South Korean Crypto Exchanges Showered Users with $87M in Interest—Here’s Why It Matters

Crypto just got a lot more lucrative in Korea—exchanges are paying out like high-yield savings accounts on steroids.

The $87M Interest Boom

Over the past year, South Korea's trading platforms turned into makeshift banks, funneling millions in interest to customers hungry for returns. No wonder traditional finance is sweating.

Yield Hunters Gone Wild

With rates elsewhere stuck in the basement, crypto's double-digit payouts became catnip for retail investors. Regulators? Mostly watching from the sidelines—for now.

The Catch (Because There’s Always One)

Sure, $87M sounds impressive—until you remember Wall Street bonuses last year topped $45 *billion*. Crypto’s playing catch-up, but at least it’s not gatekept by suits.

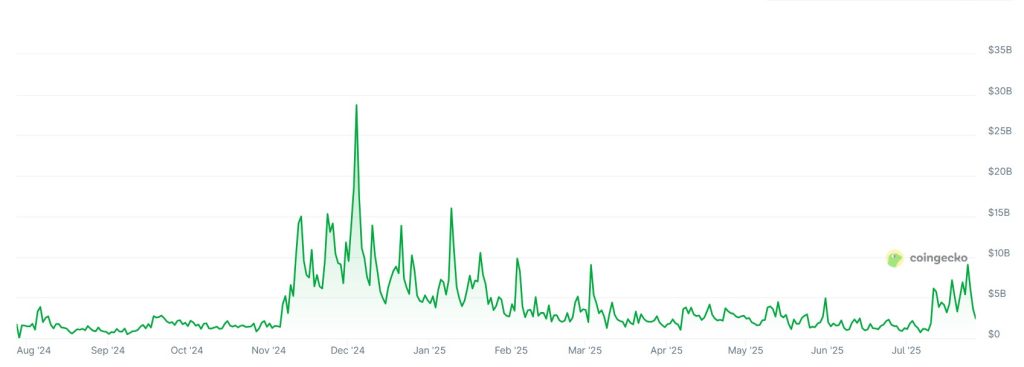

South Korean Crypto Exchange Interest Fee Competition

The data shows that the nation’s five fiat-trading platforms have paid their customers interest worth a combined 120.26 billion won since the launch of the VIRTUAL Asset User Protection Act in July last year.

The law stipulates that the exchanges (Upbit, Bithumb, Coinone, Korbit, and GOPAX) must make reasonable interest payments on fiat deposits held on exchange platforms.

Prior to the law’s launch, platforms typically made nominal interest payments of just 0.1% per annum.

However, the act’s introduction sparked a wave of competition. Platforms began scrambling to draw in new customers with eye-wateringly high interest rates, paid quarterly.

This culminated in Bithumb announcing a 4% interest rate, only to perform a u-turn just 6 hours later.

Since this flurry of interest rate-related activity, platforms have slowly begun reducing their rates.

At the end of June this year, Upbit was offering 2.1%. Bithumb was offering 2.2%, with Coinone offeing 2.0%, Korbit 2.1%, and GOPAX setting rates of just 1.3%.

However, even GOPAX’s rate was still considerably higher than most commercial banks’ standard 1% account interest rates.

A growing number of seasonal foreign workers are vanishing from job sites across rural Korea, deepening concerns among local governments. The disappearances are straining a national program that brings in short-term laborers from overseas.https://t.co/96ajzRxMOe

— The Korea JoongAng Daily (@JoongAngDaily) July 25, 2025Interest Rates on Their Way Down?

Platforms have since begun responding to the Bank of Korea’s decision to cut base interest rates. Korbit lowered its usage fee rate to 1.9% this month. Coinone has also announced its decision to cut its rate to 1.77% starting next month.

A Financial Supervisory Service spokesperson said the regulator wants to “create a standard for calculating interest payments that does not “undermine competitive order.”

Heo, meanwhile, claimed that while the act provides a “safety net” for users, too much capital is still “concentrated in certain exchanges.”

These comments come after accusations that Upbit has been allowed to create a de facto monopoly in the exchange scene, commanding over 60% of the market share. The lawmaker said:

“We will continue to improve the system to protect users and establish a sound and competitive environment.”