Next MSTR – Is Ethereum the Ultimate Crypto Equity Play in 2025?

Move over, MicroStrategy—Ethereum's Digital Asset Trusts (DATs) are stealing the spotlight as the smartest backdoor into crypto equities. Here's why Wall Street's sleeping giant just woke up.

The DAT Revolution: More Than Just Tokenized Hype

Forget waiting for spot ETH ETFs—institutional players are quietly piling into Ethereum DAT structures that offer tax efficiency, liquidity, and direct blockchain exposure without the SEC headache. It's the same playbook that made MSTR a household name… but with 10x the smart contract upside.

Why TradFi Can't Ignore This Anymore

While hedge funds obsess over Bitcoin allocations, Ethereum's programmable yield mechanisms (hello, staking rewards) turn passive holdings into active cashflow engines—something even your grandfather's Treasury bonds can't match. The kicker? These DATs trade on traditional exchanges, bypassing crypto's usual custody nightmares.

The Cynical Take

Let's be real—this is just Wall Street finding yet another way to repackage decentralized tech into fee-generating products. But when the alternative is watching your portfolio bleed against ETH's annualized 18% staking yield? Even the most stubborn fund manager will suddenly discover their 'blockchain strategy.'

Public companies are piling into crypto. MicroStrategy (Nasdaq: MSTR) – now the world’s largest corporate Bitcoin holder – has amassed about 607,770 BTC (2.8% of Bitcoin’s supply, roughly $71.8 billion).

In its wake a new breed of digital asset treasury (DAT) firms is emerging – this time focused on Ethereum.

In 2025 alone, SharpLink Gaming, Bit Digital and BitMine Immersion have raised hundreds of millions to build corporate ETH treasuries.

For example, SharpLink (SBET) announced a $425 million PIPE on May 27, 2025 to buy Ether.

Bit Digital raised $172 million and sold its BTC to buy ETH; and BitMine now holds 566,776 ETH (worth over $2 billion).

Each move sent the stock sharply higher – raising the question of whether “ETH DAT” companies may be the next big crypto equity story.

Key Moves in Crypto Treasury Strategies

MicroStrategy (NASDAQ: MSTR) – The original DAT pioneer has financed share sales to accumulate Bitcoin.

The Company raised $427.0 million in May 2025 to buy 4,020 BTC and now holds 607,770 BTC. Analysts note MSTR trades at about 2× the value of its BTC treasury.

SharpLink Gaming (NASDAQ: SBET) – On May 27, 2025 SharpLink raised $425 million in a PIPE led by ConsenSys/MetaMask founder Joseph Lubin.

It pledged to make ETH its primary treasury asset. By June 13 SharpLink had purchased 176,270.69 ETH for $462.95 million (avg ~$2,626/ETH), making it “the largest publicly-traded holder of ETH.”

SBET shares jumped ~400% on the announcement day, trading at $33.75 on May 27 (up 400.94% on the session).

Bit Digital (NASDAQ: BTBT) – A large crypto miner that recently pivoted to ETH. In early July 2025 it raised about $172 million in a public offering.

The company sold all its ~280 BTC and used the proceeds (plus the new capital) to buy ETH, ending up with roughly 100,603 ETH on hand.

CEO Sam Tabar said Bit Digital now operates “one of the largest institutional ethereum staking infrastructures” and plans to add more ETH.

BitMine Immersion (NYSE American: BMNR) – A crypto-mining firm now turned ETH accumulator.

By July 24, 2025 BitMine reported 566,776 ETH ($2 billion) on its balance sheet – more ETH than Coinbase and even the Ethereum Foundation combined.

BitMine’s chairman says the goal is to stake 5% of all ETH. Institutional money is backing it.

On July 22 ARK Invest (Cathie Wood) bought $182 million of BMNR shares (4.77 million shares), and BitMine said it will deploy the $177 million net proceeds entirely into more ETH. (BMNR stock briefly ROSE ~7% on this news.)

