Hyperliquid Smashes Records with $8.9B Open Interest as Bitcoin Blasts Past $111K

Derivatives platform Hyperliquid just notched a staggering $8.9 billion in open interest—proof that crypto traders are doubling down even as Bitcoin punches through $111,000. Who needs risk management when you’ve got hopium?

Meanwhile, Wall Street still can’t decide if crypto is ’digital gold’ or a speculative bubble. Spoiler: It’s both—and the suits are salty they missed the ride.

Hyperliquid Sees Record Trades Led by Bitcoin and a $1B Bet from Top Trader

Hyperliquid’s trading volume reached $19.15b over the past 24 hours. BTC alone accounted for $11.5b of that, followed by ETH at $4.03b and SOL at $1.2b.

Meme coins such as HYPE, kPEPE, and Fartcoin also saw substantial activity, with HYPE crossing $454m in volume.

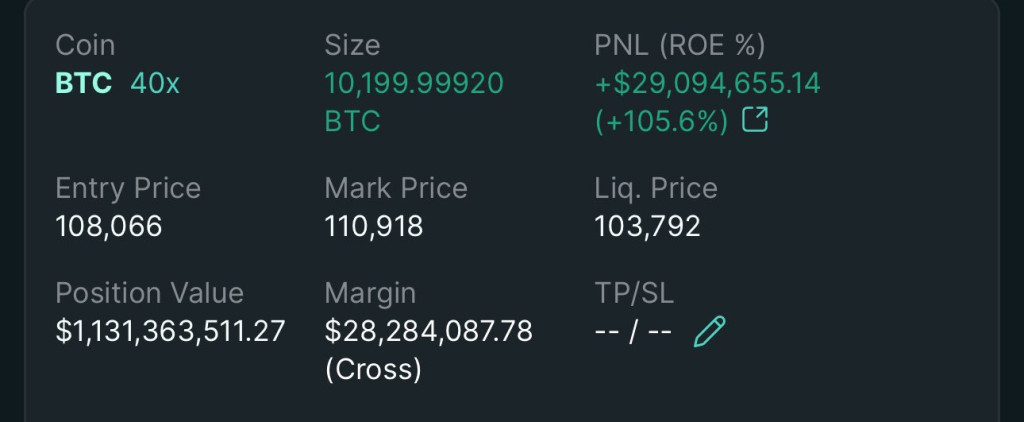

One of the most notable developments was top trader James Wynn Real’s Leveraged position on BTC, which became the first to exceed $1b on Hyperliquid.

His position used 40x leverage and involved over 10,000 BTC. The entry price was $108,084, while the liquidation price was $103,640. As a result, the unrealized profit stood at $17.5m at the time of reporting.

Funding Rates Hold Steady as Traders Bet Big on Volatility

As traders flock to volatile memecoins, tokens like kPEPE and WIF posted daily volumes exceeding $200m, with funding rates holding steady across most assets.

Open interest in HYPE and SOL showed the fastest growth, up 18% and 82% respectively in 24 hours.

The bullish sentiment is bolstered by legislative momentum in the US Senate, where the advancement of a stablecoin bill has rekindled hopes for clearer regulation.