Solana’s Steepest Weekly Crash In Top 10: What’s Really Happening Behind The Plunge?

Solana just took the hardest hit among crypto's elite—but this isn't your typical market tremor.

Network Under Fire

The bleeding isn't random. SOL's infrastructure faced its toughest stress test yet as transaction volumes spiked beyond projections. Validators scrambled to maintain stability while developers raced against network congestion clocks.

Ecosystem Domino Effect

DeFi protocols on Solana felt immediate pressure. Liquidations cascaded through lending platforms as margin calls triggered automated sell-offs. NFT marketplaces saw floor prices evaporate faster than meme coin hype.

Institutional Whiplash

Hedge funds that piled into SOL during its rally now face brutal rebalancing. Some positions got liquidated faster than you can say 'risk management'—not that traditional finance ever understood crypto volatility anyway.

Technical Breakdown or Market Overreaction?

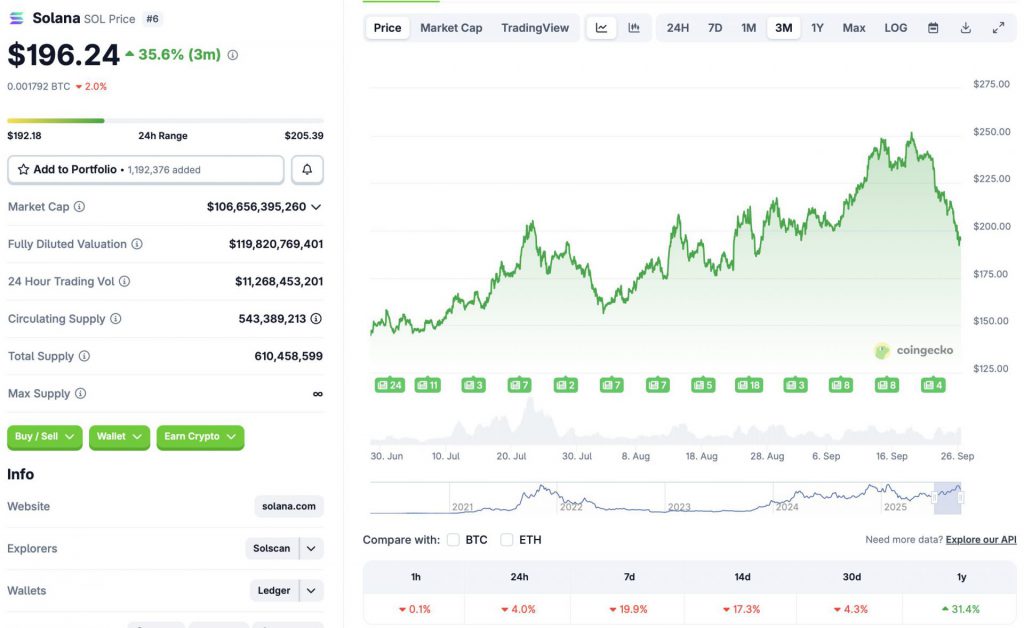

Core developers insist this is temporary growing pains. Critics point to deeper structural issues. Either way, the charts don't lie—this correction separates diamond hands from paper portfolios.

Solana's resilience will be tested harder than a Bitcoin maximalist's patience during alt season. The network either emerges stronger or becomes cautionary tale material.

Source: CoinGecko

Source: CoinGecko

Why is Solana’s Price Facing a Dip? Will It Recover?

Solana (SOL) and the larger crypto market’s latest crash are likely due to uncertainties around US monetary policy. Federal Reserve Chair Jerome Powell highlighted inflation risks and a slowing jobs market in his recent speech earlier this week. Investors are likely moving their funds away from risky assets, such as cryptocurrencies, and into safe havens like gold, which hit a new all-time high recently. The stock market also hit new records over the last few days.

Another reason for Solana’s dip could be the high number of token unlocks taking place over this week. According to Tokenomist, around $517 million worth of cryptocurrencies are entering the market from Sept. 22 to Sept. 29. The move may have spooked investors away from the crypto market. solana (SOL) may have succumbed to the potential sell pressure.

Solana (SOL) has some support at the $195 to $198 level. If the asset falls below this level, it could plunge to the $180 price level. There is a high chance that Solana’s (SOL) price will recover from the dip over the coming weeks. The Federal Reserve is expected to roll out another round of interest rate cuts next month. Another rate cut may trigger a market-wide rally, which could push SOL back to the $250 price level.