Q4 Crypto Watchlist: Bitcoin’s Seasonal Surge, XRP/BTC Dynamics, Dollar Pressure & Nvidia’s Next Move

Markets brace for crypto's most volatile quarter as historical patterns collide with macro pressures.

Bitcoin's Fourth Quarter Playbook

Historical data screams bullish—Q4 delivers Bitcoin's strongest seasonal performance. Institutional accumulation patterns suggest whales are positioning for the traditional year-end rally.

XRP/BTC: The Altcoin Bellwether

This cross pair flashes early signals for altcoin season. Watch for breakouts above key resistance levels—they could trigger capital rotation from Bitcoin dominance.

Dollar Index Dictates Liquidity Flow

A weakening DXY historically fuels crypto rallies. Current Fed policy creates perfect storm conditions for digital asset inflows as traditional finance hedges against currency devaluation.

Nvidia's AI Boom Fuels Crypto Infrastructure

The chipmaker's earnings report becomes unexpected crypto indicator. Surging GPU demand signals strengthening blockchain compute networks—and reminds us that sometimes the best crypto plays aren't even cryptocurrencies.

Q4 sets the stage for crypto's next major move. While traditional finance debates rate cuts, digital assets quietly build momentum for what could be another paradigm-shifting quarter—because nothing says 'financial revolution' like watching hedge funds chase performance while retail actually understands the technology.

