XRP Surges Past $2.00: Bullish Momentum Builds as Exchange Reserves Shrink & Inflows Accelerate

Ripple's XRP just smashed through the $2.00 psychological barrier—and this time, it’s got the fundamentals to back it up.

Whalescooping or organic demand? Either way, exchange reserves are drying up faster than a DeFi project’s liquidity pool.

Steady inflows suggest institutions might finally be playing nice with the ‘SEC’s favorite punching bag.’

Funny how a token can moon when regulators aren’t busy strangling it in court.

XRP shows resilience amid steady digital

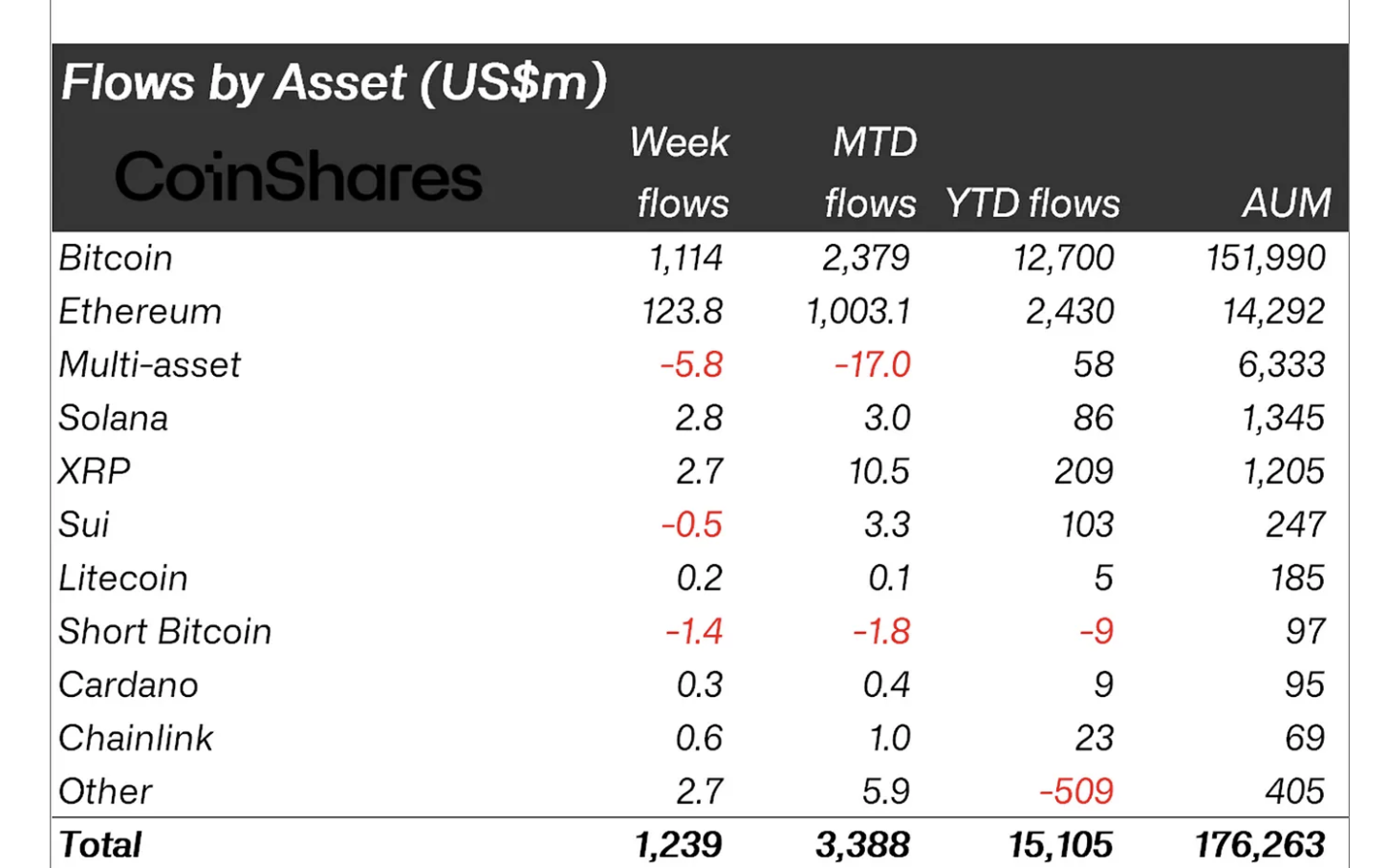

Institutional interest in XRP and related products stabilized last week, alongside inflows into Bitcoin (BTC) and ethereum (ETH). According to CoinShares' weekly report, XRP recorded an inflow of $2.69 million, falling behind Solana (SOL) with $2.8 million, Ethereum with $124 million and Bitcoin with $1.1 billion.

