Ethereum Price Forecast 2025: Can ETH Hit $6,400 Despite Current Market Turbulence?

- Ethereum's Technical Crossroads: Bearish Signals vs. Bullish Potential

- Institutional Moves Tell a Different Story Than Price Action

- Developer Boom Mirrors Pre-Bull Market Conditions

- Short-Term Pain, Long-Term Gain?

- FAQ: Ethereum Price Outlook 2025

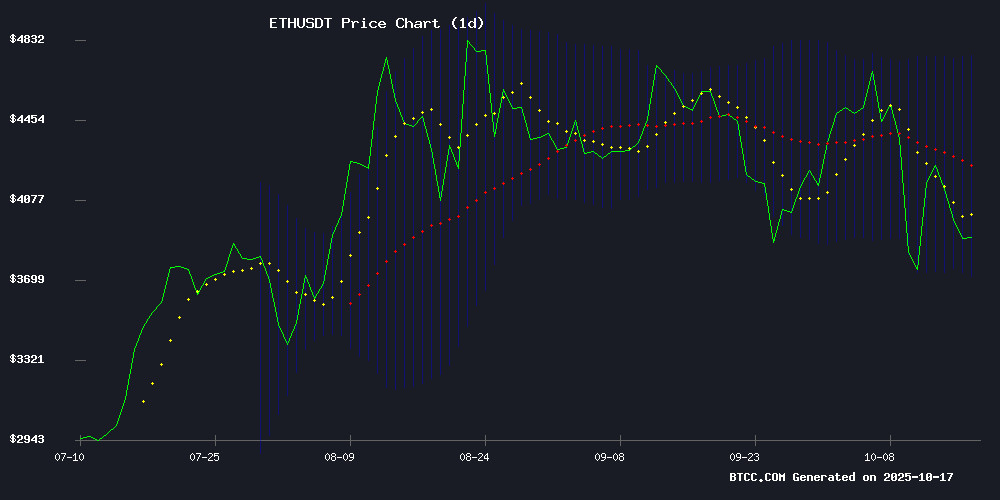

Ethereum (ETH) finds itself at a critical juncture in October 2025, trading at $3,840 amid significant market volatility. While short-term indicators show bearish pressure, multiple technical and fundamental factors suggest potential for a major rally toward $6,400. This analysis examines the conflicting signals from institutional accumulation, developer activity, and technical patterns that could determine ETH's trajectory through year-end.

Ethereum's Technical Crossroads: Bearish Signals vs. Bullish Potential

As of October 17, 2025, ETH sits below its 20-day moving average ($4,234), typically a bearish signal. However, the MACD histogram at +98.52 shows building momentum, while Bollinger Bands place ETH NEAR support at $3,702. "This is classic consolidation before a potential breakout," notes the BTCC research team. "The $3,500-$3,800 zone has historically served as a springboard for ETH rallies."

Source: BTCC Market Data

Institutional Moves Tell a Different Story Than Price Action

While retail traders panic about the sub-$4,000 price, institutions are accumulating aggressively. BitMex's $417 million ETH purchase (104,336 tokens) on October 15 stands out, executed through regulated custodians Kraken and BitGo. This follows VanEck's staked ETH ETF filing with the SEC - the third such institutional product proposed this quarter.

Developer Boom Mirrors Pre-Bull Market Conditions

Ethereum's ecosystem added 16,181 new developers year-to-date, bringing total active builders to 31,869. For context, the 2019-2020 developer surge preceded ETH's climb from $200 to $4,000. Current innovations like Pico Prism for asset tokenization ($12 billion market) suggest similar potential. "Developer activity is our most reliable leading indicator," shares a pseudonymous analyst at TradingView.

Short-Term Pain, Long-Term Gain?

The current correction (13% weekly decline) has pushed ETH toward $3,500 Fibonacci support. While RSI readings (37 daily, 33 4-hour) suggest more downside possible, Binance funding rates remain positive at 0.01-0.03% - far from the 0.1-0.2% euphoria levels of 2021. This divergence often precedes rallies.

| Price Level | Significance | Probability |

|---|---|---|

| $3,500 | Critical Support | High |

| $4,234 | 20-day MA Resistance | Medium |

| $6,400 | Bullish Target | Low-Medium |

FAQ: Ethereum Price Outlook 2025

What's driving Ethereum's current price volatility?

The October 2025 volatility stems from conflicting forces: institutional accumulation (bullish) vs. macroeconomic uncertainty and profit-taking after ETH's 80% YTD gain. Technical factors like the $4,200 resistance rejection amplified the swings.

How reliable is the $6,400 price target?

While plausible, the $6,400 target (66% above current price) requires ETH to break key resistances at $4,234 and $4,766 first. The probability decreases to

Should investors be concerned about North Korean hacking threats?

The EtherHiding tactic poses risks primarily to poorly secured wallets and exchanges. Major platforms like BTCC implement robust security measures, making institutional-grade custody relatively safe.

How does Ethereum's developer growth compare to competitors?

ETH's 16,181 new developers in 2025 dwarfs Solana's 4,200 and Cardano's 3,100. The network effect creates a virtuous cycle - more developers build more apps, attracting more users.

What's the significance of VanEck's staked ETH ETF?

The filing signals institutional demand for yield-bearing crypto products. If approved, it could unlock billions in traditional finance capital, similar to bitcoin ETFs' impact in 2024.