of direction continues to enforce a neutral directional bias in options, as skews remain near neutral across tenors, suggesting a “wait-and-see” stance among traders.

BTC skew chart (Left) BTC implied volatility chart (Right) Source: K33 Research

Trump’s company files for “Crypto Blue Chip ETF” with the US SEC

US President Donald Trump’s Trump Media Group filed an S-1 registration statement with the US Securities and Exchange Commission (SEC) on Tuesday to launch a “Crypto Blue Chip ETF” for five assets, including Bitcoin, ethereum (ETH), Solana (SOL), Cronos (CRO) and Ripple (XRP).

This ETF fund aims to allocate 70% of its assets to BTC, while 15%, 8%, 5%, and 2% are allocated to ETH, SOL, CRO, and XRP, respectively.

The approval of this fund WOULD signal a bullish outlook for cryptocurrencies — especially for Bitcoin, given its maximum allocation — by boosting broader adoption and improving liquidity for the asset.

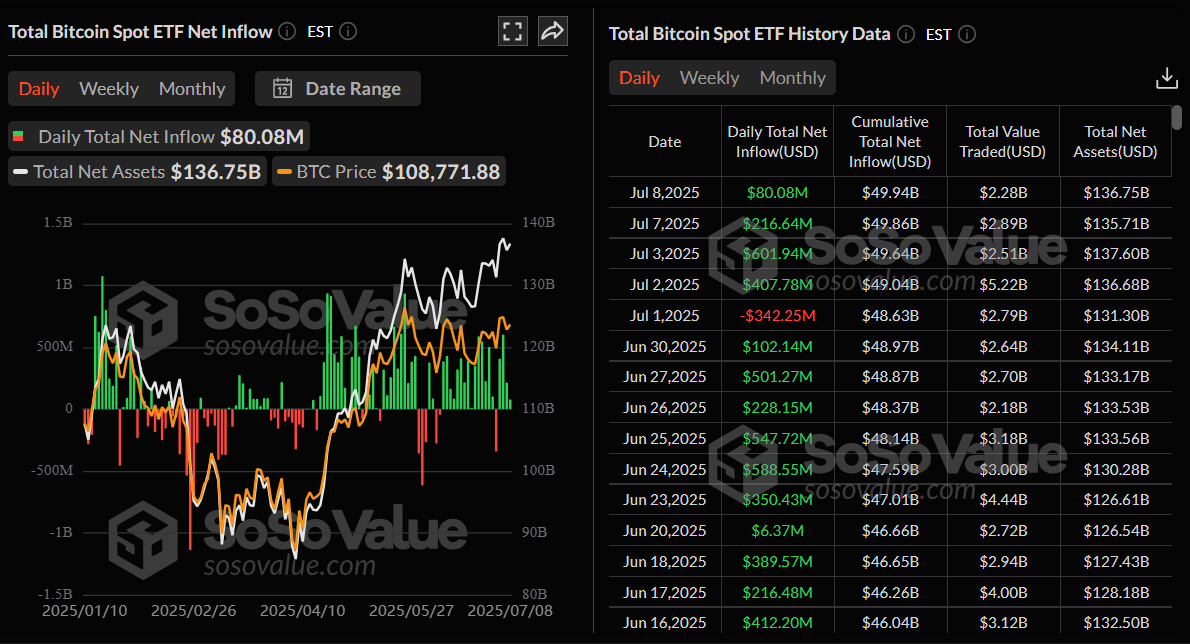

Apart from the demand from corporate companies, the institutional investors’ demand for BTC also remains robust. SoSoValue data show that spot Bitcoin ETFs recorded an inflow of $80.08 million on Tuesday, continuing its four-day streak of inflow since July 2.

Total bitcoin spot ETF net inflow daily chart. Source: SoSoValue

Bitcoin Price Forecast: BTC holds strong around $108,000 support level

Bitcoin price has been consolidating around the upper boundary of a previously broken consolidation zone at $108,355 since Friday. On Monday, it dipped slightly and retested this support level, recovering slightly the next day. At the time of writing on Wednesday, it trades down at around $108,700.

If the support level at $108,355 continues to hold, BTC could extend the rally toward the May 22 all-time high at $111,980.

The Relative Strength Index (RSI) on the daily chart reads 55, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) lines on the daily chart coil against each other, indicating indecisiveness among traders.

BTC/USDT daily chart

If BTC faces a correction and closes below its support at $108,355, it could extend the decline to retest the lower boundary of the consolidation zone at $105,333, which roughly coincides with the 50-day Exponential Moving Average (EMA) at $105,414, making this a key support zone for BTC.