🚀 Crypto Bulls Charge: Bitcoin, SPX & AAVE Price Forecasts – Europe’s Hot Take (9 July 2025)

Markets twitch as Bitcoin flirts with key resistance—while traditional indices play catch-up. Here's where smart money's placing bets this week.

Bitcoin's make-or-break moment

The OG crypto tests overhead supply at levels not seen since the 2024 halving frenzy. Miners are hodling, but derivatives traders smell blood.

SPX: Old money wants in

S&P 500 correlation hits 18-month highs as institutional desks quietly build crypto exposure (through 'respectable' ETFs, of course).

AAVE's defi dance

Lending protocols bleed TVL—except this sector outlier adding collateral options faster than TradFi can file SEC paperwork.

Bottom line: The 'digital gold' narrative gets its inflation test this quarter. Meanwhile, Wall Street still can't decide if crypto's the future or just a really volatile compliance headache.

Bitcoin Price Forecast: BTC steady around $108,000 as investors await FOMC minutes for Fed rate clues

Bitcoin (BTC) holds steady at around $108,000 at the time of writing on Wednesday as investors adopt a cautious stance ahead of the Federal Reserve’s (Fed) meeting minutes release. In the absence of any relevant market-moving news, market participants are closely watching for signals on the Fed’s potential rate-cut path.

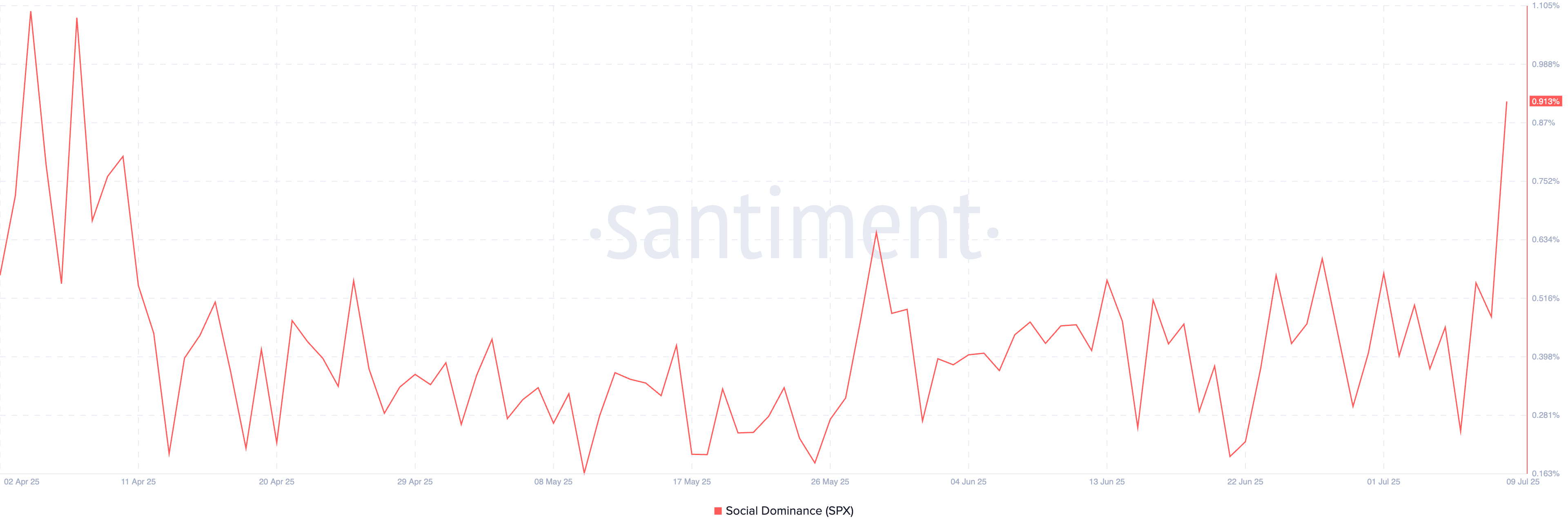

SPX6900 Price Forecast: Triangle breakout chances and rising social chatter signal a bullish outlook

