Bitcoin Plunges to $106K: This Week’s Biggest Crypto Losers Exposed - Weekend Market Alert

Market carnage hits digital assets as Bitcoin's slide triggers widespread portfolio bloodbath

Top Assets Taking the Biggest Hits

The crypto market's weekend reckoning arrived with brutal efficiency—Bitcoin's descent to $106,000 wiped out billions in market cap, leaving altcoins bleeding in its wake. Meme coins and over-leveraged DeFi plays got absolutely hammered, proving once again that when Bitcoin sneezes, the entire crypto space catches pneumonia.

Portfolio Wipeout Patterns Emerge

High-flying tokens that rode last month's rally got grounded hard—some dropping 30-50% in mere hours. The usual suspects led the decline: overhyped governance tokens, experimental layer-2 solutions, and anything with 'AI' in its name got particularly crushed. Meanwhile, traditional finance bros are probably sipping martinis and muttering 'told you so' about volatility.

Survival Strategies in the Red Zone

Smart money rotated into stablecoins faster than you can say 'risk-off'—proving that sometimes the best trade is no trade at all. The weekend selloff exposed which projects had actual fundamentals versus those running on pure speculation and hopium. Remember: in crypto, what goes up must come down—usually at the most inconvenient time possible.

The takeaway? Even at $106,000, Bitcoin remains the tide that lifts—or sinks—all boats. This weekend's massacre serves as another expensive reminder that in crypto, nobody rings a bell at the top.

BTC Back to $106K

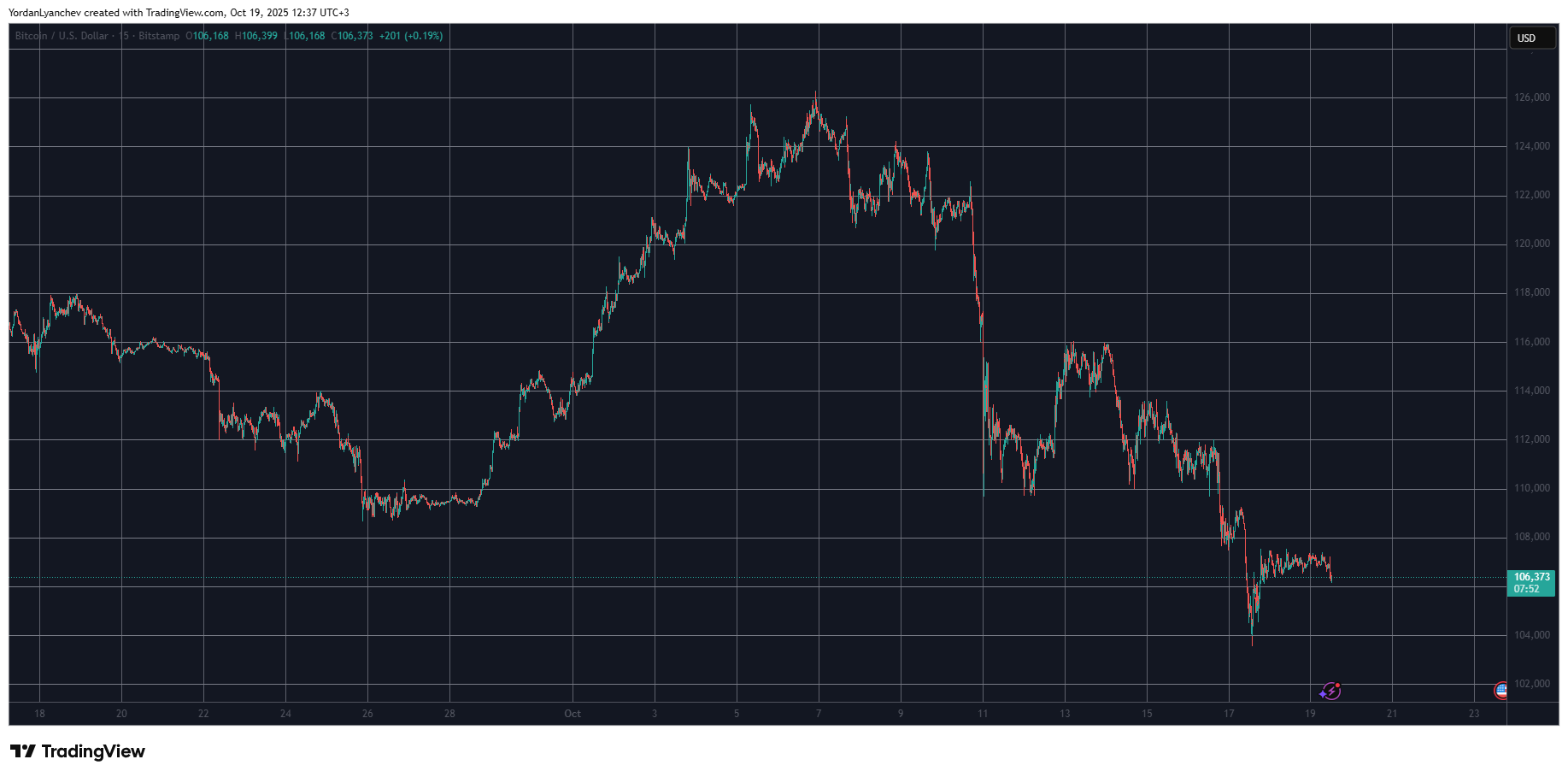

It has been a hell of a ride for the primary cryptocurrency that began on October 10 with a massive price plunge from over $121,000 to $110,000 on some exchanges and to $101,000 on others. The initial propeller was the threats by US President Trump against China, but the actual pain came as the overly leveraged market came undone.

Nevertheless, BTC bounced off rather quickly and recovered some ground during the previous weekend. It kept climbing as the business week progressed and topped $116,000 on Tuesday. However, it was stopped there and pushed south to $110,000.

This resistance held at first but was lost on Thursday when the bears drove it south to $108,000. Friday saw another leg down that this time resulted in a price dump to under $104,000.

The cryptocurrency finally reacted with a relief rally when TRUMP said the tariffs on China won’t stand. BTC pumped to $106,000 and even $107,000 yesterday, but was stopped and pushed south to the former as of now. Its market cap is down to $2.120 trillion on CG, while its dominance over the alts is just over 57%.

Ups and Downs

Most altcoins have remained sideways over the past day, but the weekly charts show a different picture. BNB is among the poorest performers, having lost 8% of value and trading below $1,100. BCH is down by 12%, while LINK, XLM, AVAX, HBAR, ADA, and XRP are also slightly in the red.

In contrast, ETH, SOL, TRX, and Doge are with minor weekly gains. More impressive increases came from the likes of MNT, WLFI, TAO, and ENA.

The total crypto market cap is down to $3.7 trillion, which means it has erased roughly $500 billion in just over a week.