AI Tokens Bounce Back: Story & Virtuals Protocol Recover After Iran Strike Sell-Off

Markets shuddered—then shrugged. AI-linked tokens Story and Virtuals Protocol claw back losses after geopolitical panic triggered a flash sell-off.

Here's why the rebound matters.

From Fear to Greed in 48 Hours

Traders dumped risk assets after US strikes on Iran—until they remembered algorithms don't care about Middle East tensions. AI token prices snapped back faster than a hedge fund's moral compass.

The Cynical Take

Another day, another 'crisis' proving crypto markets react first and ask questions never. At least the volatility keeps brokers in yachts.

Story leads AI sector recovery

Story’s price has reclaimed support at $3.00 after extending its decline in June by nearly 42% to $2.46. The reversal, exceeding 10% on Monday, marks day three of a steady bullish streak, underpinned by the fresh inflow of money into IP.

The Money FLOW Index (MFI) on the daily chart backs the remarkable technical breakout, signaling strong trader conviction. As the MFI rises from oversold territory into the neutral region, the path of least resistance could stay firmly upward, supported by growing demand for the token.

The Relative Strength Index (RSI) is extending the pullback from the oversold region, with a potential of breaking above the 50 midline as bullish momentum steadies.

IP/USDT daily chart

A daily close above the recently reclaimed support level at $3.00 could provide stronger signals of a technical breakout continuing this week. Key milestones likely to shape Story’s recovery include the 50-day Exponential Moving Average (EMA) resistance at $3.82, marked in red on the dayly chart above, the descending trendline resistance and the 100-day EMA at around $4.13. On the downside, support at $2.46 remains critical for the resumption of the uptrend, while a break below the same level could bring IP’s all-time lows around $1.00 into sight.

Virtuals Protocol pares losses, aiming for $2.00

Virtuals Protocol’s price holds above support at $1.25, trading at around $1.37 at the time of writing. Interest in the AI token is on track following the Israel-Iran conflict-triggered crash.

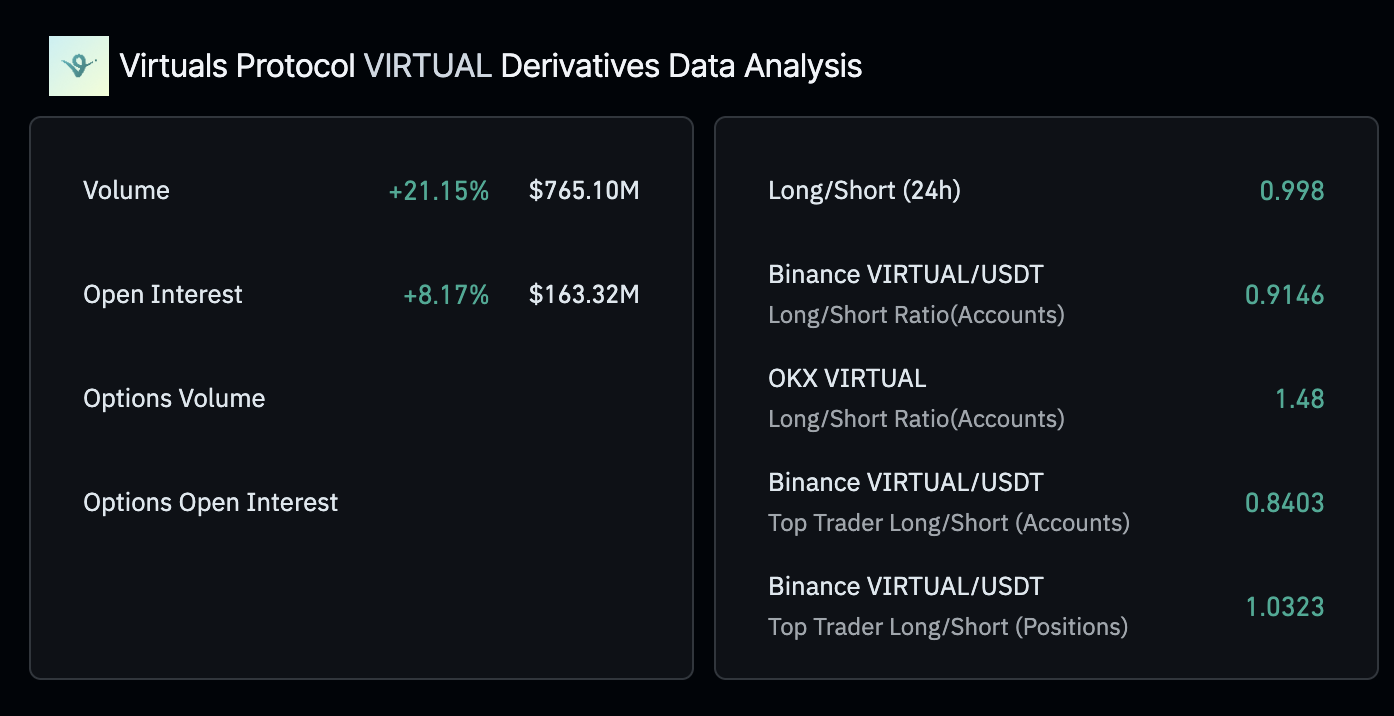

CoinGlass shows over 8% increase in the derivatives market Open Interest (OI) to $163 million in the last 24 hours. Trading volume surged in tandem, reaching $765 million, indicating growing interest among traders and expanding market activity.

Virtuals Protocol derivatives data | Source| CoinGlass

Despite marginal intraday gains, traders should pay attention to the Moving Average Convergence Divergence (MACD) indicator, with a sell signal remaining in effect since June 13, when the blue MACD line crossed below the red signal line. Traders often consider reducing exposure to VIRTUAL on sighting this signal.

VIRTUAL/USDT 8-hour chart

However, a buy signal could follow the sell-off, characterized by the blue MACD line crossing above the red signal line. The RSI, NEAR oversold territory, could also support the uptrend if it sustains a recovery toward the midline.

Still, downside risks remain, with support at $1.25, as well as key levels at $1.00 and $0.80, which were tested as support in late April, likely to come into play to absorb potential sell-side pressure.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.