$1 Billion Liquidation Tsunami Engulfs Crypto Market as BTC, ETH, XRP Plunge

Crypto markets just got hit with a billion-dollar reality check.

The Domino Effect Begins

Leveraged positions evaporated faster than a meme coin's utility as Bitcoin led the charge downward. Ethereum couldn't escape the gravitational pull, while XRP holders watched their paper gains turn into actual losses.

Margin Calls Echo Across Exchanges

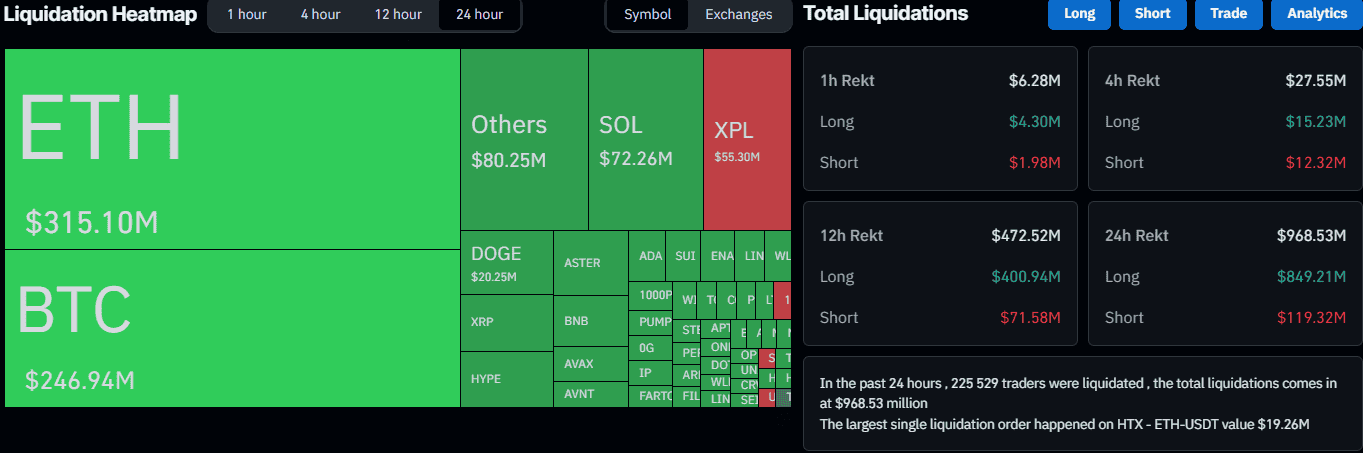

Traders faced the music as stop-losses triggered cascading liquidations. The $1 billion bloodbath swept through derivatives markets—reminding everyone that crypto's volatility cuts both ways. Even the most bullish strategies got tested when support levels crumbled like a decentralized promise.

Wall Street's Favorite New Casino

Traditional finance types are probably sipping champagne while watching crypto traders learn the oldest lesson in markets: leverage works until it doesn't. The 'number go up' mentality met its match in a classic risk-off move that bypassed sentiment and went straight for wallets.

This isn't a crash—it's a recalibration. And for those still standing? A chance to buy the fear.