Each of these moves is data-driven. SharpLink’s SEC filings and press releases show the exact ETH acquired. Bit Digital’s press release confirms the $172M raise and 100,603 ETH holding.

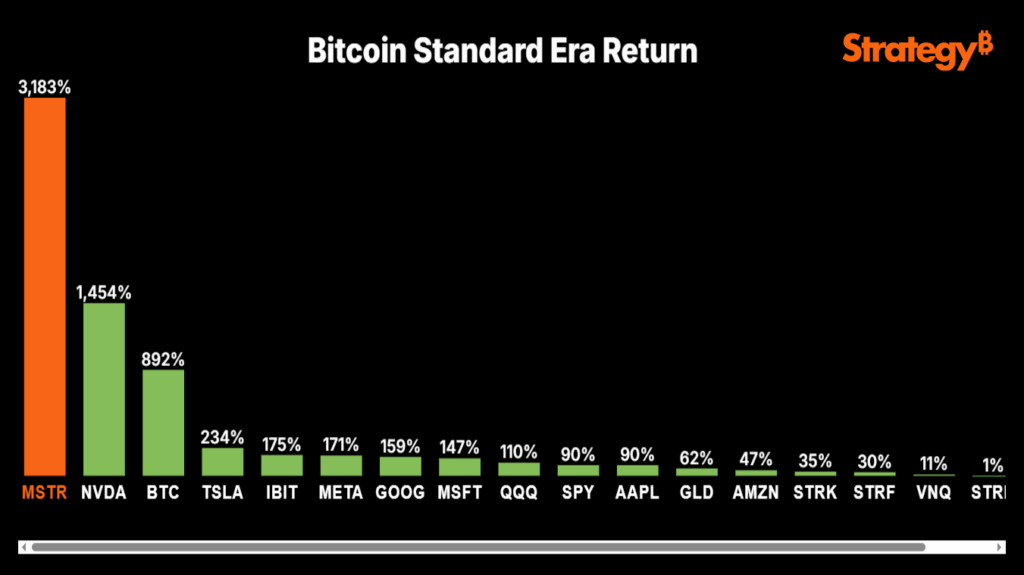

MicroStrategy’s Legacy and the DAT Trend

MicroStrategy’s early adoption of bitcoin set the template. The Virginia-based software firm “is the world’s first Bitcoin Treasury Company.”

Using share and bond financings it has systematically accumulated BTC. Industry analysts note MSTR stock trades at roughly twice the value of its BTC holdings and legacy business.

In effect, each share is a Leveraged bet on Bitcoin’s price. As one commentator put it, DAT companies trade dollars for scarce crypto – if an MSTR share once equaled 1 BTC, the hope is it will be worth more later.

This Bitcoin model is now crossing over to Ethereum. Databases like Strategy’s show MSTR holds 607,770 BTC ($71.8 billion).

By comparison, ETH companies are much smaller today, but catching investor attention. At mid-2025 Ethereum was NEAR all-time highs, and proponents argue ETH’s smart-contract and staking features give it broader utility.

SharpLink CEO Rob Phythian has called ETH “foundational infrastructure” and a better reserve asset for his firm.

In short, MicroStrategy proved corporate treasuries can MOVE markets; now SharpLink, Bit Digital, and BitMine are trying the same on Ethereum.

SharpLink Gaming’s Ethereum Bet

SharpLink Gaming (SBET) is a U.S. sports betting affiliate marketer that became the first Nasdaq company to adopt an ETH treasury policy.

On May 27, 2025 it announced a $425 million PIPE led by ConsenSys (headed by Ethereum co-founder Joe Lubin).

The deal sold 69.1 million shares at $6.15 and explicitly stated the proceeds WOULD be used to buy ETH, which would become SharpLink’s “primary treasury reserve asset”.

Lubin agreed to join SharpLink’s board as part of the deal. Thanks to that capital, SharpLink went on a spending spree in June.

