XRP Outpaces Giants: How Ripple Just Surpassed Uber, Boeing, and Goldman’s Firepower

Ripple's XRP is flexing its market muscle—towering over legacy titans like Uber, Boeing, and even Goldman Sachs' most aggressive plays. Here's why crypto's dark horse is leaving blue chips in the dust.

The new heavyweight

Forget market cap comparisons to tech unicorns or aerospace behemoths. XRP's valuation now eclipses them all, fueled by institutional adoption and a payments network that actually works (unlike some *cough* blockchain 'solutions').

Wall Street's wake-up call

Goldman's trading desks might still be obsessed with guns and oil, but smart money's pivoting to digital assets that settle cross-border payments in seconds—not days. The irony? Banks are now lobbying for the tech they spent years dismissing.

One rule remains: in finance, hypocrisy always moons.

Ripple’s Market Expansion

We talked a lot about XRP’s price moves over the past week, but just to summarize in a few sentences, the asset traded within a tight range between $2.2 and $2.3 for a while before a sudden and decisive breakout pushed it north hard. Within just over a week, it skyrocketed to over $3.6 (earlier today) to mark a new all-time high before it corrected slightly to $3.5 as of press time.

Given its total circulating supply of over 59 billion tokens, this places XRP’s market capitalization at $207 billion. Aside from making it the third-largest cryptocurrency by that metric, this spectacular growth has solidified XRP’s place among the 100 biggest global assets as well.

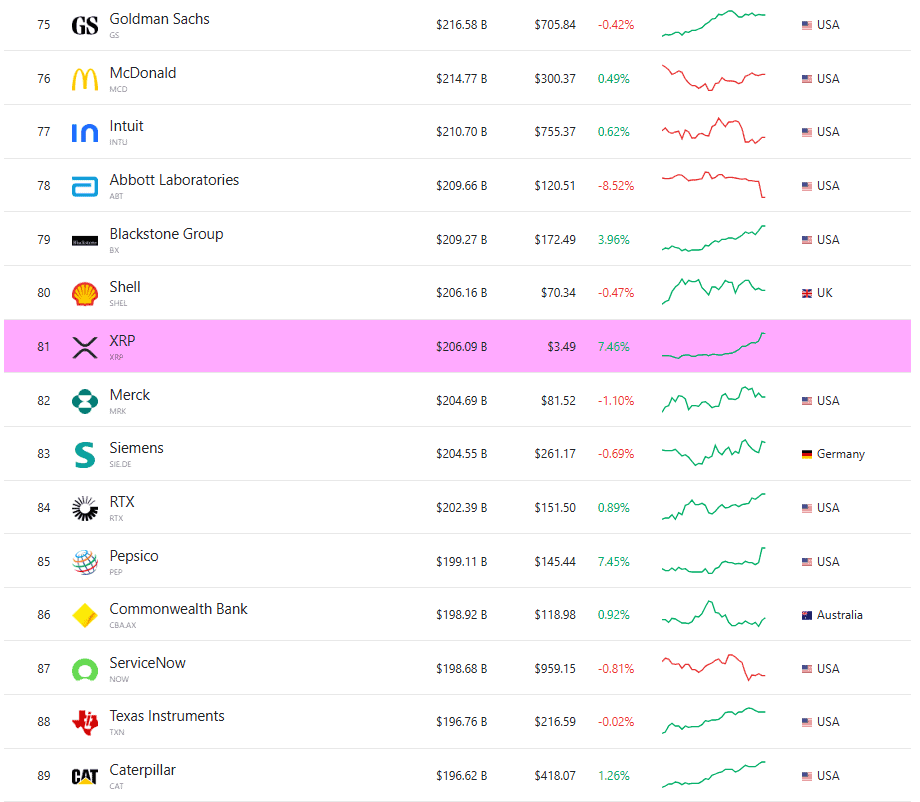

Data from CompaniesMarketCap reveals that Ripple is now in the 81st position, above well-known entities like Boeing, Xiaomi, Uber, AT&T, Siemens, and Commonwealth Bank.

Just ahead of Ripple on its way up are other giants like Shell, McDonald’s, and the banking behemoth Goldman Sachs. Image being told a few years ago (or even in 2024 when XRP struggled at $0.6 for months) that Ripple can and will give Goldman a run for its money.

What About ETH, BTC?

As mentioned above, the cryptocurrency industry has three representatives in the top 100 global assets. Well ahead of Ripple is Ethereum, which is currently situated at 25th place with a market cap of $435 billion after its recent ascent to a price tag of $3,600.

ETH is north of Procter and Gamble, Johnson & Johnson, and Costco, while the first few entities above it are Exxon Mobile, Mastercard, and Netflix.

Bitcoin has been a top 10 rep for a while now. Its most recent price surge to a new all-time high of over $123,000 made it the fifth-largest asset briefly, by surpassing silver, Alphabet, and Amazon. The Jeff Bezos-founded behemoth, though, retrieved the fifth place, and Bitcoin is now sixth with a market cap of $2.373 trillion.