Bybit’s 2026 Japan Exit: Regulatory Walls Force Crypto Giant’s Retreat

Another crypto exchange hits a regulatory wall. Bybit, one of the world's largest trading platforms, is pulling out of Japan entirely by 2026. The reason? An inability to meet the country's stringent compliance demands.

The Compliance Crunch

Japan's Financial Services Agency (FSA) has built a fortress of rules around digital assets. For global players like Bybit, adapting local operations to satisfy these specific mandates proved too costly, too complex, or simply incompatible with their global model. The 2026 deadline isn't a suggestion—it's the finish line for their wind-down.

A Familiar Retreat

This isn't a unique story. The landscape is littered with exchanges that chose exit over endless adaptation. It highlights the ongoing tension between borderless crypto innovation and national regulatory frameworks. When the cost of compliance outweighs the market's potential, the business case evaporates—another reminder that in finance, sometimes the most profitable trade is cutting your losses.

For Japan's crypto users, it's back to the drawing board. For Bybit, it's a strategic recalibration. And for regulators? Just another day at the office, diligently building moats that keep some giants out while protecting the castle—and its banking fees.

Long-Running Compliance Battle With FSA

Japan’s crackdown on unregistered exchanges dates back to 2017 legislation requiring FSA-issued permits for platforms serving Japanese residents.

The regulator sent formal warnings to Bybit in November 2024 and March 2023, claiming the exchange conducted crypto business with Japanese counterparties without proper authorization.

While existing services remained operational following the October registration pause, the latest announcement marks a complete withdrawal from the market.

Apple reportedly blocked Japanese users from downloading Bybit’s app in February, returning indefinite “Connecting…” messages or “Cannot connect to iTunes Store” errors when they attempted to access it from the Japanese App Store.

The FSA has consistently argued that platforms like Bybit court Japanese clients through Japanese-language interfaces and customer support, despite lacking domestic licenses.

Downloads from Google Play appeared unaffected at the time, though regulatory pressure continued to mount.

Bybit apologized for any inconvenience and said affected users will receive additional updates on the remediation process in subsequent communications.

Global Repositioning Amid Regional Regulatory Shifts

Beyond Japan, Bybit has faced regulatory hurdles across Asia as it expanded into more crypto-friendly jurisdictions.

The Monetary Authority of Singapore ordered unlicensed digital token service providers to cease overseas activities by June, prompting Bybit to reportedly explore relocating staff to Dubai and Hong Kong, where licensing frameworks offer greater regulatory clarity.

In fact, last month, Cryptonews reported that the exchange is in talks to acquire Korbit, South Korea’s fourth-largest crypto exchange, to ease its regulatory pathway into the country.

Cryptocurrency exchange Bybit, the world’s second-largest by trading volume, is reportedly in talks to acquire Korbit, South Korea’s fourth-largest crypto exchange, according to South Korea’s Maeil Business Newspaper.According to multiple industry …https://t.co/nPXqLg5OrF

— Cryptonews.com (@cryptonews) November 10, 2025While there are frictions in some countries, Dubai’s VIRTUAL Asset Regulatory Authority has recently granted licenses to over 20 firms, including Bybit.

Despite regional setbacks, Bybit launched its EU-dedicated platform, Bybit.eu, in July after securing a Markets in Crypto-Assets Regulation license from Austria’s Financial Market Authority.

The fully licensed Crypto-Asset Service Provider now operates across 29 European Economic Area countries, reaching approximately 450 million users, and has its headquarters in Vienna.

Mazurka Zeng, Managing Director and CEO, called the launch “a long-term commitment to Europe” that balances technology with robust regulatory standards.

The exchange plans to open regional offices across France, Germany, Spain, and Italy while offering 24/7 multilingual customer support.

Japan’s Broader Regulatory Overhaul

Japan’s tightening stance extends well beyond individual exchange enforcement actions.

The FSA is preparing sweeping reforms that WOULD outlaw insider trading in cryptocurrencies, require exchanges to hold dedicated reserves against customer losses, and lower crypto profit taxes to a flat 20% from the current 55% top rate.

The regulator aims to submit amendments to the Financial Instruments and Exchange Act in 2026, reclassifying digital assets from “” to “” comparable to stocks and bonds.

The reserve requirement proposal would mirror frameworks long used in Japan’s securities industry, with platforms setting aside capital to compensate users for hacks or operational failures following high-profile incidents, including DMM Bitcoin’s $312 million theft in May 2024 and Bybit’s own $1.46 billion hack in February 2025.

The FSA is also considering allowing banks to hold cryptocurrencies for investment purposes and permitting bank groups to register as licensed exchanges, reversing a 2020 restriction.

Japan’s crypto adoption continues growing despite stricter oversight. According to the Financial Services Agency, over 12 million registered accounts as of February 2025, and deposits exceeding ¥5 trillion.

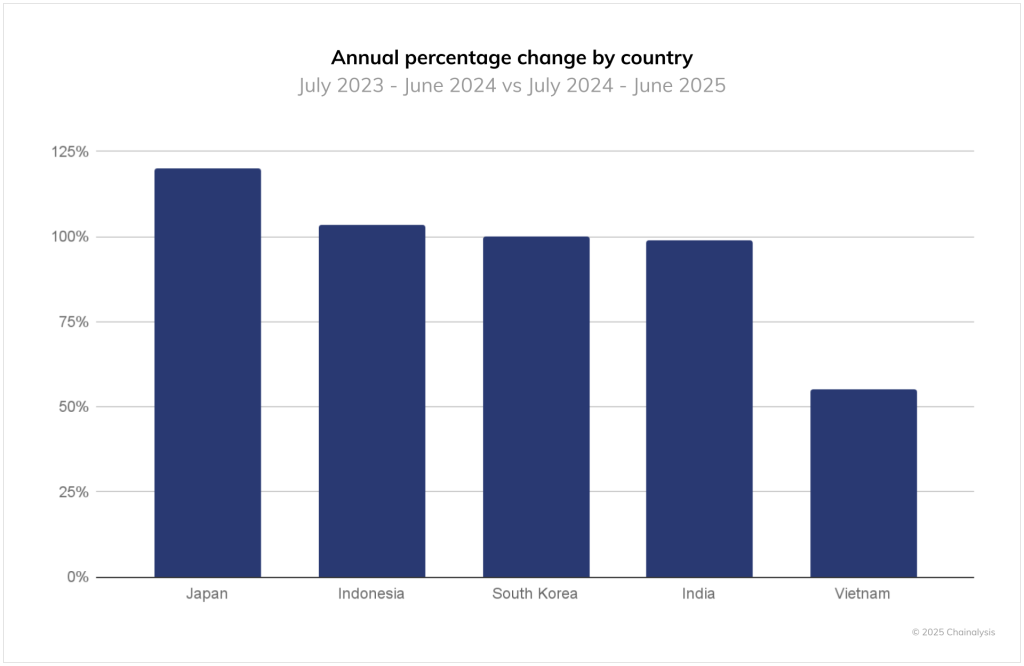

In fact, Chainalysis reported a 120% year-over-year increase in on-chain value received.