Crypto Market Pulse September 26: ETH, XRP, ADA, BNB, and HYPE Face Critical Juncture

Digital assets hit inflection point as traders brace for volatility surge.

Technical Breakdown

Ethereum tests key support level while altcoins show divergent patterns. Resistance zones become make-or-break territory for short-term momentum.

Market Psychology

Fear and greed indicators flash conflicting signals—institutional money waits on sidelines as retail traders chase momentum plays. Another day where traditional finance pundits scratch their heads about 'digital tulips' while missing the real revolution.

Closing Bell

Next 24 hours could determine October trajectory. Watch for breakout attempts or breakdown scenarios across major pairs.

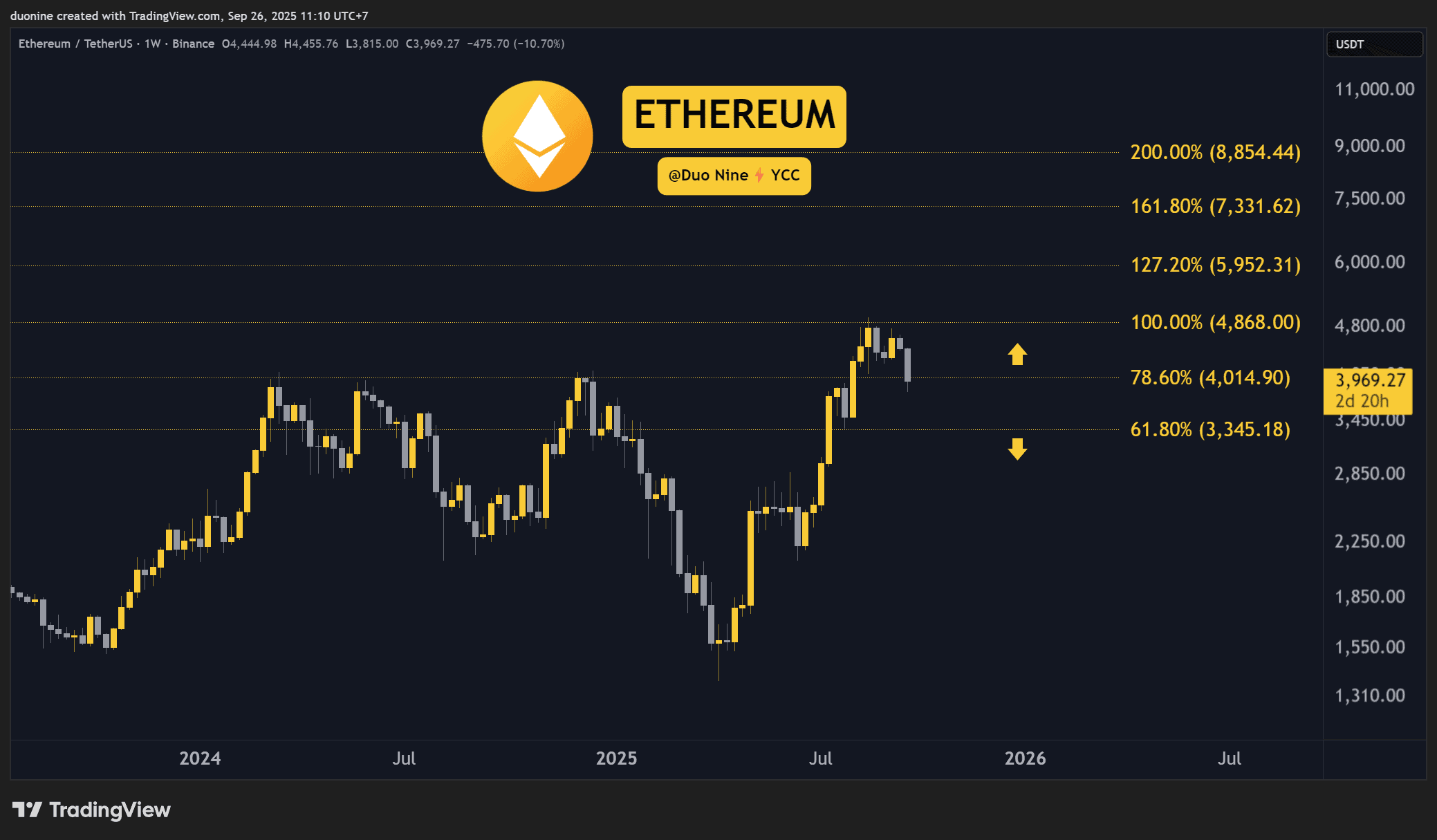

Ethereum (ETH)

Ethereum had a tough week after losing support at $4,000. Its price also closes with a 13% loss. This correction is quite significant and comes after bulls failed to MOVE ETH above $5,000. Since then, sellers have had the upper hand.

If buyers cannot reclaim $4,000 as support, this level will turn into a key resistance and push this cryptocurrency much lower and towards $3,345, which is the next major support on the chart.

Looking ahead, the next few days are critical for ethereum as they will decide if the price continues down or reverses. Ideally, buyers return in force soon to stop this downtrend, but that appears unlikely at the time of this post.