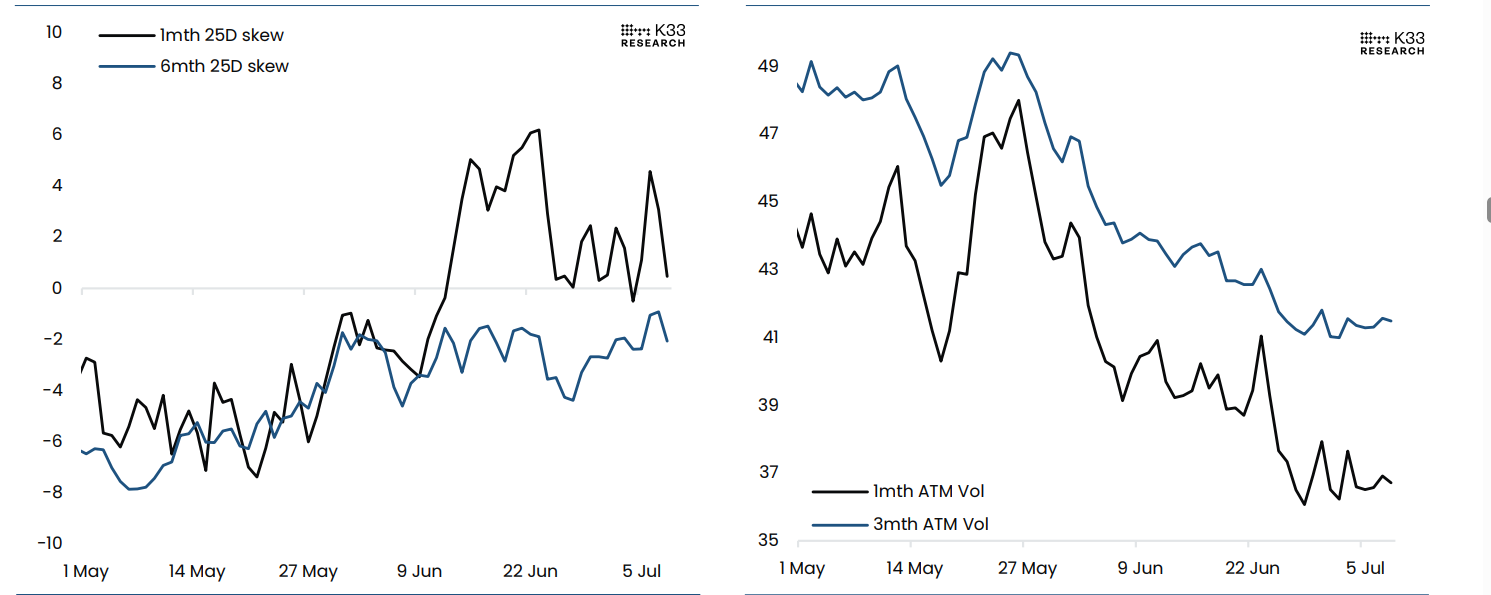

Meme coin SPX6900 (SPX) edges higher by over 3% on Wednesday so far to extend the 8.44% gains from the previous day, which could be backed by the rising social chatter around it. The technical outlook maintains a bullish bias as the SPX approaches a breakout from an ascending triangle pattern, accompanied by increased Optimism among derivative traders.

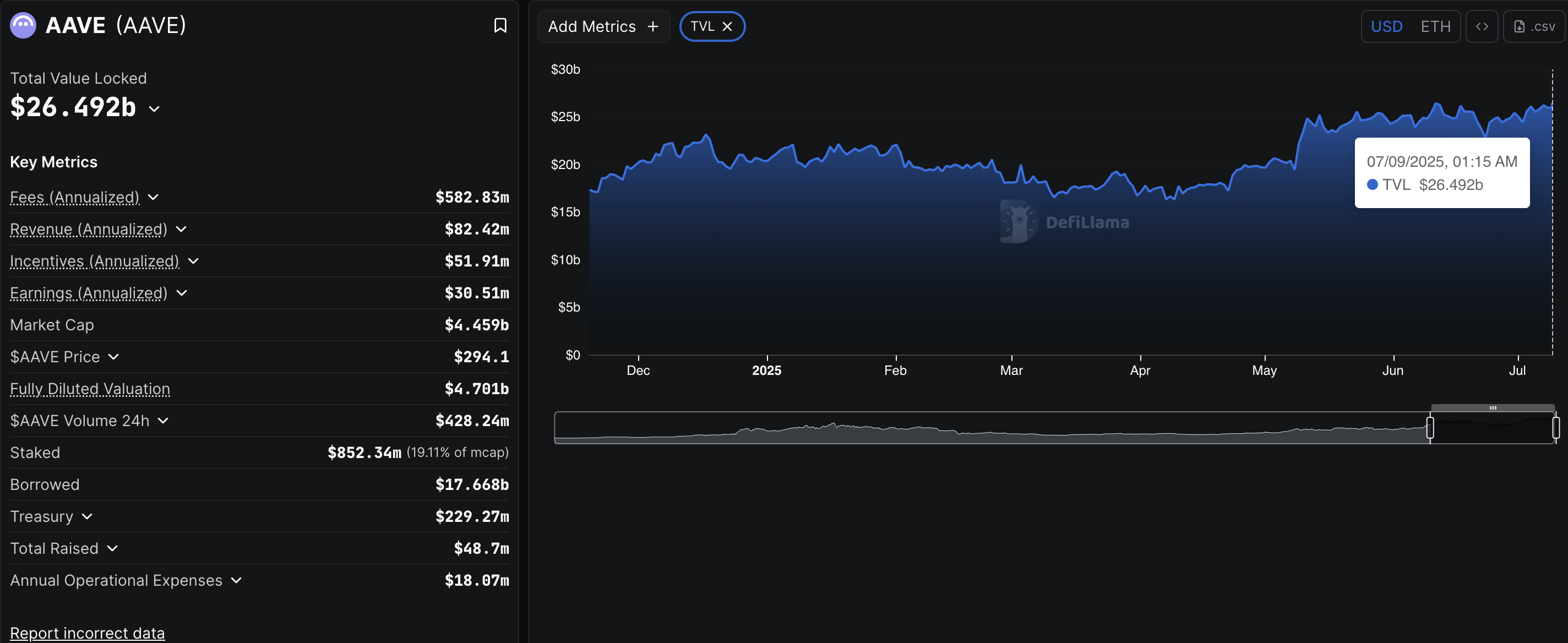

AAVE Price Forecast: AAVE eyes further gains as DeFi TVL hits record high

Aave (AAVE) edges higher by nearly 1% at press time on Wednesday, adding to the 3.45% gains from the previous day, while the total value locked hits a record level of $26.49 billion. However, the derivatives traders remain divided as AAVE inches closer to the $300 psychological mark. The technical outlook indicates a bullish tilt as the trend momentum shows gradual growth.