Digital asset weekly inflows | Source: CoinShares

The steady inflow streak mirrors growing interest in XRP-related products, including spot Exchange Traded Funds (ETFs). While the US Securities and Exchange Commission (SEC) is still considering several proposals, Canada launched three XRP spot ETFs last week.

XRP-focused treasury funds have continued to gain momentum in recent weeks, including Singapore-based Trident Technologies' $500 million investment, China-based Webus International's $300 million, and London-based VivoPower's $121 million, which has been channeled toward decentralized finance (DeFi) and the XRP Ledger.

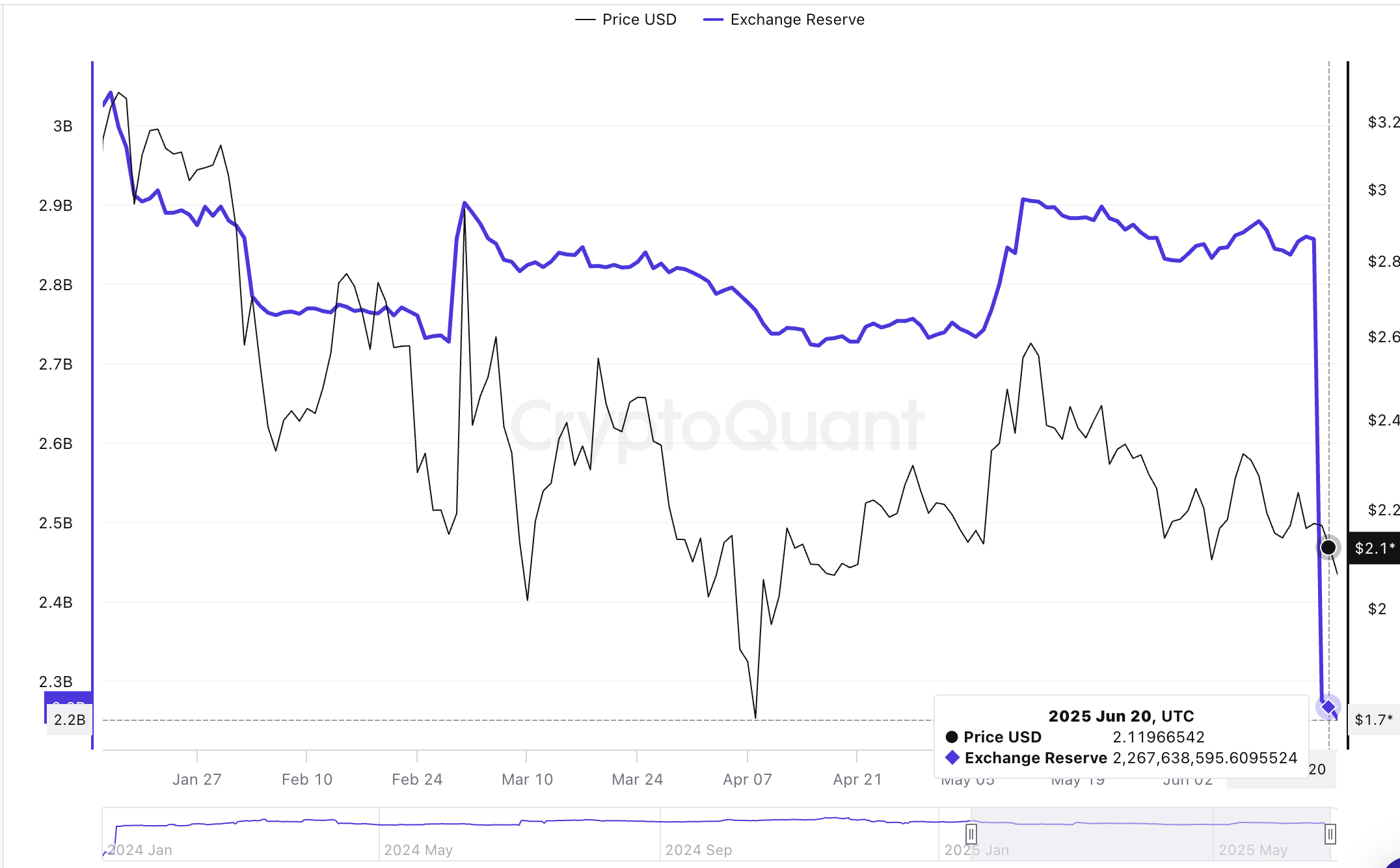

Fundamentally, XRP remains strong, with CryptoQuant highlighting a nearly 21% drop in exchange reserves to $2.3 billion from $2.9 billion as of May 12. The Exchange Reserves metric tracks the total number of coins in exchange wallets. As the value continues to drop, it indicates lower sell-side pressure, thereby predisposing XRP to a sustainable uptrend.

