Ethereum Price Analysis: Bullish Setup Hangs by a Thread - This Key Level Determines Everything

Ethereum's bullish momentum faces its ultimate test as critical support levels come under pressure. The entire upward structure could unravel if ETH fails to hold this crucial price zone.

The Technical Breakdown

Charts reveal a make-or-break scenario unfolding. Ethereum's recent consolidation pattern suggests either a powerful breakout or devastating breakdown lies ahead. Technical indicators flash warning signals as buying pressure weakens at current levels.

Market Psychology at Play

Traders hold their breath watching this key support level. A breach below this threshold could trigger cascading liquidations and panic selling. Meanwhile, institutional players circle like sharks - ready to either bail out the market or feast on the remains.

The Institutional Wildcard

Wall Street's crypto desks monitor the situation with detached amusement. They've seen this movie before - retail traders emotional, algorithms indifferent. Another day, another opportunity to profit from market inefficiencies while pretending to care about 'decentralized finance.'

Ethereum stands at the precipice. Either it validates the bullish thesis with a decisive bounce, or joins the graveyard of broken technical patterns. The market's about to show its hand - and someone's going to pay for the cards.

Technical Analysis

By Shayan

The Daily Chart

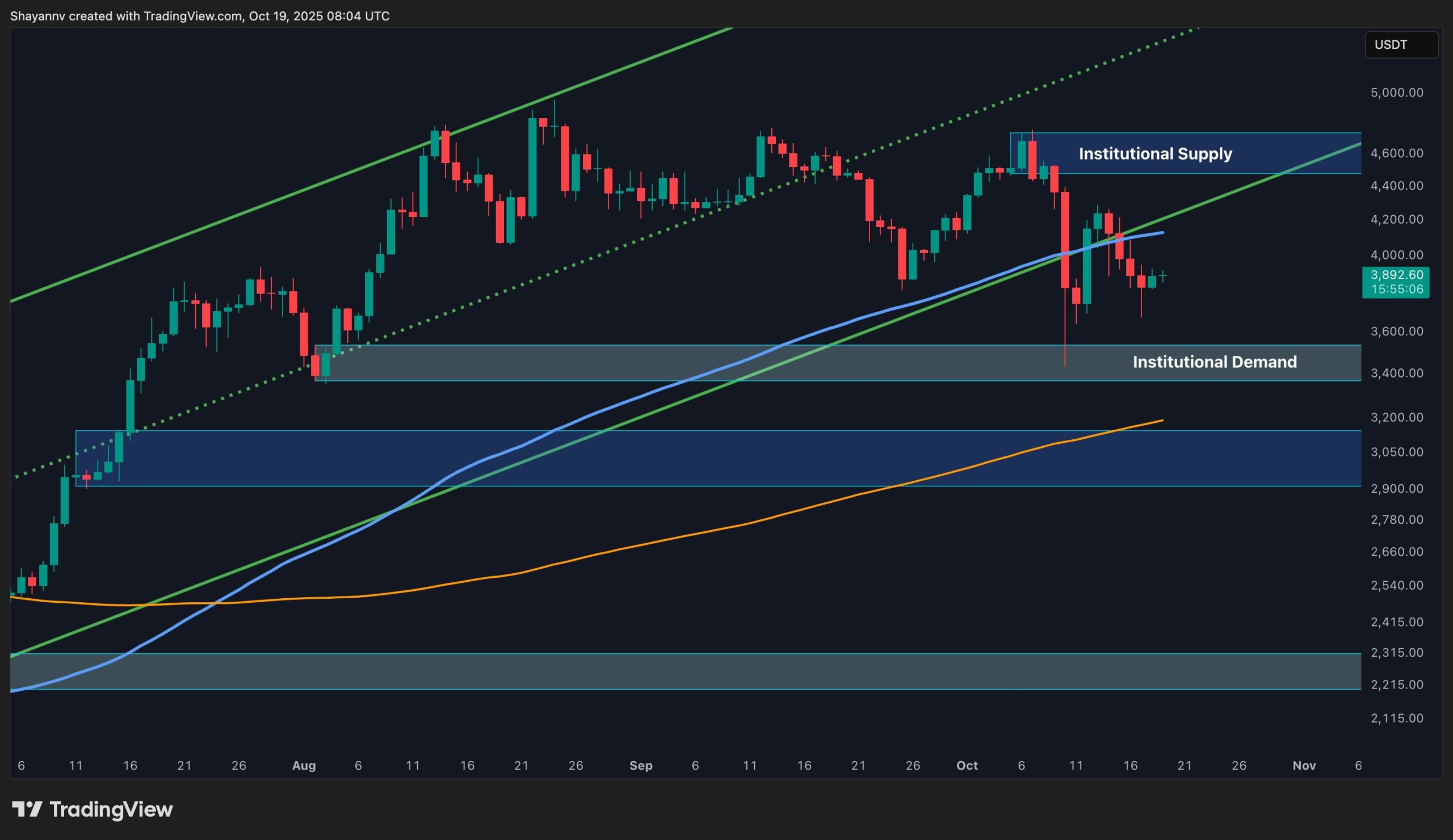

On the daily timeframe, ethereum continues to trade between two major zones: the institutional supply area around $4.6K–$4.7K and the institutional demand zone near $3.4K–$3.5K. After losing the channel’s lower trendline support earlier this month, the asset has now retested it from below, confirming it as resistance.