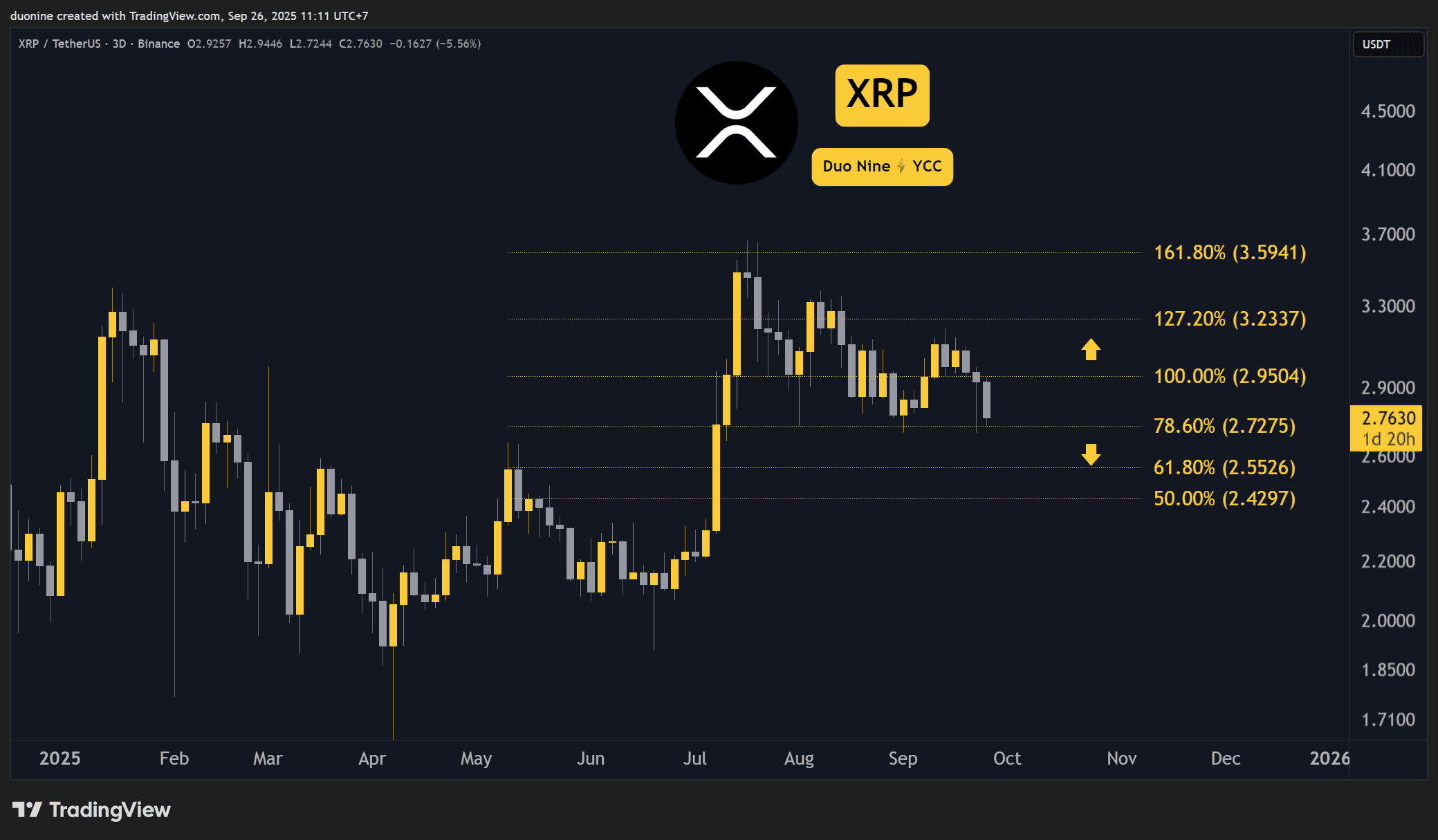

Ripple (XRP)

With most of the market in red, XRP also lost 10% of its valuation this week, and its price fell to the key support at $2.72. This level was tested before in early September and held well, but a second test could be less successful if buyers don’t show interest soon.

Should $2.72 fall, then this level will turn into a resistance, and buyers will retreat to $2.55, where the asset has a higher chance to bounce. The momentum is also bearish on the daily and higher timeframes, which makes this an uphill battle for bulls.

Looking ahead, XRP failed to make a higher high most recently. That’s a sign of weakness that could prolong this downtrend for some time.