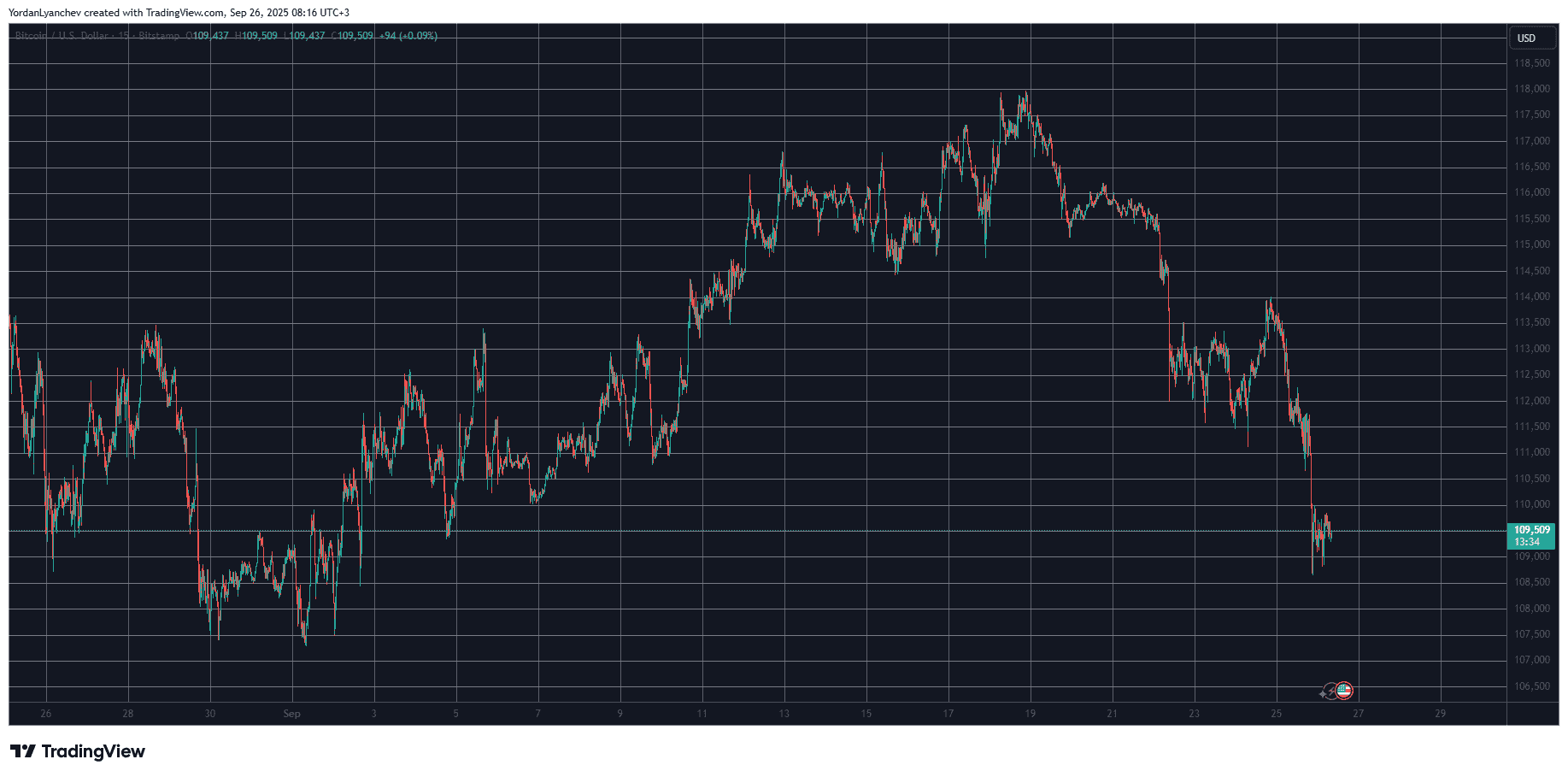

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

It was less than a week ago when the primary cryptocurrency stood tall at $118,000 after the US Federal Reserve cut the interest rates for the first time this year. However, the asset failed to maintain its run and started to lose value rapidly.

Harrowing trading days were Monday (September 22) and Thursday (September 25). At first, BTC dumped from $115,500 to $112,000. It managed to recover some ground mid-week, but the bears initiated another leg down yesterday, which drove Bitcoin further south to its lowest position since the start of the month at $108,600 (on Bitstamp).

Although it has recovered around a grand since then, BTC is still below $110,000, which is a crucial support level, according to Ali Martinez. The next one actually managed to hold the freefalls, which is set at $108,530.

As usual, many industry observers and commentators began speculating on the state of the correction. Some, such as Peter Schiff, called it the start of a bear market.

Crypto analysts remain more optimistic. Captain Fabrik, for instance, referred to the current retracement as a ‘healthy’ one and predicted a surge to $140,000 as long as BTC can reclaim the $113,000 resistance.

Nevertheless, almost all altcoins followed bitcoin on the way south, posting massive losses. ethereum is among the poorest performers as it lost the $4,000 support and slumped beneath $3,900 yesterday. XRP is deep in the red as well, dumping by 10% weekly and struggling to remain close to $2.80.

This enhanced volatility has harmed over-leveraged traders, as the total value of wrecked positions has shot up to almost $1 billion on a daily scale. More than 225,000 such market participants have been liquidated daily.