Michigan Goes Full Crypto Cop: Four New Bills Aim to Tame the Wild West of Digital Assets

Lawmakers in Michigan just dropped a regulatory hammer—introducing four new bills targeting everything from exchanges to stablecoins. Because nothing says ’innovation’ like a stack of paperwork, right?

Here’s the breakdown:

-

License to Ill(iquidity)

: One bill could force crypto platforms to jump through more hoops than a DeFi yield farmer during a gas spike.

-

Stablecoin Showdown

: Another takes aim at dollar-pegged tokens—because apparently, the feds weren’t already breathing down their necks.

-

Tax Man Cometh

: A third proposal hints at tighter capital gains tracking—just in case you thought your anonymous wallet was actually anonymous.

Meanwhile, Wall Street’s old guard is probably popping champagne—nothing makes traditional finance happier than watching regulators swarm the competition. Stay tuned to see if these bills die in committee or become the new rules of the road.

Another Bill Targets CBDCs

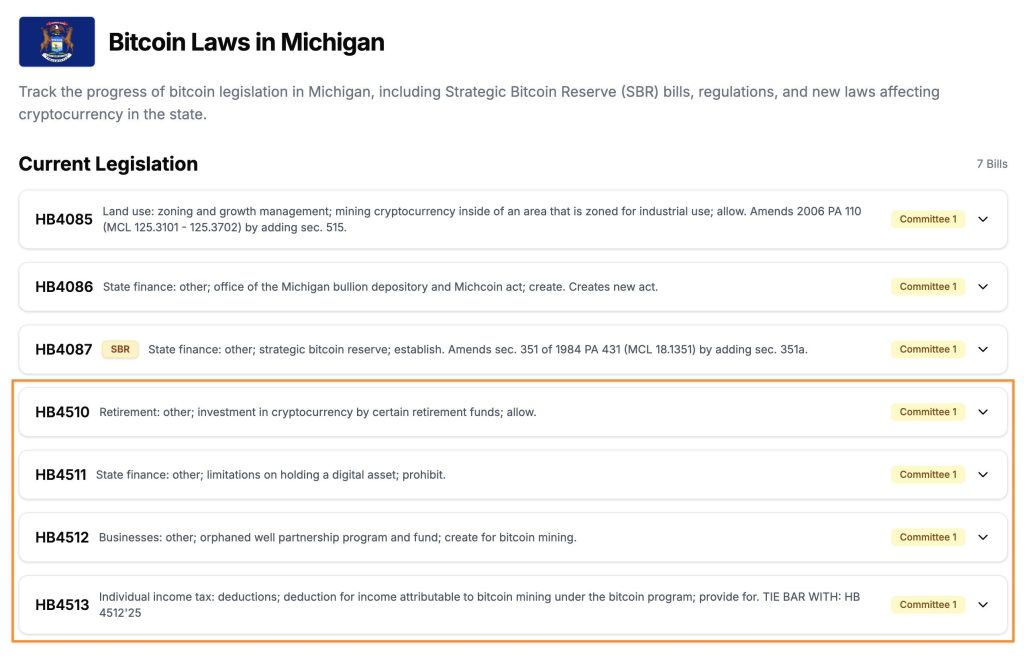

A second bill, House Bill 4511, sponsored by Rep. Bryan Posthumus (R-MI), targets federal efforts to roll out a central bank digital currency (CBDC).

It proposes a ban on any state agency or department from supporting, testing, or promoting a U.S. CBDC. The legislation also seeks to shield digital asset holders from additional state-level restrictions or taxes.

On the other side of the aisle, Rep. Mike McFall (D-MI) filed two companion bills—HB 4512 and HB 4513—focused on Bitcoin mining and environmental remediation.

One bill outlines a “Bitcoin Program” that would grant private firms temporary rights to mine bitcoin at abandoned oil or gas well sites, using leftover fuel.

In return, companies would be responsible for site restoration.

The accompanying bill offers state tax deductions for income generated through this type of mining activity. The program would be regulated by the Supervisor of Wells, who would oversee a public registry of eligible sites, conduct annual bidding rounds, and enforce restoration obligations.

Michigan’s proposals add to a growing patchwork of crypto legislation emerging across the U.S. Earlier the same day, Texas lawmakers passed a bill to establish a state-run Bitcoin reserve.

New Hampshire recently became the first state to authorize crypto and precious metal investments for public funds.

Blackstone Makes First Crypto Move

On May 20, Blackstone, the world’s largest alternative asset manager, made its first MOVE into crypto markets, purchasing shares in BlackRock’s iShares Bitcoin Trust (IBIT), a spot Bitcoin exchange-traded fund.

According to a filing with the U.S. Securities and Exchange Commission, Blackstone acquired 23,094 IBIT shares as of March 31, valued at approximately $1.08 million.

Prior to that, shares of Indonesian fintech firm DigiAsia Corp surged by over 91% on May 19, after the Nasdaq-listed company announced plans to raise $100 million to initiate Bitcoin purchases as part of a new treasury strategy.

The Jakarta-based firm revealed that its board has approved the creation of a Bitcoin treasury reserve.

DigiAsia says it intends to allocate up to 50% of its net profits toward acquiring Bitcoin, signaling a shift in how it plans to manage its capital amid growing corporate interest in digital assets.

Notably, public companies continue to increase their exposure to Bitcoin, with Michael Saylor’s firm, Strategy, leading the charge.

The Virginia-based company recently announced it would double its capital-raising efforts to $84 billion in order to acquire more Bitcoin.