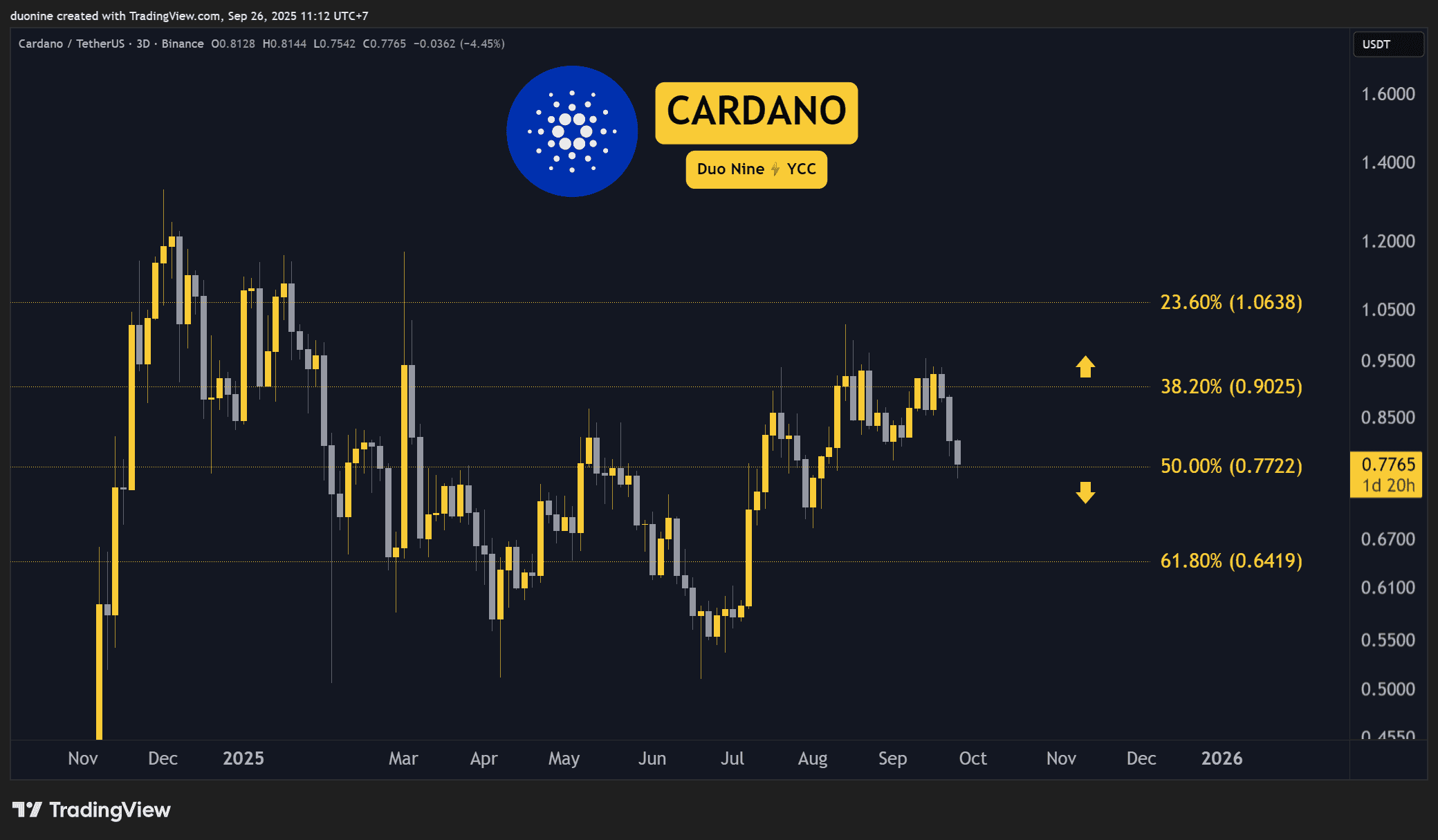

Cardano (ADA)

Cardano holders had a disappointing week after the price fell by 16%. That’s a significant crash for such a short period of time, which has taken the price to the $0.77 support. Should that fall, buyers will retreat to $0.64 next.

This most recent impulse up in mid-September failed to reclaim a price of $1. With a lower high confirmed, sellers took over and pushed ADA lower. Because of this, this cryptocurrency has a high chance of making lower lows in the NEAR future.

Looking ahead, this downtrend is likely to continue and only find relief around the $0.60 area where buyers were active in the past. Moreover, the price action shows Cardano has lost its bullish momentum and would be a surprise to see it recover the recent losses.

