XRP Primed for Detonation? Analyst Warns Market Setup Looks ’Explosive’

XRP's technical formation screams breakout potential as market analysts spot converging patterns that could trigger massive price movement.

The Perfect Storm

Multiple technical indicators align simultaneously—descending wedge patterns, bullish divergences, and critical support levels holding firm against selling pressure. Market watchers describe the setup as a coiled spring waiting for the right catalyst.

Liquidity Pools Converge

Key resistance levels cluster around psychological price points, creating potential energy that could unleash rapid upward momentum. Trading volume patterns suggest institutional accumulation beneath the surface while retail traders remain largely unaware.

Regulatory Clarity Fuel

Recent legal developments remove uncertainty that previously capped XRP's upside potential. The resolution of longstanding regulatory questions provides fundamental justification for the technical breakout thesis.

Market participants brace for volatility as the setup reaches critical mass—because nothing says 'stable financial innovation' like digital assets that trade like geological pressure systems about to erupt. Timing the explosion remains the only question.

Technical Setup And Key Levels

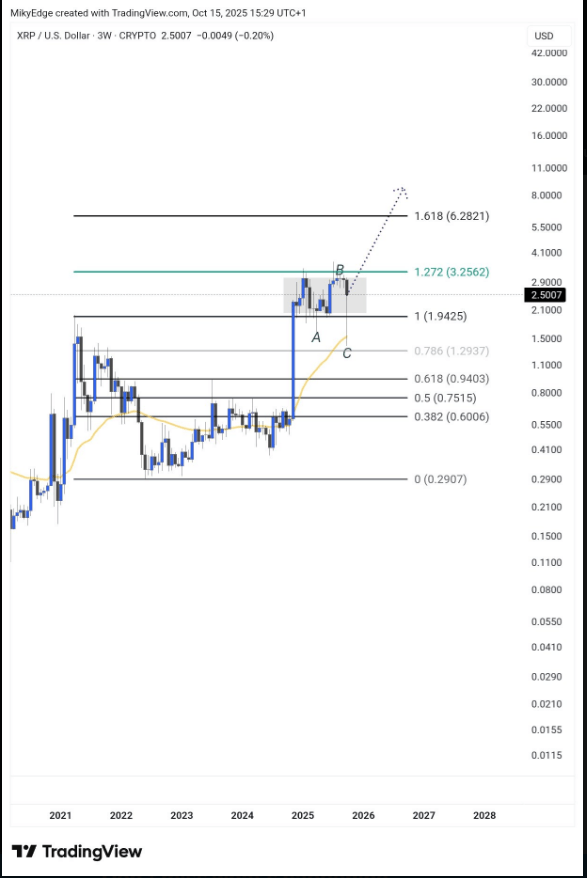

Mikybull pointed to an ABC correction pattern that looks close to finishing. He showed XRP hovering around $2.50 and sitting just above a long-term moving average, a zone that has acted as support in prior cycles.

On his chart the 1.00 Fibonacci level is pegged to $1.94, while the 1.272 extension comes in at $3.25. The next major upside target, the 1.618 extension, is marked at about $6.28. A MOVE past $3.25, according to this view, could clear the way toward $6.28 and possibly beyond.

$XRP

Hate it or like it, this setup is going to be explosive during breakout. pic.twitter.com/pgGbC0awzX

— Mikybull![]() Crypto (@MikybullCrypto) October 15, 2025

Crypto (@MikybullCrypto) October 15, 2025

‘Explosive’ Setup

Based on reports, the 1.272 level at $3.25 is the first real line of resistance to overcome. If XRP breaks that, momentum traders may push price toward the 1.618 level at $6.28.

The analyst described the setup as “explosive,” pointing to how tightly price has been squeezed inside a narrow range. Past patterns of similar squeeze-and-break setups have produced quick runs, and that is the parallel he drew on the chart.

He also flagged the idea that a journey into double digits could follow a decisive breakout, though that WOULD require several big moves to align.

Bitcoin’s recent activity was used as context for the altcoin case. Reports note Bitcoin reached $125,725 on Oct. 5 after bouncing from a low near $108,650 on Sept. 25. Between Sept. 25 and Oct. 5 there were seven green days out of nine.

A market commentator, writing under the name Nathaniel Rothschild, suggested that if that $125,725 mark was a true peak for Bitcoin, then some altcoins — including XRP — could test their own highs within about three weeks. That would place possible new highs in the week starting Oct. 26, according to his projection.

If this was the new all-time high for Bitcoin, XRP and other altcoins will have their own in three weeks.

— Nathaniel C. J. Rothschild (@NCJRothschild) October 5, 2025

Risks, Sentiment, And TimingMarket sentiment toward XRP has been weak recently, with the token down about 14% over the last seven days. That bruise has left some holders cautious. The technical case rests largely on pattern recognition and Fibonacci math rather than fresh on-chain data or new adoption headlines.

Price action and trading volume will be the real tell. Projections tied to Bitcoin’s path are time-sensitive and could miss if broader crypto flows change.

In short, the outlook offered by Mikybull is optimistic and clear in its targets: $3.25 then $6.28, with higher levels possible after that. Traders will likely watch whether XRP can hold support above the long-term average and whether a break above $3.25 is confirmed by strong buying.

Featured image from Gemini, chart from TradingView