The structure suggests that Ethereum is currently in a mid-range equilibrium phase, where neither buyers nor sellers have clear control. The 100-day MA, which previously provided dynamic support, has now flipped into a resistance zone near $4.1K–$4.2K, while the 200-day MA near $3.1K remains the last line of structural defence.

As long as the price remains above the $3.4K institutional demand, Ethereum’s macro trend stays intact. However, failure to maintain this level could expose the market to a deeper retracement toward the $3.0K–$2.9K liquidity cluster, where the 200-day MA and prior accumulation base converge.

The 4-Hour Chart

The 4-hour structure reveals a descending wedge pattern, forming after a sharp rejection from the $4.2K breakdown zone. The repeated rejections at this confluence of descending and ascending trendlines reflect the ongoing tug-of-war between short-term buyers and sellers.

At the same time, the lower boundary of the wedge aligns closely with the broader institutional demand zone, suggesting that Ethereum is approaching a point of compression where volatility expansion is imminent.

If the price breaks above the descending trendline and closes above the $4K–$4.1K resistance, it could confirm a reversal, targeting $4.4K–$4.6K. Conversely, a breakdown below $3.7K WOULD likely trigger a deeper decline toward $3.4K, the same zone that underpins the broader bullish structure. Until confirmation occurs, Ethereum remains range-bound, oscillating between structural supply and demand.