June 13 release shows SharpLink “acquired 176,270.69 ETH for $462,947,816” (including fees) at an average of ~$2,626 per ETH.

That purchase made SharpLink the largest publicly-traded ETH holder, second only to the Ethereum Foundation.

SharpLink says over 95% of those ETH are staked to secure the network and generate yield. The market’s reaction was intense.

SBET shares soared nearly 400% on May 27, 2025 to ~$33.75. (For reference, SBET had been around $6/share pre-announcement).

Over the following weeks SharpLink kept buying ETH and reporting its treasury balance in filings, which has steadily increased.

Bit Digital Shifts from BTC to ETH

Bit Digital (BTBT) is a publicly traded crypto miner. In July 2025 it told investors it had “completed its transition to an Ethereum treasury strategy.”

A press release dated July 7, 2025 says Bit Digital raised ~$172 million in a public offering and used the funds to buy ETH.

Bit Digital also sold about 280 of its Bitcoin into the market and used those proceeds to purchase more ETH.

In total, after the transactions, Bit Digital held roughly 100,603 ETH on its balance sheet. CEO Sam Tabar explained that Bit Digital now views Ethereum as the future of programmable finance and is effectively positioning it as an “Ethereum treasury platform”.

This news gave Bit Digital’s stock a lift (though less dramatic than SBET’s). On July 18, 2025, after announcing the ETH purchase, BTBT shares were up a few percent.

Bit Digital now also operates ETH validators to earn staking yield on its holdings. In sum, BTBT shows a clear case of a miner swapping its crypto exposure from Bitcoin to Ethereum.

BitMine Immersion’s Ethereum Hoard

BitMine Immersion (BMNR) was originally a Bitcoin miner. By mid-2025 it had become an Ethereum giant. CryptoSlate reports BitMine has accumulated 566,776 ETH (worth over $2 billion) as of July 24, 2025.

That makes it the largest publicly traded ETH hoard – roughly 0.46% of all ETH in circulation. In fact, BitMine’s stash exceeds the combined ETH held by the Ethereum Foundation and Coinbase, and is about 200,000 ETH more than SharpLink’s holdings.

BitMine’s chairman Thomas Lee says the company is “focused on acquiring and staking 5% of Ethereum’s total supply”.

Investors have taken note. On July 22, 2025 ARK Invest (Cathie Wood) revealed it bought $182 million of BitMine stock (4.77 million shares).

BitMine said it will reinvest the $177 million net proceeds entirely into buying ETH. BitMine’s ETH strategy and big institutional backing have led analysts to dub it a prime example of an ETH-focused DAT. Its share price rose about 7% on the ARK news.

Risks and Outlook

These Ethereum treasury plays are data-driven and transparent, but experts caution they carry heavy leverage.

As Axios notes, DAT companies essentially trade cash (or equity) for scarce crypto; if Ether’s price falls, the effect on these stocks could be dramatic.

MicroStrategy itself has financed Bitcoin purchases with convertible debt, betting it on future gains – a strategy that could backfire if crypto crashes.

Similarly, SharpLink or BitDigital used fresh equity to buy ETH, and if ETH slumps their per-share crypto value would shrink.

Regulatory changes or a sudden crypto bear market could force these firms to sell crypto or raise cash, creating downward pressure on both crypto and their stock price.

For now, though, markets have rewarded the ETH treasurers. All the moves above were confirmed by company filings or press releases, and analysts will watch results closely.

Are these firms smarter plays than Bitcoin bulls like MicroStrategy? It’s too early to say. Ethereum’s fundamentals and staking yield may give these companies an edge, but they are also effectively doubling down on crypto risk.

Investors should weigh the confirmed data (large ETH holdings, backing by ConsenSys/ARK, etc.) against the volatility of the crypto market.

In any event, SharpLink, Bit Digital and BitMine have clearly opened a new chapter in the crypto equity story – one that bears watching as Ethereum’s ecosystem evolves.