Bullish seasonality

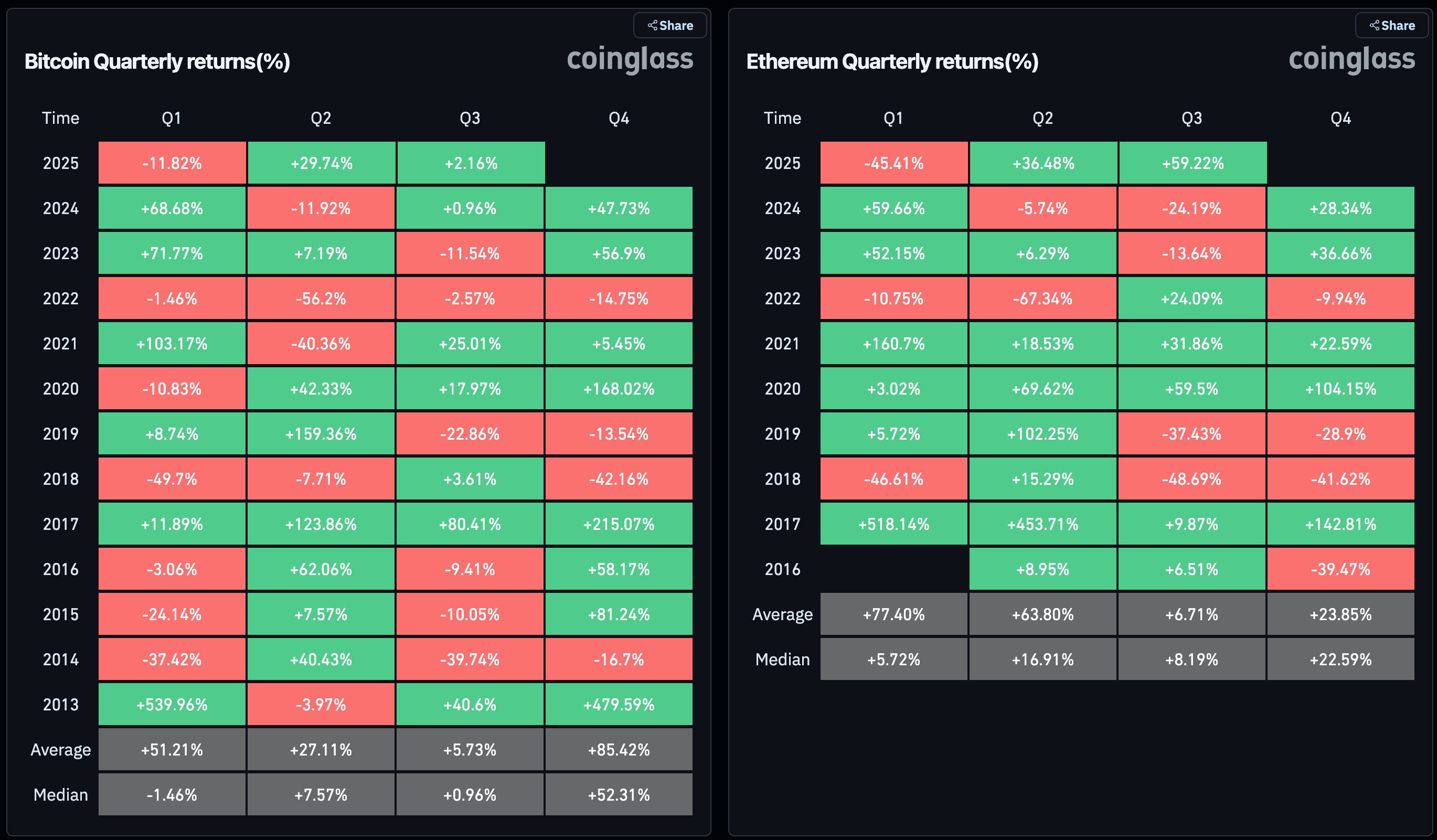

Seasonal trends suggest a bullish Q4 outlook for both Bitcoin (BTC) and ether (ETH), the top two cryptocurrencies by market capitalization.

Since 2013, bitcoin (BTC) has delivered an average return of 85% in the final quarter, according to data from Coinglass, making Q4 historically the strongest period for bulls.

November stands out as the most bullish month, with an average gain of 46%, followed by October, which typically sees a 21% increase.

Ether (ETH) also tends to perform well in the last three months of the year, although its strongest historical returns have been in the first quarter since inception.

BTC's 50-week SMA support

Bitcoin's price has dropped by 5% this week, consistent with the bearish technical signals and looks set to extend losses to late August lows NEAR $107,300. If bulls fail to defend that, the focus will shift to the 200-day simple moving average at $104,200.

The ongoing price decline, combined with bitcoin's historical pattern of peaking approximately 16 to 18 months after a halving event, may scare bulls.

However, such concerns may be premature as long as prices remain above the 50-week simple moving average (SMA). This moving average has consistently acted as a support level, marking the end of corrective price pullbacks during the current bull run that began in early 2023.

Traders, therefore, should closely watch the 50-week SMA, which is currently positioned around $98,900, as a key level for broader market direction.

XRP/BTC compression

XRP, often called the "U.S. government coin" by firms like Arca, has surged 32% this year. However, despite this strong rally, the payments-focused cryptocurrency remains confined within a prolonged sideways trading range against Bitcoin (XRP/BTC), showing limited relative strength.

The XRP/BTC pair has been confined within a narrow trading range since early 2021, resulting in over four years of low-volatility compression.

Recent price action near the upper boundary of this channel suggests that bulls are gradually gaining control. A breakout from such a prolonged consolidation could trigger a powerful rally in XRP relative to BTC, as the accumulated energy from this squeeze is released.

Now, let’s turn to charts that call for caution.

Breakout in Defiance Daily Target 2x Short MSTR ETF (SMST)

The Leveraged anti-Strategy ETF (SMST), which seeks to deliver daily investment results that are -200%, or minus 2x, the daily percentage change in bitcoin-holder Strategy's (MSTR) share price, is flashing bullish signals.

The ETF’s price climbed to a five-month high of $35.65, forming what appears to be an inverse head-and-shoulders pattern, characterized by a prominent trough (the head) flanked by two smaller, roughly equal troughs (the shoulders).

This pattern often signals a potential bullish reversal, suggesting the ETF may be gearing up for a significant upward move.

In other words, it's flashing a bearish signal for both BTC and Strategy, which is the largest publicly listed BTC holder with a coin stash of 639,835 BTC.

Dollar Index's double bottom

Last week, I discussed the dollar's post-Fed rate cut resilience as a potential headwind for risk assets, including cryptocurrencies.

The dollar index has since gained ground, establishing a double bottom at around 96.30. It's a sign that bulls have successfully established the path of least resistance on the higher side.

A continued move beyond 100.26, the high of the interim recovery between the twin bottoms around 96.30, WOULD confirm the so-called double bottom breakout, opening the door for a move to 104.00.

Watch out for the pattern failure below 96.00, as that could lead to increased risk-taking in financial markets.

NVDA topping?

Nvidia (NVDA), the world's largest listed company by market value, and a bellwether for risk assets, continues to flirt with the upper end of the broadening channel identified by June 2024 and November 2024 highs and lows hit in August 2024 and April 2025.

The rally has stalled at the upper trendline since late July in a sign of bullish exhaustion. Should it decline from here, it could signal the onset of a risk-off period in global markets, including cryptocurrencies.