Exchange Reserve metric | Source: CryptoQuant

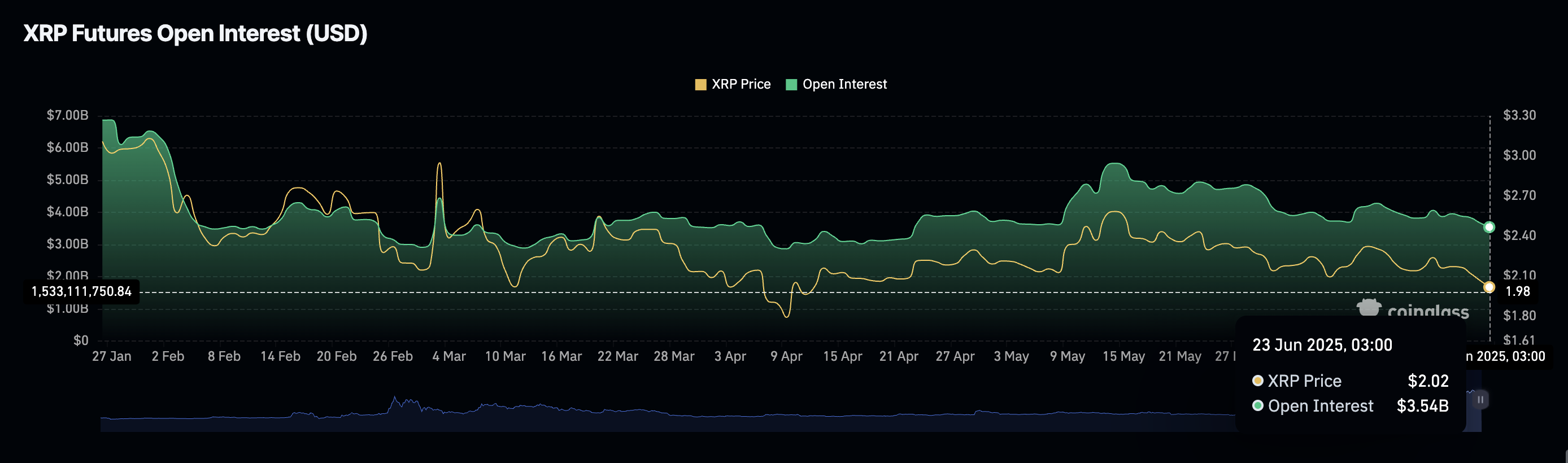

However, the derivatives market sheds light on the complex technical situation intertwined with macro factors, such as geopolitical tensions-triggered sell-offs. CoinGlass reports a decline in Open Interest (OI) to $3.54 billion, down from $5.52 billion recorded on May 14.

A sharp increase in trading volume to $8.7 billion indicates a rise in liquidations, valued at $21 million over the last 24 hours, and an increase in activity as traders buy XRP to cover their positions. A short squeeze could trigger a technical reversal in upcoming sessions or days.

XRP futures Open Interest | Source | CoinGlass

Technical outlook: XRP upholds $2.00 support

XRP struggles to uphold support at $2.00 amid macro-driven volatility due to the escalation of the conflict between Israel and Iran. Despite strong fundamentals, including steady institutional interest and shrinking exchange reserves, the token remains below a key support-turned-resistance level at $2.09, provided by the 200-day Exponential Moving Average (EMA).

A sell signal sustained by the Moving Average Convergence Divergence (MACD) indicator since mid-May indicates bearish momentum. Traders often consider reducing exposure to XRP when the blue MACD line flips below the red signal line. The red histogram bars beneath the mean line (0.00) uphold a bearish bias, further increasing the potential for losses extending below $2.00.

XRP/USDT daily chart

The Relative Strength Index (RSI) indicates a potential reversal at 35, following a downtrend that began in mid-May. Recovery toward the midline WOULD signal an increase in bullish momentum.

Key areas of interest to traders remain the 200-day EMA resistance at $2.09, the seller congestion at $2.25 and $2.65, tested as resistance in May. On the other hand, price action below the $2.00 level could see XRP slide toward $1.90, tested on Sunday.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.