Hyperliquid (HYPE) Price Forecast: Mixed Signals Flash as Futures Hold Steady—What’s Next?

Hyperliquid's HYPE token is serving traders a classic crypto conundrum—diverging technical signals against stubbornly stable futures open interest. Bulls and bears are locked in a stalemate, leaving the market in limbo.

Technical Whiplash: The chart tells two stories

RSI flirts with overbought territory while MACD hints at weakening momentum. Meanwhile, perpetual swaps funding rates hover near neutral—no extreme greed or fear here. It's the kind of setup that has analysts reaching for their crystal balls (and possibly their antacids).

Futures Market Holds Its Breath

Open interest remains eerily calm despite the technical crosscurrents. Either traders are waiting for a clear breakout, or they've all taken a collective coffee break while the Fed decides inflation's next move. Classic crypto—where 'wait and see' counts as a strategy.

The Bottom Line: HYPE's stuck in purgatory until either the bulls or bears blink. Meanwhile, futures traders are collecting premiums like Wall Street collects bailouts—patiently and with zero apologies.

Hyperliquid flaunts robust derivatives market

If tensions escalate or Iran retaliates to US strikes on its nuclear facilities, Hyperliquid’s price may fall further, primarily driven by risk-off sentiment.

“Although crypto is decentralized, it remains vulnerable to global instability. In times like this, we often see traders turning to stablecoins as a way to preserve capital,” Andrejs Balans, a risk manager at YouHodler, said in a statement to FXStreet.

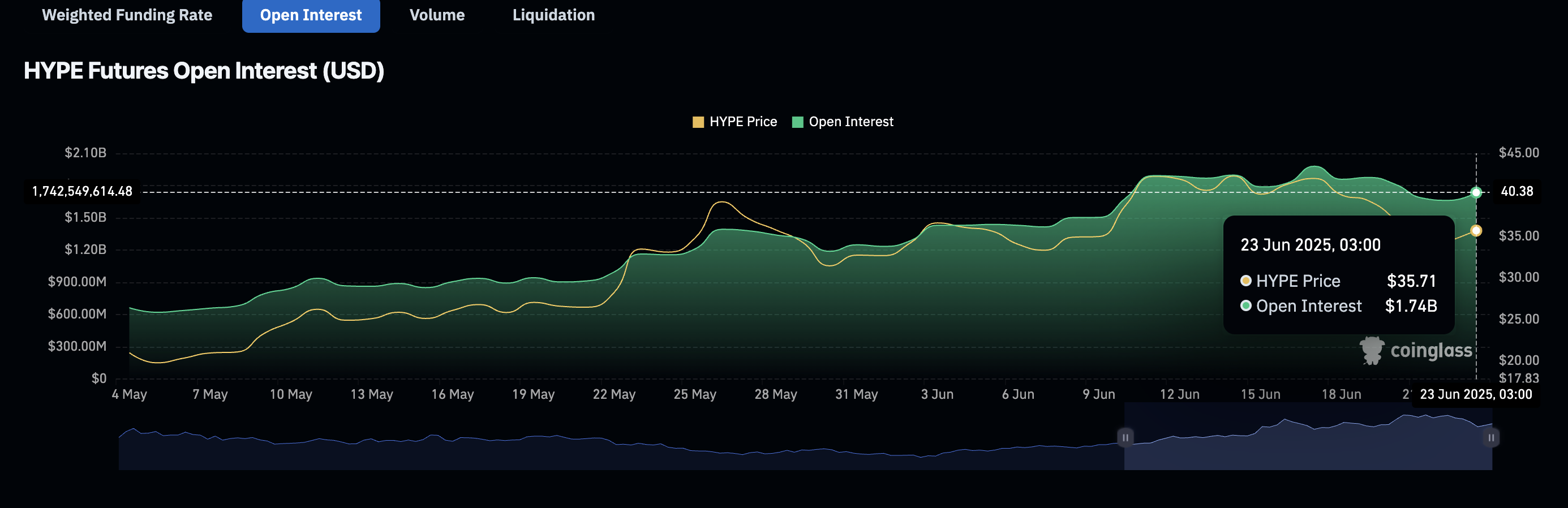

However, Hyperliquid’s derivatives market remains interestingly stable despite the sharp increase in volatility. CoinGlass sheds light on HYPE futures contracts Open Interest (OI), which steadied to $174 billion on Monday, indicating rising interest in the token.

Hyperliquid futures Open Interest | Source: CoinGlass

The increase in volume, as liquidations surge to $1.96 million over the past 24 hours, is a bullish indication of a potential short squeeze recovery as traders buy HYPE to cover their positions. Moreover, short position liquidations at $1.55 million significantly surpassed long positions at approximately $413,000 over the past 24 hours. A long-to-short ratio of 1.0606 implies that traders have a higher risk appetite and are betting on Hyperliquid’s recovery.

Hyperliquid derivatives data | Source| CoinGlass

Technical outlook: Hyperliquid recovery falters

Hyperliquid’s price recovery is in jeopardy after facing rejection below the resistance level at $37.00. Key indicators continue to uphold a bearish bias, including the Moving Average Convergence Divergence (MACD) sell signal, which was confirmed on June 17.

The downward trend of the MACD indicator as it approaches the zero line (0.00) reinforces the tight bearish grip, with the Relative Strength Index (RSI) sliding below the midline, indicating increasing sell-side pressure.

HYPE/USDT daily chart

The 50-day Exponential Moving Average (EMA) at $32.77 could trigger a reversal. Still, traders should pay attention to the previously tested support at $30.00. Beyond this level, the 100-day EMA at $28.34 comes into play, with accelerated losses targeting the next key support level at $23.39, tested in mid-May.

The possibility of an immediate trend reversal above $40.00 cannot be ignored, particularly with HYPE futures open interest remaining elevated at around $1.74 billion. Steady interest in the token could boost demand for HYPE, potentially overshadowing sell-side pressure and paving the way for a significant price increase.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.