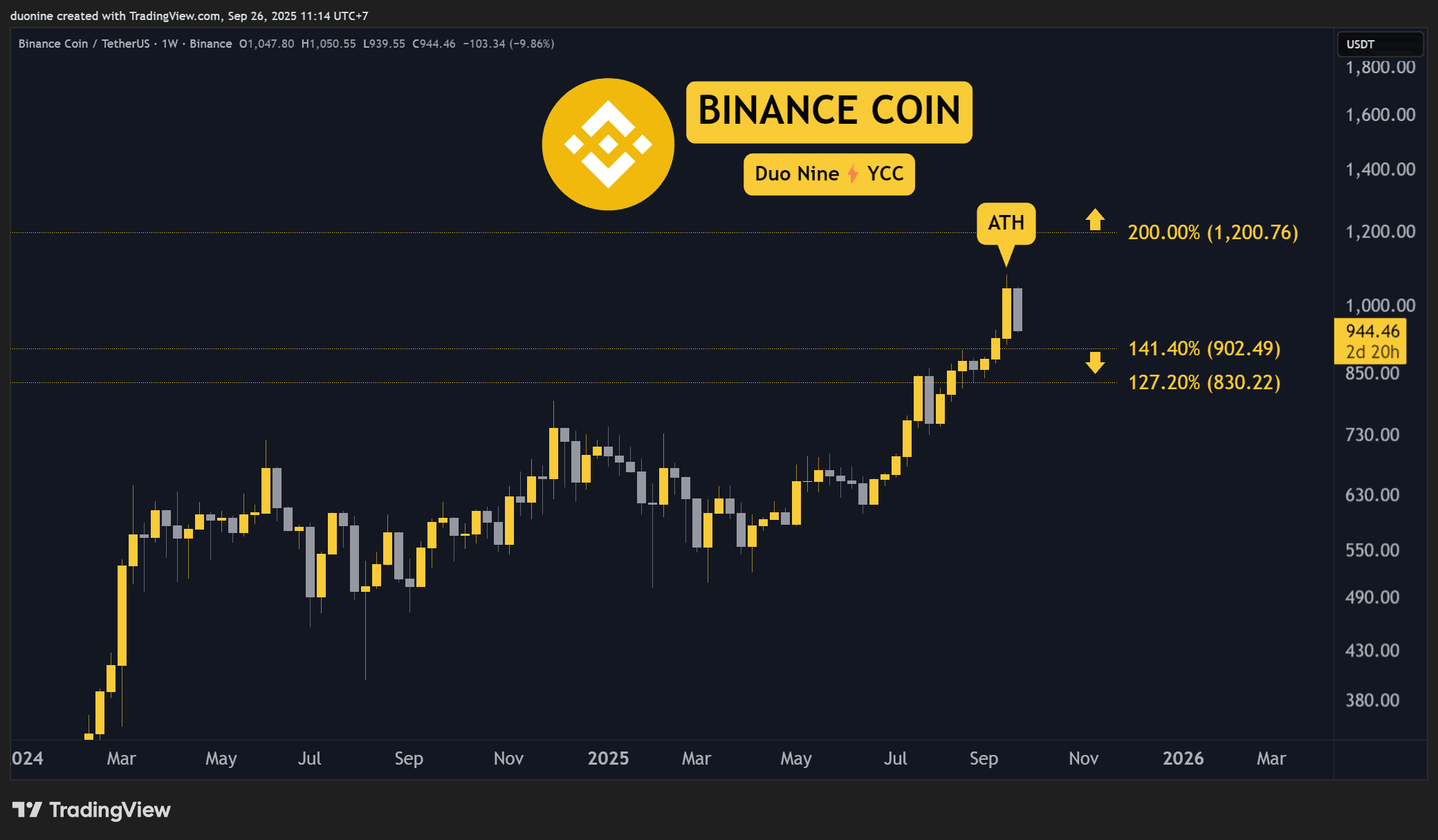

Binance Coin (BNB)

Binance Coin made a new record price last Sunday at $1,083. However, the celebrations were short-lived. Since that moment, the price entered a correction that made it close the week with a 5% loss.

The asset also fell back under $1,000, but has great support at $900 and $830, where buyers could return in the future. The $1,000 level could also act as resistance going forward.

Looking ahead, despite the ongoing correction, this cryptocurrency remains one of the strongest performers in the market. Any future recovery will likely see BNB perform very well, which could see it attempt new price records towards the end of 2025.