Sentiment Analysis

By Shayan

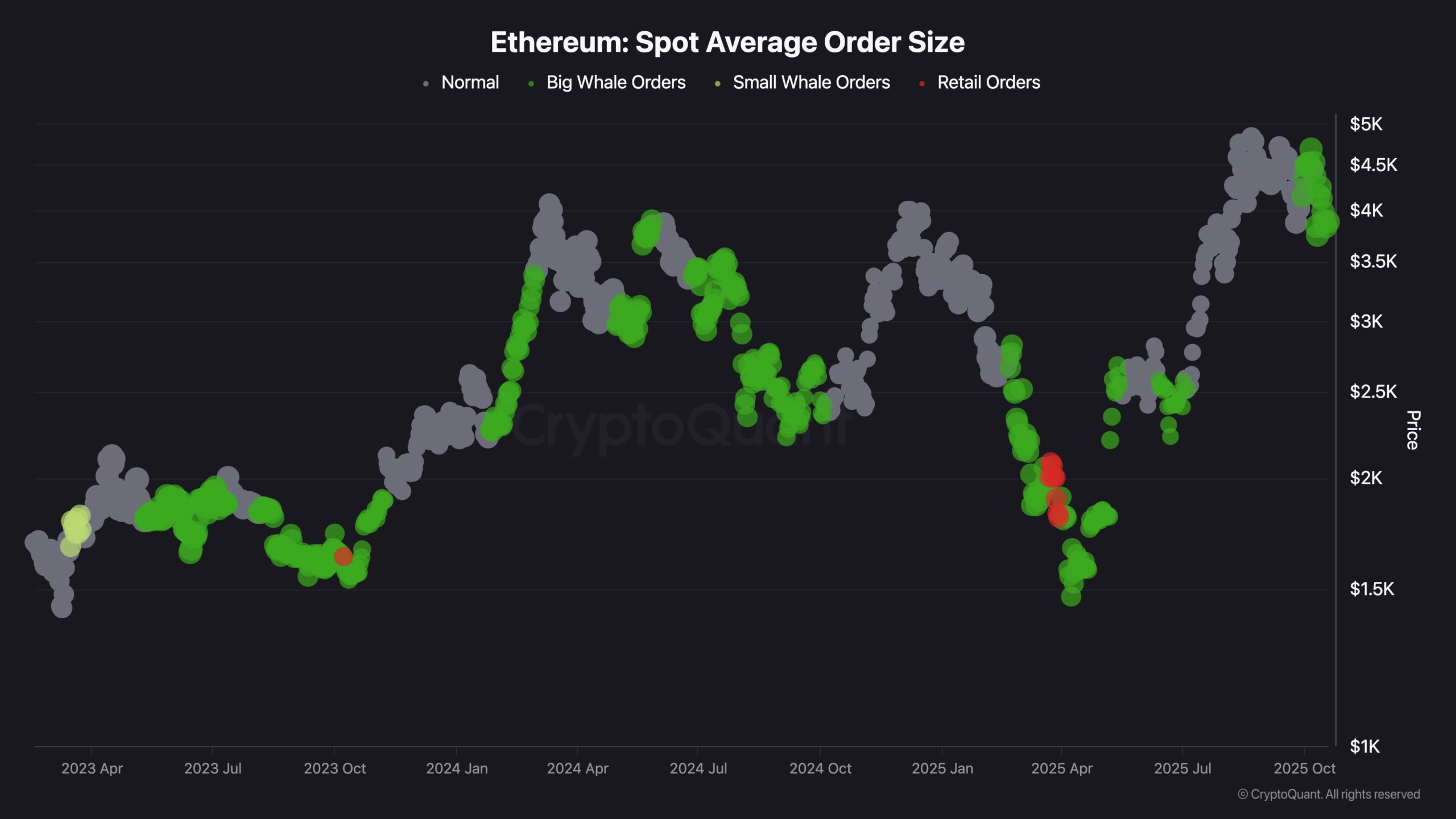

Recent on-chain data points to a renewed tightening in Ethereum’s market structure. Since mid-October, two significant dynamics have emerged simultaneously: exchange reserves have declined sharply, while average spot order sizes have increasingly been dominated by large whale transactions.

Following October 15, ETH’s price has remained relatively stable just below the $4K level, but the underlying market composition has shifted meaningfully. Whale-sized spot orders (green clusters) have expanded, signalling renewed activity from deep-pocketed participants, while the amount of Ethereum held on exchanges, measured in USD terms, has dropped to one of the lowest levels of 2025.

This combination, shrinking exchange reserves and growing whale spot activity, has historically indicated strategic accumulation by institutional or high-net-worth investors. With liquidity thinning across exchanges, even moderate inflows of new demand could produce amplified price reactions, as reduced sell-side availability magnifies volatility to the upside.

Ethereum now appears to be entering another supply squeeze phase, echoing the quiet but powerful accumulation period of late 2020. During that cycle, consistent spot buying and exchange outflows preceded one of ETH’s strongest multi-month rallies. If macro conditions stabilise and ETF-related inflows return, the current structural tightening could serve as the foundation for Ethereum’s next major upward cycle.