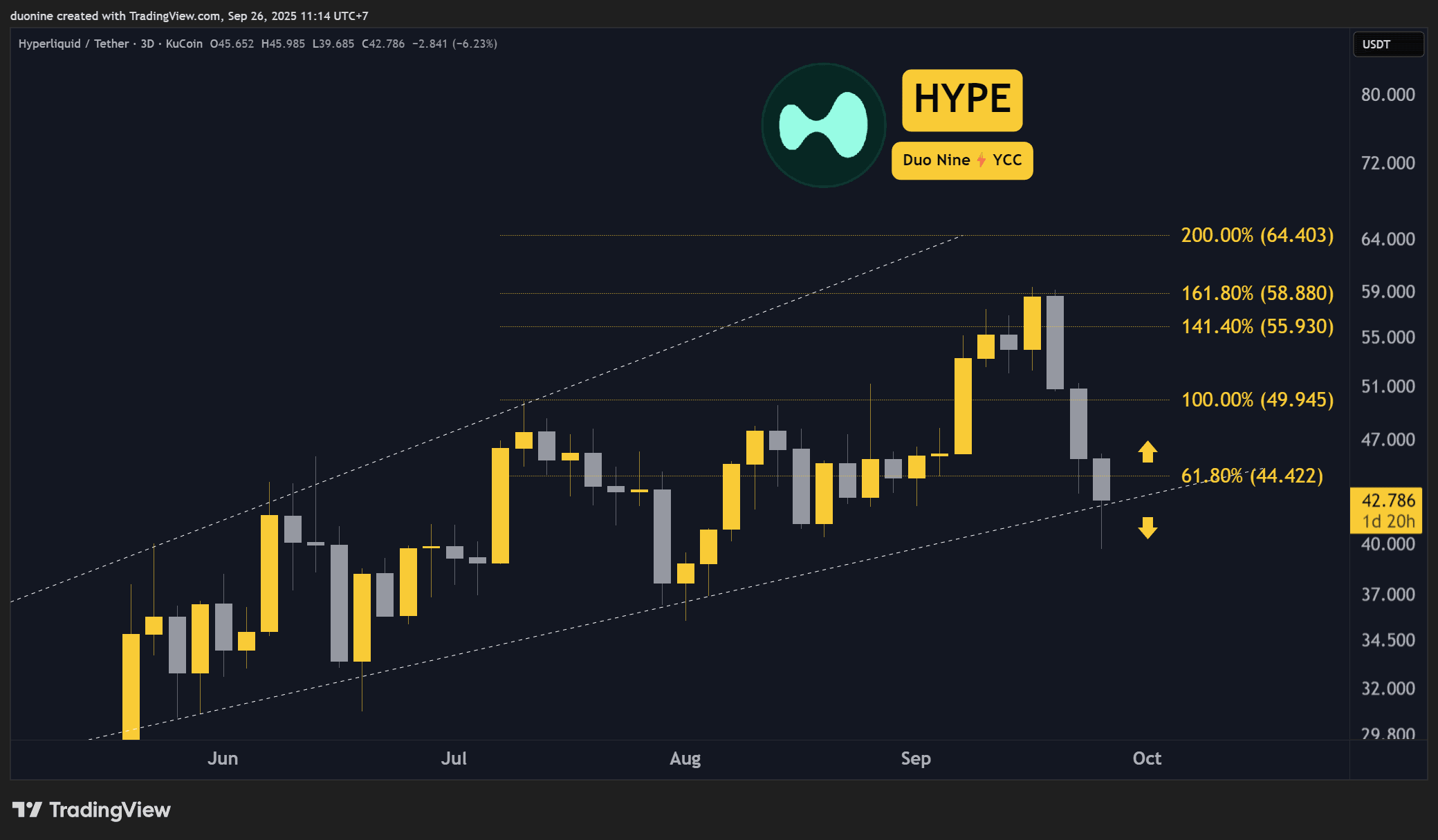

Hype (HYPE)

Surprisingly, HYPE is the worst performer on our list this week after a crash of 26%! This huge loss came on the back of the recent launch of Aster, the Binance-backed decentralized exchange created to compete with Hyperliquid.

Liquidity left HYPE and moved to Aster, which had a tremendous impact on its price. Sellers visited the $40 support before buyers returned. The current resistance levels are found at $44 and $50.

Looking ahead, the battle between decentralized exchanges just got tuned to the max as liquidity and traders switch between platforms chasing quick gains. While Hyperliquid may suffer right now, this could also be a good opportunity to get exposure at discounted prices.